Kraken Blocked Jurisdictions for Crypto Trading: Where You Can't Trade and Why

If you're trying to trade crypto on Kraken and got locked out, you're not alone. Thousands of users hit a wall when they try to log in - not because of a password issue, but because their location is blocked. Kraken doesn't randomly shut people out. It follows strict rules set by governments and financial regulators around the world. And those rules change often. As of early 2025, Kraken blocks trading in 14 countries outright and imposes layered restrictions in dozens more. This isn’t about limiting access - it’s about staying legal.

Where Kraken Completely Blocks Trading

Kraken won’t let anyone from these countries open an account or trade anything:

- Afghanistan

- Belarus

- Russia (including Crimea, Donetsk, and Luhansk)

- Iran

- Iraq

- North Korea

- Syria

- Libya

- Sudan

- South Sudan

- Democratic Republic of the Congo

- Cuba

- Central African Republic

- Eritrea

These are all countries under international sanctions from the U.S., EU, or UN. Kraken follows these rules because it’s registered as a Money Services Business (MSB) with FinCEN in the U.S. and holds licenses in the UK, Canada, Australia, and Japan. If it ignored sanctions, it could lose those licenses - and with them, its ability to operate anywhere.

Even if you have a passport from a permitted country, but live in one of these blocked nations, Kraken will detect your IP address and lock your account. Using a VPN to bypass this? That’s a direct path to permanent account termination and frozen assets. Kraken’s systems track not just your IP, but your device fingerprint, payment methods, and even your residential address if you’ve uploaded ID documents.

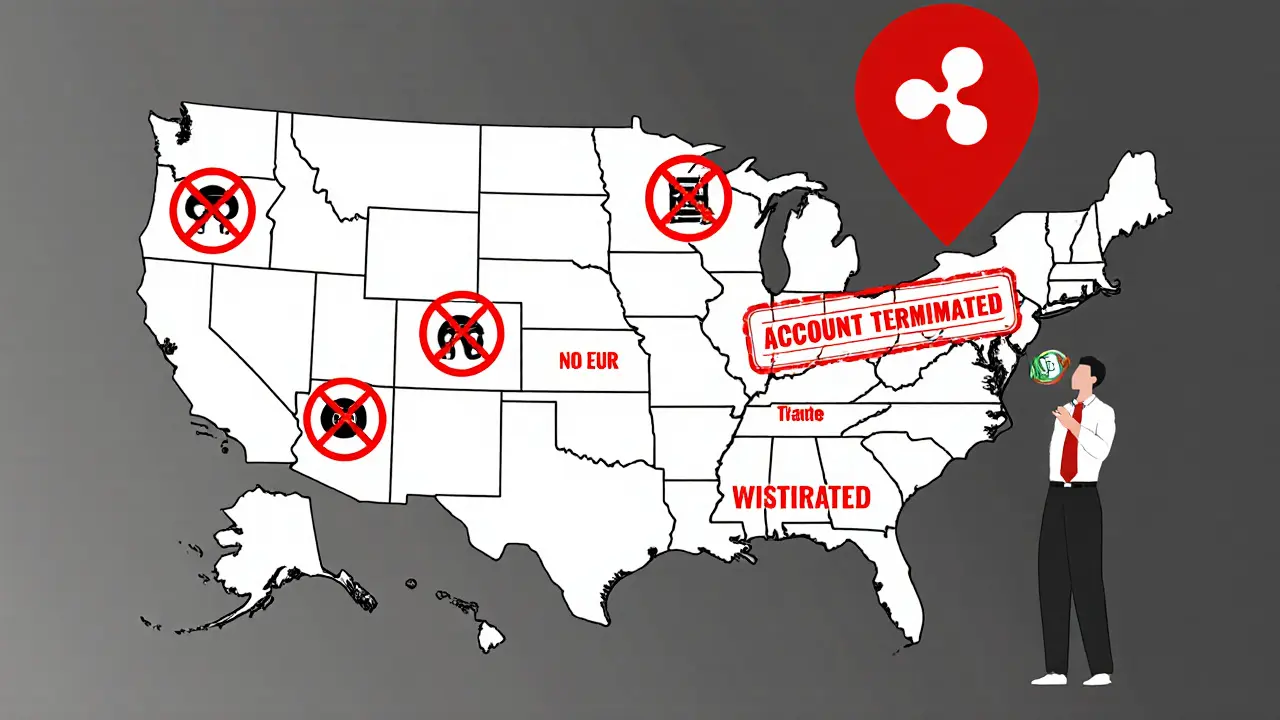

U.S. Residents: A Patchwork of Rules

If you’re in the U.S., Kraken works - but with heavy limits. It’s not one rule for all 50 states. Each state has its own crypto laws, and Kraken adjusts accordingly.

