Kuwait's Complete Ban on Banking and Crypto Mining: What You Need to Know

Kuwait has shut down all cryptocurrency activity - including mining and banking support - with zero exceptions.

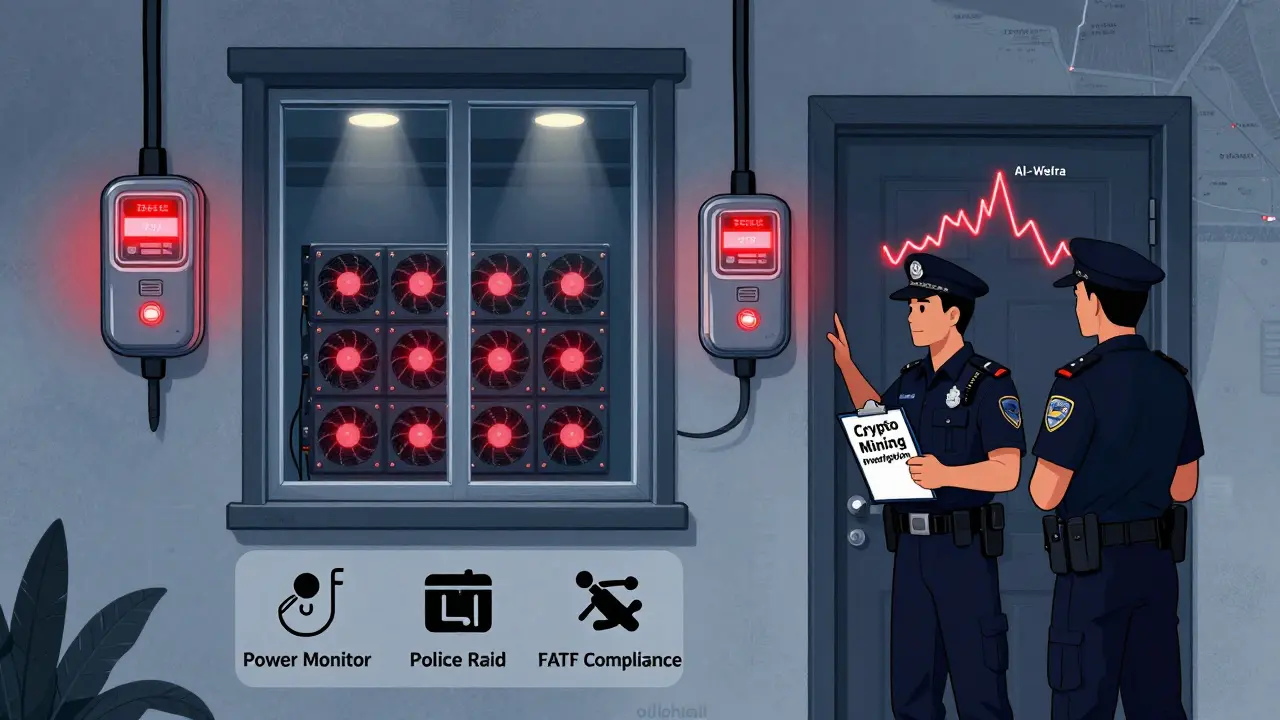

If you live in Kuwait and tried to buy Bitcoin last year, your bank likely froze your account. If you ran a rig in your garage to mine Ethereum, the electricity company flagged your usage. By 2025, over 1,000 suspected mining sites were identified across the country. This isn’t a rumor. It’s policy - enforced with power monitors, police raids, and fines up to $164,000.

The Central Bank of Kuwait, along with the Capital Markets Authority and Ministry of Interior, issued a blanket ban in July 2023. No licenses. No exceptions. No gray area. Crypto isn’t just discouraged - it’s illegal. And the rules go further than just trading. Mining, investing, paying with digital assets, even receiving crypto into a bank account - all banned.

Why did Kuwait go this far?

Kuwait’s regulators didn’t act out of fear of technology. They acted to stop money laundering and terrorist financing. The ban aligns with Recommendation 15 from the Financial Action Task Force (FATF), an international body that sets global anti-fraud standards. Kuwait’s government says it’s protecting its financial system from untraceable, volatile assets that can’t be audited.

But there’s another layer: energy. Kuwait runs its power grid mostly on oil. Crypto mining eats electricity - a lot of it. In Al-Wafra alone, homes suspected of running mining rigs used up to 20 times more power than normal. That’s not just expensive - it’s destabilizing. Power outages in residential areas became common. The Ministry of Electricity and Water started monitoring usage patterns. If your bill spikes for no reason, they come knocking.

Unlike the UAE, which built a $2.1 billion blockchain economy and created 15,000 jobs, Kuwait chose isolation. While Bahrain issued 12 crypto licenses and Saudi Arabia approved 7 firms under its sandbox, Kuwait said no to all of it. The result? An estimated $1.2 billion in lost investment between 2023 and 2025.

