How to Manage Liquidity Pool Positions in DeFi for Better Returns

What Is a Liquidity Pool Position?

A liquidity pool position is your share in a decentralized exchange’s trading pool-like Uniswap, Curve, or Balancer-where you lock up two tokens in a 50/50 ratio (or custom weights) to help traders swap between them. In return, you earn a cut of every trade fee that flows through that pool. It’s not like staking; you’re not locking tokens to secure a network. You’re acting like a market maker, providing the buy and sell side so others can trade easily.

Back in 2018, Uniswap made this simple: deposit ETH and USDC, get LP tokens back, and watch fees roll in. But today, it’s far more complex. The average return isn’t 100% APY like in 2021. It’s 5-15% for volatile pairs, 2-4% for stablecoins. And if you don’t manage your position, you could lose more than you earn.

Why Most People Lose Money in Liquidity Pools

The biggest trap? Impermanent loss. It’s not a bug-it’s how automated market makers work. When the price of one token in your pair moves sharply, the protocol automatically rebalances your holdings to keep the pool’s value equal. You end up with more of the token that dropped and less of the one that rose. If you’d just held the tokens instead of putting them in the pool, you’d have made more.

For example: You deposit 1 ETH and 2,000 USDC when ETH is $2,000. If ETH spikes to $3,000, your pool share now contains less ETH than you started with. The pool’s math forces you to sell high and buy low-inside the pool. That’s impermanent loss. In volatile pairs like ETH/USDC, this can cost you 15-25% over a few weeks. In stablecoin pools like USDC/DAI, it’s under 1.5%.

Another hidden cost? Gas fees. Every time you adjust your position, you pay Ethereum fees. During peak hours, that’s $20-$50 per transaction. Do it too often, and you eat your profits.

Uniswap V3 vs. Traditional Pools: The Big Difference

Uniswap V3 changed everything. Instead of spreading your money across the whole price range (like in V2), you can now concentrate it between two prices-say, $1,900 to $2,100 for ETH/USDC. This makes your capital 10x to 4,000x more efficient. If ETH stays in that range, you earn way more fees per dollar than in a traditional pool.

But here’s the catch: if ETH moves outside your range, you earn zero fees. No trading activity. No income. Just your tokens sitting idle. A Gauntlet Network study in January 2025 found that 65-80% of fee potential is lost if a position sits outside its range for over 30 days.

Traditional pools (Uniswap V2, SushiSwap) are simpler. Your money is always working. But you earn 60-75% less per dollar deployed. If you don’t want to check your positions weekly, stick with V2. If you’re willing to manage actively, V3 gives you better returns.

How to Choose the Right Pool

Not all pools are created equal. Here’s how to pick:

- Stablecoin pairs (USDC/DAI, USDT/USDC) → Use Curve. Slippage is near zero, impermanent loss is minimal, APY is steady at 2-4%. Low risk, low reward.

- Major volatile pairs (ETH/USDC, BTC/USDC) → Use Uniswap V3. Set tight ranges around current price. Target 15-20% price movement buffer. Expect 8-18% APY if managed well.

- Niche tokens (LINK/USDC, SOL/USDC) → Avoid unless volume is over $1M daily. Thin liquidity means high slippage and big losses when you exit.

- Multi-token pools (Balancer 80/20) → Good for diversification, but volume is often low. You might earn less because fewer people are trading.

Check DefiLlama for TVL and volume. Never put money in a pool with less than $10 million locked or less than $1 million in daily volume. Low liquidity = big price swings when you deposit or withdraw.

Managing Your Position: A Step-by-Step Routine

Successful LPs don’t set it and forget it. They treat it like a trading account.

- Start small → Use 0.1-0.5 ETH equivalent. Learn before scaling.

- Verify the contract → Double-check the address on Uniswap’s official site or Etherscan. Fake contracts cost people millions.

- Set minimal approvals → Never allow unlimited token access. Approve only what you need for one deposit.

- Use a hardware wallet → For positions over $5,000, use Ledger or Trezor. Hot wallets get hacked.