- Every U.S. resident can’t trade XRP. That’s because the SEC sued Ripple Labs in 2020, and Kraken pulled XRP to avoid legal risk.

- New York and Washington State residents can’t open new accounts. Existing users can still hold assets but can’t deposit, trade, or withdraw. New York’s BitLicense requirements are so strict that even big exchanges struggle to comply.

- New Hampshire and Texas residents can’t hold or trade in Euros (EUR). Kraken doesn’t offer EUR funding in these states due to state-level banking restrictions.

- US and Canadian users can’t trade EWT, GRT, or FLOW tokens. These are deemed too risky under current SEC guidance.

- ETH2.S is only available for staking - you can’t buy or sell it directly.

- Margin trading is capped at 28 days for U.S. users. Outside the U.S., you can hold positions for up to a year.

These aren’t arbitrary. They’re legal safeguards. Kraken got fined $30 million by the U.S. Treasury in 2022 for violating sanctions, and it’s still dealing with the fallout from a 2023 SEC lawsuit (which was later dropped). The exchange is walking a tightrope - trying to serve U.S. customers without triggering another regulatory crackdown.

Europe’s Big Shift: Stablecoins Are Gone

In early 2025, Kraken made a major move in Europe. It delisted five major stablecoins under the new Markets in Crypto-Assets (MiCA) regulation:

- Tether (USDT)

- PayPal USD (PYUSD)

- TrueUSD (TUSD)

- Tether EURt (EURt)

- TerraClassic USD (LUNC)

This affected over 30 European countries including Austria, Spain, Sweden, Portugal, Czechia, and Malta. The timeline was brutal:

- February 13, 2025: Reduce-only mode (can’t buy, only sell)

- February 27, 2025: Sell-only mode

- March 17, 2025: Margin positions closed

- March 24, 2025: Spot trading ended

- March 31, 2025: All remaining balances converted to EUR or USD

This was a shock to many users. Tether alone makes up over 60% of stablecoin trading volume globally. Kraken’s head of asset management, Mark Greenberg, had publicly said just months earlier that USDT wouldn’t be delisted. But MiCA’s new rules forced a reversal. Now, European users have to use alternatives like EURS or EURC - which have far less liquidity and higher spreads.

Australia and Japan: Privacy Coins Are Banned

In Australia, Kraken blocks all privacy coins:

- Monero (XMR)

- DASH

- Zcash (ZEC)

AUSTRAC, Australia’s financial intelligence unit, requires exchanges to track every transaction. Privacy coins make that impossible. So Kraken removed them entirely. No exceptions.

In Japan, the rules are different but just as strict. Japanese users must submit extra documentation to trade in JPY. Kraken also limits the number of cryptocurrencies available for trading to comply with Japan’s Financial Services Agency (FSA). Tokens like FLOW and certain DeFi tokens are blocked for Japanese residents.

How Kraken Knows Where You Are

It’s not just your IP address. Kraken uses a multi-layered system:

- IP geolocation - detects your real location, even if you use a proxy.

- ID verification - uploads of passport, driver’s license, or utility bills are checked against your claimed location.

- Payment method tracking - if your bank or card issuer is based in a blocked country, your deposit gets flagged.

- Transaction monitoring - unusual activity, like sudden logins from a banned region, triggers a review.

Once you’re flagged, you get a warning. If you don’t fix it - like updating your address or closing your account - Kraken freezes your assets. There’s no appeal process for users in sanctioned countries. It’s a hard line.

Why Kraken Blocks So Much - And Why It Matters

Some users hate these restrictions. They call Kraken too cautious. But here’s the truth: Kraken is one of the few major exchanges that hasn’t collapsed under regulatory pressure. While others like Binance and Bybit have been fined, sued, or banned outright, Kraken still operates in 190+ countries.

It’s not perfect. The rules are confusing. State-by-state limits in the U.S. are a nightmare. The European stablecoin delisting left users scrambling. But Kraken’s strategy is clear: comply first, grow later.

That’s why institutional investors - hedge funds, family offices, even banks - prefer Kraken. They need regulatory certainty. Retail traders might want more coins and higher leverage. But institutions want to sleep at night knowing their assets aren’t at risk of being seized by regulators.

Kraken’s restrictions are a trade-off. You get fewer coins and more rules. But you also get a platform that’s still standing when others have vanished.

What’s Next for Kraken’s Restrictions?

Change is coming - slowly.

- Washington and New York: Kraken is in talks with regulators to reapply for licenses. No timeline, but it’s active.

- Staking: Kraken may bring back staking for more tokens if the SEC clarifies its stance on proof-of-stake.

- Europe: As MiCA rolls out fully in 2026, Kraken might reintroduce some stablecoins if they meet new compliance standards.