What does the ban actually block?

The ban isn’t vague. It’s detailed. Here’s what’s forbidden:

- Buying, selling, or holding any cryptocurrency - Bitcoin, Ethereum, Dogecoin, you name it.

- Mining crypto using any device, whether it’s a single GPU or a warehouse full of ASICs.

- Using crypto to pay for goods or services - even if both parties agree.

- Banking services tied to crypto: deposits, withdrawals, wire transfers, or account linking.

- Operating or promoting any virtual asset service - exchanges, wallets, or trading platforms.

- Issuing or promoting any local crypto token - like the fake "Bitcoin Kuwait" scam that stole $40 million in early 2025.

Even if you’re just holding crypto in a wallet and never spend it, you’re technically violating the law. Banks are required to monitor accounts for any sign of crypto-related activity. If they see a transaction from Binance, Coinbase, or even a peer-to-peer app, they must report it. And they’ve been trained - all 45 licensed banks in Kuwait had to complete mandatory FATF compliance training by late 2023.

How is the ban enforced?

Kuwait doesn’t just write rules - it enforces them.

The Ministry of Interior runs specialized units that scan for abnormal power usage. They use data from the national grid to pinpoint homes and businesses with suspicious consumption. Once flagged, they send inspectors. In 2024, they conducted 89 raids on suspected mining operations. In Q1 2025, seizures increased by 40% compared to the previous quarter.

Telecom providers are also part of the system. In May 2025, the Central Bank ordered all ISPs to block access to 137 international crypto exchanges. That includes Binance, Kraken, Bybit, and others. Over 90% of Kuwaiti crypto users lost direct access to these platforms. Many turned to VPNs - but even that’s risky. Using a VPN to bypass the ban can lead to criminal charges.

Fines have gotten steeper. Under the 2025 Financial Technology Amendment Law, mining can now land you a $164,000 fine - or up to five years in prison. It’s not just about money. It’s about deterrence.

What’s happening on the ground?

Despite the crackdown, crypto hasn’t disappeared. It’s gone underground.

Telegram groups in Kuwait now have over 3,500 members trading crypto via peer-to-peer deals. Users pay in cash or use hawala-style transfers. But fraud is rampant. The "Bitcoin Kuwait" scam in January 2025 tricked hundreds into buying a fake token. Victims lost millions. Trustpilot reviews for crypto services in Kuwait average just 1.8 out of 5 - mostly complaints about frozen accounts and lost funds.

One user wrote: "I’ve had three bank accounts frozen since 2023. I didn’t even know I was doing anything illegal until they shut me down." Another said: "I lost $12,000 trying to send crypto to a friend. The bank blocked it, then accused me of fraud. Took six months to clear my name."

But not everyone hates the ban. Some businesses say it’s helped them avoid scams. A Kuwaiti shop owner told Kuwait Forums: "My competitors in Dubai got hit with crypto fraud. We didn’t even have to think about it. The law kept us safe."

How does Kuwait compare to its neighbors?

Kuwait is the outlier in the Gulf.

The UAE has a full regulatory framework. Dubai’s VARA has licensed over 250 crypto firms. Saudi Arabia runs a sandbox with 7 approved companies. Bahrain has issued 12 licenses. Qatar is even planning to launch its own digital asset system by mid-2025.

Kuwait? Zero licenses. Zero exceptions. Zero engagement.

The World Bank ranks Kuwait 127th out of 140 countries for crypto regulatory environment. The UAE? 28th. That gap isn’t just about rules - it’s about opportunity. While other GCC nations are building blockchain logistics systems, smart contracts for government services, and tokenized assets, Kuwait’s businesses are avoiding the tech entirely. PwC’s 2025 survey found only 3% of Kuwaiti firms use any blockchain tech - compared to 37% in UAE logistics firms.

Is there any hope for change?

Don’t expect it soon.

Kuwait’s government shows no signs of backing down. The $500 million National Digital Transformation Strategy explicitly excludes cryptocurrency. The Central Bank of Kuwait says its policy has reduced crypto-related fraud by 63% since 2023. That’s a win for them.

But critics say the cost is too high. Dr. Noura Al Dhaheri, a fintech researcher in the UAE, argues: "Kuwait’s ban doesn’t stop crypto - it just pushes it into darker corners where regulation can’t reach. That’s more dangerous than letting it be seen and managed."

Some analysts think Kuwait might allow blockchain for non-crypto uses by 2027 - like supply chain tracking or digital IDs. But full crypto legalization? Experts say it’s unlikely before 2030.

What should you do if you’re in Kuwait?

If you’re a resident: don’t mine. Don’t trade. Don’t even hold crypto in a wallet if you plan to use local banking services. Your bank will report you. Your power bill will raise red flags. Your phone might get flagged by telecom filters.