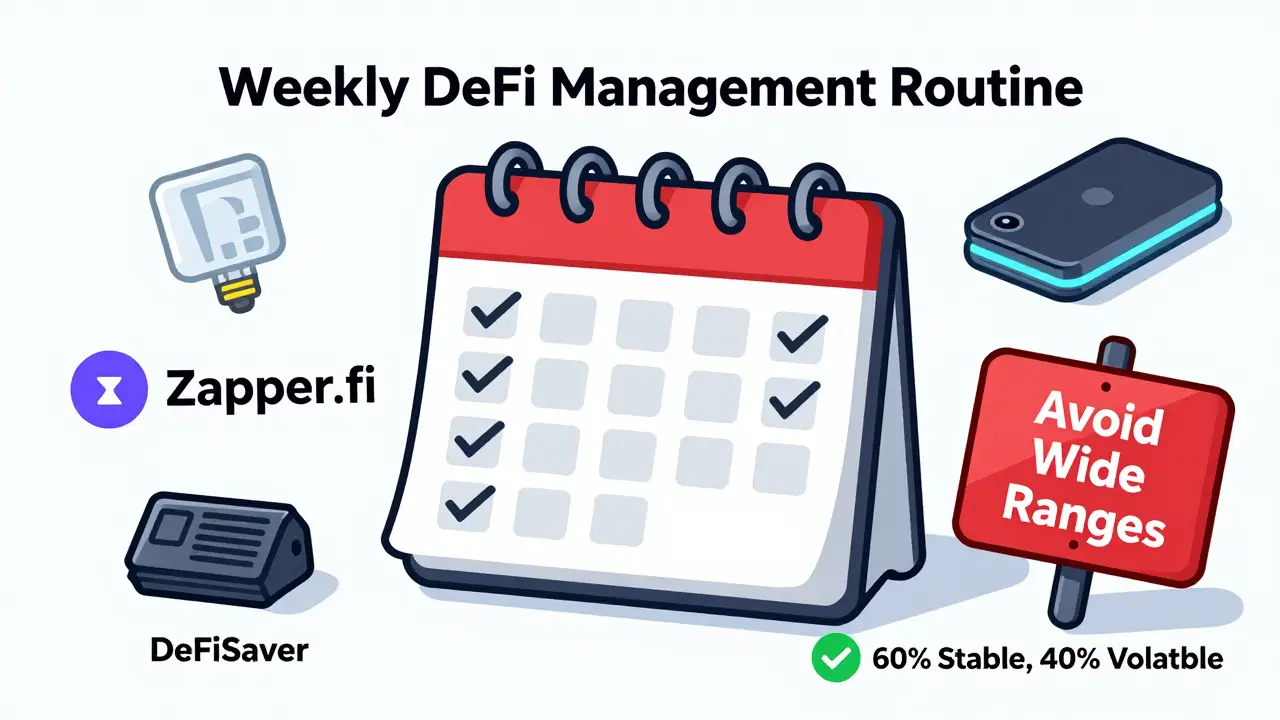

- Monitor weekly → Check if your price range is still valid. If ETH moved 15% from your range, adjust it. Use Zapper.fi or DeFiSaver for alerts.

- Rebalance every 2-4 weeks → If one token has grown much more than the other, swap some to restore balance. This reduces impermanent loss.

- Exit in tranches → Don’t pull all your money out at once. Withdraw 25% at a time during big price moves to avoid bad timing.

Tools That Actually Help

You don’t need to do this manually. Here are tools that save time and money:

- Zapper.fi → Best for beginners. Shows real-time impermanent loss, fee earnings, and lets you adjust ranges in one click. Rated 4.3/5 by 1,247 users.

- DeFiSaver → Automates rebalancing and range adjustments. Integrates with Uniswap V3 and Curve.

- SWAAP Autopilot → Uses machine learning to predict optimal price ranges. Users report 12-18% higher returns than manual management.

- Etherscan Gas Now → Shows real-time gas prices. Wait for under $3 to make adjustments. Avoid peak hours (UTC 14:00-18:00).

Don’t trust tools that promise 50% APY. If it sounds too good to be true, it is. The top 10% of LPs make consistent returns-not windfalls.

The Risk-Return Balance: What Experts Recommend

Delphi Digital’s February 2025 research found the sweet spot: 60% in stablecoin pools, 40% in volatile pairs. That mix reduces overall portfolio loss during crashes while keeping returns above 7%.

SWAAP Finance’s risk framework (March 2025) adds another layer: diversify across protocols. Put 40% in Curve (stablecoins), 35% in Uniswap V3 (ETH/USDC), 25% in Balancer (multi-token). This cuts drawdowns by 48% during market crashes, per Messari’s analysis of the May 2024 sell-off.

Don’t go all-in on one pool. If Uniswap gets hacked (it hasn’t, but others have), you lose everything. Spreading across three platforms reduces protocol risk.

What’s Changing in 2025 and Beyond

DeFi is maturing. Liquidity mining rewards are gone. Now it’s about smart management.

Uniswap’s new Position Manager (Jan 2025) automates range adjustments. SWAAP’s Autopilot learns from price patterns. Ethereum’s EIP-7288 (coming Q2 2025) will cut gas fees for position changes by 40%.