- Global standardization: More exchanges will follow Kraken’s lead. The days of free-for-all crypto trading are ending.

Don’t expect Kraken to lift restrictions anytime soon. The regulatory pressure is only increasing. Countries like India, Brazil, and Nigeria are drafting strict crypto laws. Kraken will adapt - again - because its survival depends on it.

Why can’t I trade XRP on Kraken even if I’m not in the U.S.?

Kraken removed XRP trading globally in 2020 after the SEC sued Ripple Labs, claiming XRP was an unregistered security. Even though the case is ongoing, Kraken chose to block XRP for all users to avoid legal exposure. This applies to every country, regardless of local laws.

Can I use a VPN to access Kraken if I’m in a blocked country?

No. Kraken actively detects and blocks VPN usage. If you’re caught, your account will be permanently terminated and your assets frozen. The system checks your IP, device fingerprint, payment history, and ID documents. A VPN won’t fool it.

Why did Kraken delist USDT in Europe?

Kraken removed USDT and four other stablecoins because of the EU’s MiCA regulation, which requires stablecoins to meet strict reserve transparency and audit standards. USDT didn’t meet those standards in time, so Kraken had to delist it to stay compliant. This affected over 30 European countries.

Are there any crypto exchanges that don’t have these restrictions?

Yes - but they come with higher risk. Exchanges like Binance, Bybit, and OKX operate in fewer regulated markets and have fewer restrictions. However, many have been fined, banned, or lost licenses in the U.S., EU, and UK. You might get more coins and leverage, but you also risk losing access to your funds overnight.

How long does Kraken’s verification process take?

Standard verification takes 24-48 hours. If you’re in a high-risk jurisdiction or need enhanced verification (like for margin trading), it can take up to 7 days. Processing times vary based on your country and how complete your documents are.

24 Comments

So we're trading freedom for safety now?

I get why Kraken does this, but man-it’s like they’re building a museum instead of a marketplace. Crypto was supposed to be borderless. Now you need a passport, a lawyer, and a prayer to trade.

It’s wild how the same tech that promised decentralization ended up obeying the same old flags on a map. 🤷♂️

But honestly? I’d rather have a platform that survives than one that’s flashy today and gone tomorrow. Kraken’s playing the long game-even if it feels like they’re locking the vault with a golden key.

U.S. users can't trade XRP but can trade ETH2.S? That makes zero sense. SEC is just picking favorites now. This isn't regulation it's corporate favoritism

The delisting of USDT in Europe under MiCA is a textbook example of regulatory overreach disguised as consumer protection. Stablecoins are not securities-they are digital cash. By forcing exchanges to de-list them, regulators are effectively forcing users into slower, more expensive, and less liquid alternatives. This isn't innovation-it's infrastructure sabotage.

And yet, Kraken remains one of the few exchanges still operating with legal integrity. That’s not cowardice-it’s responsibility. Institutions aren’t choosing Kraken because it’s fun. They’re choosing it because they can sleep at night knowing their assets won’t vanish in a regulatory dawn raid.

Let’s be honest: if you want unrestricted crypto, you’re not looking for a regulated exchange-you’re looking for a casino with no bouncers. And those casinos always burn down.

India is watching closely. If Kraken can survive U.S. and EU rules, maybe we can get a local version here too. Hope they don’t block INR deposits next.

As someone from India, I find it ironic that Kraken blocks entire nations under sanctions while simultaneously enabling U.S. states to impose their own crypto apartheid. This isn't compliance-it's selective obedience. The world doesn't operate in binary black-and-white. Neither should finance.

Yet, I respect the clarity. No false promises. No 'we'll try to comply later.' Kraken says: 'This is the line.' And for once, that’s admirable.

Still, the real question remains: who gets to draw the line? And why do the same people who demand financial freedom still accept these borders without protest?

Let’s be real-Kraken’s restrictions are the reason we still have a functioning exchange. Binance got slapped with $4B in fines. Bybit got banned in the UK. Kraken? Still here. Still licensed. Still serving 190+ countries. That’s not weakness-that’s strategy. You want more coins? Go to a shady offshore platform. You want to keep your assets? Stick with the one that plays by the rules.

Margin trading capped at 28 days? Good. Leverage is a casino chip. ETH2.S only for staking? Smart. SEC’s watching. Don’t be the guy who got liquidated because he thought ‘regulation doesn’t apply to me.’

Crypto’s grown up. Time to stop whining and start adapting.

Why does Kraken listen to the U.S. and EU? Because they’re weak. We should be building our own exchange. Not some corporate puppet obeying the Fed’s bedtime stories. America doesn’t own crypto. We’re not your financial colony.