If you’re a business owner: avoid any crypto-related services. Even if you think you’re just "testing" a blockchain tool, you could be violating the law. Stick to traditional payment systems. The legal risk isn’t worth it.

If you’re an investor: look elsewhere. The UAE, Bahrain, and Saudi Arabia are where the money and opportunity are. Kuwait isn’t just closed - it’s actively hostile to digital assets.

The message is clear: Kuwait’s banking and crypto mining ban isn’t temporary. It’s permanent. And the penalties are real.

Frequently Asked Questions

Is it illegal to own cryptocurrency in Kuwait?

Yes. While simply holding crypto in a wallet isn’t always actively tracked, any transaction - buying, selling, receiving, or transferring - is illegal. Banks are required to freeze accounts linked to crypto activity. The law treats possession as part of the broader ban on virtual assets.

Can I use a VPN to access crypto exchanges?

Technically, yes - but it’s risky. While using a VPN isn’t explicitly illegal, doing so to bypass government blocks on crypto exchanges violates the spirit and enforcement intent of the ban. If detected, you could face fines, account freezes, or criminal charges under the 2025 Financial Technology Amendment Law.

What happens if I get caught mining crypto at home?

Authorities use power consumption data to identify suspicious usage. If you’re flagged, inspectors will visit. You could face fines up to 50,000 KD ($164,000), confiscation of mining equipment, and up to five years in prison under the 2025 law. Many have been raided - equipment seized, and cases referred to prosecutors.

Can I open a bank account if I’ve traded crypto before?

It’s possible, but difficult. Banks in Kuwait screen for past crypto activity. If your account was previously flagged or frozen, you may need to provide documentation proving you’ve stopped all crypto-related transactions. Some have had to close old accounts and open new ones under different names - but this carries legal risk if discovered.

Are there any legal alternatives to crypto in Kuwait?

Yes - but not crypto. Kuwait is investing in blockchain for non-crypto uses like digital IDs, supply chain tracking, and government records. These are separate from cryptocurrency and allowed under the National Digital Transformation Strategy. For financial services, stick to traditional banking, government bonds, and real estate - all fully legal and regulated.

Why doesn’t Kuwait allow crypto like the UAE does?

Kuwait prioritizes financial stability and energy security over innovation. Unlike the UAE, which sees crypto as a growth engine, Kuwait views it as a threat to its oil-based economy and banking system. Its regulators prefer absolute control - even if it means missing out on tech investment and job creation. The country’s conservative financial culture plays a big role in this decision.

7 Comments

Kuwait just turned into the crypto version of a library where whispering gets you arrested. 🤯 I mean, they’re monitoring POWER USAGE like it’s a spy movie. Next thing you know, they’ll fine you for breathing too hard near a GPU.

I find it fascinating-though deeply concerning-that Kuwait has chosen such an absolute, zero-tolerance approach. While I understand the concerns around money laundering and energy consumption, especially given their oil-dependent infrastructure, the complete ban on even passive holding of crypto feels like overreach. It’s not just about regulating risk; it’s about eliminating possibility entirely. And in doing so, they’re pushing innovation underground, where oversight becomes impossible, fraud thrives, and trust erodes. The fact that they’ve blocked 137 exchanges and trained all 45 banks to monitor for crypto activity shows a level of institutional coordination that’s impressive, if terrifying. What’s the endgame? A society where digital finance doesn’t exist? That’s not stability-it’s stagnation dressed up as security.

LMAO they banned crypto but still let people buy 5000-pound camels with cash? Classic. You can’t mine Bitcoin but you can smuggle gold in your socks? The hypocrisy is thicker than Kuwaiti ghee. Also, 164k fine? That’s less than a Lamborghini. Who’s scared? Not me.

I get why they did it-energy waste, scams, instability-but I also feel bad for regular people who just wanted to invest or learn. Imagine getting your bank account frozen because you bought $50 of Bitcoin years ago and forgot about it. That’s not justice. It’s punishment without context. Maybe there’s a middle ground? Like regulated, low-energy mining for education or tech development? Not all crypto is chaos.

It’s like they’re trying to freeze time. 🌍⚡ Crypto is the internet’s version of fire-dangerous if misused, but revolutionary if harnessed. Kuwait chose to bury the match instead of learning to build a campfire. I wonder if future generations will look back and think, 'Why did they fear what they didn’t understand?'

Honestly, this is why I don’t trust any government that thinks banning tech is the same as solving problems. They’re not fixing fraud-they’re hiding from it. In India, we have scams too, but we’re building systems to track them, not burying people under fines. This ban is a band-aid on a broken leg.

The power usage angle is legit. I’ve seen mining rigs in basements in Texas that pulled more juice than a small town. Kuwait’s grid isn’t built for this. But banning *everything*? Even holding? That’s like banning books because someone used one to commit a crime. The real solution is smart regulation-not total prohibition. And yeah, the UAE is winning this race. Kuwait’s just digging a deeper hole.