But regulation is tightening. The SEC’s February 2025 guidance classified some LP tokens as securities. 18% of protocols now require KYC for large deposits. That means less anonymity-but more institutional money coming in. Citadel Securities launched a permissioned LP platform in late 2024 for hedge funds.

Long-term, Pantera Capital predicts professionally managed liquidity positions will return 8-15% annually. That beats most savings accounts and bonds. But only if you treat it like a business-not a lottery ticket.

Common Mistakes and How to Avoid Them

- Mistake: Setting too wide a range in Uniswap V3. Solution: Keep it within 15% of current price. Wider ranges = less fee capture.

- Mistake: Depositing without checking slippage. Solution: Use Uniswap’s position simulator to model your trade before confirming.

- Mistake: Ignoring gas costs. Solution: Only adjust positions when gas is under $3. Use Etherscan’s gas tracker.

- Mistake: Leaving positions unmonitored for weeks. Solution: Set a weekly calendar reminder. Check your range, your fees, your loss.

- Mistake: Using unlimited approvals. Solution: Always revoke and re-approve for each deposit. One click can save you $100K.

One Reddit user, 'DeFiDegen42', turned $2,000 into $2,374 in six months by adjusting his ETH/USDC range every time ETH moved 10%. Another, 'CryptoNoob1987', lost 32% on a LINK/USDC pool because he didn’t check for two months. The difference? Discipline.

24 Comments

bro this is all just a pyramid scheme wrapped in blockchain glitter 🤡 the SEC is gonna shut this down next quarter and we'll all be begging for jobs at McDonald's

you guys are doing amazing just by trying to understand this stuff!! 🌟 even if you lose a little, you're learning way more than most people ever will. keep going, you've got this!

liquidity is just modern alchemy. turning risk into reward, or illusion into reality. the real question is: who benefits?

i tried this once and lost my whole eth balance 😭 now i just hodl and pretend i never heard of lp's. also gas fees are a scam

v3 is cool but honestly if you dont wanna check your position every day just use v2. simpler life

this whole thing is a joke. i deposited 5k and got 47 cents in fees. the devs are laughing all the way to the bank

imagine spending your weekends tweaking price ranges like a stockbroker from 1999. we're not farmers, we're crypto gods. just hodl and let the universe do its thing

i've been in usdc/dai pools for a year. 3.2% apy. no stress. no gas drama. just steady growth. sometimes the quiet wins.

can someone explain why we're still using ethereum for this? the fees alone make this unsustainable for small players. isn't there a better chain?

SWAAP autopilot changed my life. i used to lose 20% to impermanent loss. now i'm up 14% net in 4 months. automation is the future. stop manual grinding

they call it decentralization but the real power lies with the algorithm designers and the gas speculators. we're just cattle grazing on the blockchain pasture

i just use zapper.fi and set alerts. if it moves 10% i get a ping. i check once a week. works fine. no need to overthink

uniswap v3? more like uniswap v3.14159265359 because they're trying to sell us pi as a feature. this is just financial engineering for the gullible

this guide is gold. i used to be scared of lp's but now i'm actually excited. thanks for making it feel doable!

i'm curious - has anyone tried combining this with yield aggregators like yearn? could you stack apy on apy safely?

you all are so naive. the real winners are the ones who front ran your rebalances and sniped your liquidity before you even hit confirm. you're not making money. you're paying for their coffee

i tried v3. set a range. waited 3 weeks. gas was $40 to adjust. lost 18% to il. now i just use binance. at least they pay me in usdt

so you're telling me i have to work harder to earn less than my savings account? brilliant. thanks for the 2025 financial nightmare

just deposit in usdc/dai and forget it. 4% is free money. stop chasing 20% and you'll sleep better

The methodology outlined herein is methodologically sound and empirically supported by recent market data. However, one must consider the systemic risk inherent in protocol-level smart contract vulnerabilities, particularly in the context of evolving regulatory frameworks. Prudent risk mitigation necessitates multi-sig custody and diversified protocol exposure.

this post is written by a degenerate who thinks gas fees are a feature not a bug. if you're not losing money in lp's, you're not trying hard enough

liquidity provision is the new labor exploitation. you're providing capital as a service while the protocol captures the rent. welcome to crypto-feudalism

why are we letting these foreign devs dictate our financial future? this is american capital being siphoned into chinese-run contracts. we need a usdc-only, patriot-approved lp protocol

people think they're being smart by managing positions, but they're just feeding the machine. the real sin is participating in this gambling system at all. true wealth is in silence and simplicity