Thank you for this breakdown. As someone who’s had accounts frozen on other platforms, I appreciate Kraken’s transparency-even when it’s inconvenient. The fact that they clearly state why XRP is blocked, why USDT was pulled, and how they detect VPNs? That’s rare. Most exchanges hide behind vague TOS. Kraken gives you the legal context. That’s respect.

Also, the MiCA timeline? Brilliantly documented. Someone should turn this into a PDF for new users. Seriously.

It’s funny how people scream about censorship when they can’t trade Monero, but when the government freezes their bank account for sending $500 to a crypto exchange, suddenly they’re like ‘ohhh I guess that’s fair.’ Double standards everywhere.

So if I live in Texas and want to trade EUR, I’m out? But if I move to California, I can? That’s insane. Why can’t Kraken just let me use a different bank? Why does the state I live in control my crypto access?

This feels less like regulation and more like… digital redlining.

Man… I used to think crypto was about freedom. Now it’s like trying to buy a beer in a country where every bar has its own rules. Some let you drink if you’re 21. Others say 25. Some say no beer at all. And if you lie about your age? They ban you forever. No second chances. No appeals. Just… gone.

And the worst part? We knew this was coming. We just didn’t want to admit it. Crypto didn’t escape the system. It got absorbed by it.

The fact that Kraken delisted USDT in Europe under MiCA is a necessary step. Stablecoins must be audited, transparent, and regulated. USDT’s lack of public reserve proofs for years was unacceptable. This isn’t censorship-it’s accountability. If you want to be money, you must behave like money.

And yes, liquidity is lower now. But that’s a market problem, not a regulatory failure. The market will adapt. New stablecoins will emerge. And they’ll be better for it.

i just want to trade xmr… why do they hate privacy so much?? i didn’t do anything wrong… i just want to buy some coins… why do they make it so hard… i hate this

kraken's not perfect but at least they don't vanish overnight like some other exchanges. i've lost coins before. not gonna risk it again.

you know what’s wild? the fact that we’re even having this conversation. 10 years ago, no one thought crypto would be regulated. now we’re debating state-by-state rules like it’s normal. maybe we won the war… and lost the peace? 🤔

Let me say this clearly: Kraken’s restrictions aren’t a bug-they’re a feature. They’re the reason you can still log in today. While other exchanges chased growth at all costs, Kraken chose longevity. That’s leadership.

Yes, you can’t trade XRP. Yes, you can’t use USDT in Europe. Yes, your privacy coin is gone. But you still have access to 190+ countries, legal compliance, and institutional-grade security.

That’s the trade-off. And honestly? Most of us would take it again tomorrow.

And to those who say ‘just use a VPN’-you’re not a hacker. You’re a liability. Kraken doesn’t ban you because they’re mean. They ban you because if they don’t, the entire platform risks being shut down by the U.S. Treasury. Your ‘freedom’ to bypass sanctions puts everyone else’s assets at risk. That’s not rebellion. That’s recklessness.

And yes, it’s frustrating. But freedom without responsibility is chaos. And chaos doesn’t build wealth-it destroys it.

Love this. 🙌

It’s like saying, ‘I want to drive a car, but I don’t want to wear a seatbelt.’ Sure, you *can* do it. But if the whole highway shuts down because someone got reckless, then everyone loses. Kraken’s just buckling the belt-even if it’s uncomfortable.

As an Irishman who’s watched this unfold, I find it deeply ironic that the same governments demanding ‘financial sovereignty’ are the ones enforcing global crypto bans. Kraken isn’t the villain. It’s the messenger. And the message is clear: the age of crypto anarchy is over. The age of regulated finance has begun.

Whether you like it or not, the future belongs to those who adapt-not those who rage against the walls.

There’s a quiet dignity in Kraken’s approach. They don’t boast. They don’t pretend. They say: ‘Here are the rules. Follow them, or leave.’ No fluff. No ‘we’re here for you’ marketing. Just cold, hard compliance.

That’s why I trust them. Not because they give me everything I want-but because they don’t promise what they can’t deliver.

And honestly? That’s more than I can say for most of the crypto world.

Let’s not pretend this is about ‘compliance.’ This is a coordinated global effort to control money. Kraken didn’t choose to block these countries-they were ordered to. The U.S. Treasury, the EU, the UN-they’re using Kraken as a tool. And soon, every exchange will be forced to do the same. This isn’t the end of crypto. It’s the beginning of financial surveillance.

They’re not banning coins. They’re banning freedom. And Kraken? They’re the gatekeepers.

Eric, your paranoia is understandable-but misplaced. Kraken isn’t a tool of the state. It’s a company trying to survive it. If they refused to comply, they’d be shut down. And then *everyone* would lose access. The alternative isn’t freedom-it’s oblivion.

Yes, the system is flawed. But the only way to change it is from within-not by screaming into the void.