How Crypto Exchanges Detect and Block Multi-Layered VPNs

When you try to access a crypto exchange like Binance or Coinbase from a country where trading is restricted, you might think using a VPN is enough to slip through. But today’s exchanges don’t just check your IP address-they run a full diagnostic on your entire digital footprint. Multi-layered VPN detection isn’t just a feature; it’s a necessity for exchanges trying to stay legal while users push back against geographic locks.

It’s Not Just About Your IP Address

The oldest trick in the book was changing your IP to appear in a different country. Back in 2020, that worked fine. Now? It’s like showing up to a bank with a fake ID and expecting no questions. Exchanges maintain massive, constantly updated databases of known VPN server IPs-thousands of them. If your connection comes from an IP flagged as NordVPN, ExpressVPN, or even a lesser-known provider, you’re likely blocked before you even log in. But that’s just the first layer. Advanced systems now look at how your traffic behaves. Deep Packet Inspection (DPI) doesn’t just see that you’re connected to a server-it analyzes the pattern of your encrypted data. Regular internet traffic has a rhythm. VPN traffic, even when obfuscated, often has telltale timing quirks, packet sizes, or handshake signatures that machine learning models learn to spot. It’s not about breaking encryption-it’s about recognizing the fingerprint of a VPN tunnel.DNS Leaks and Time Zone Mismatches

Your browser might think it’s in Singapore, but if your DNS resolver is still pointing to a server in Moscow, the exchange knows something’s off. DNS leak detection is simple but brutally effective. Even if your VPN hides your real IP, misconfigured DNS settings can give you away in seconds. Then there’s time zone analysis. If your account was created in Brazil, you’ve always traded between 8 AM and 11 PM local time, and suddenly you’re placing orders at 3 AM New York time while your device claims you’re in London-alarm bells ring. Behavioral patterns matter more than you think. Exchanges track login times, trading hours, even how long you spend on the app before making a trade. Sudden shifts in behavior trigger verification requests or temporary holds.Browser Fingerprinting: The Silent Tracker

You might not realize it, but your browser leaks a ton of identifying info. Screen resolution, installed fonts, GPU model, plugin list, even the exact version of your operating system-all of it gets collected silently. If your fingerprint says you’re using a Windows 11 machine with a 4K display and Chrome 120, but your IP says you’re in Turkey where most users have older Android phones and Firefox-it doesn’t add up. This isn’t just about VPNs. It’s about consistency. If your device profile changes every time you switch servers, the system flags it as suspicious. Some users report success by cloning their browser profile exactly across different VPN servers. But that’s hard to do consistently, and exchanges are getting better at spotting cloned fingerprints.

Not All VPNs Are Created Equal

Free VPNs? They’re almost always caught. Their IP ranges are tiny, overloaded, and well-known. Even if you manage to get in, your account will likely get flagged for suspicious activity within hours. Premium services like NordVPN and ExpressVPN have better odds-but not because they’re untraceable. They’re just harder to block entirely. Users report mixed results: sometimes a server in Japan works for days, other times it’s blocked within minutes. The key is server selection. Some servers are optimized for streaming, others for torrenting. Only a handful are actually tuned to bypass crypto exchange detection. And then there’s the newer players. Services like NymVPN use a completely different model-mixnets that route traffic through dozens of volunteer-run nodes, making it nearly impossible to trace origin or pattern. These aren’t designed for speed or streaming. They’re built for anonymity. And right now, most crypto exchanges can’t detect them-not because they’re too advanced, but because the detection systems aren’t built to look for something that doesn’t behave like a traditional VPN at all.Behavioral Triggers Beyond the Network

The smartest detection systems don’t stop at your connection. They look at your wallet. If you’ve been trading on Binance from a Brazilian account for six months, and suddenly you deposit ETH from a wallet that’s only ever been active on Russian IPs, the system connects the dots. Blockchain analysis tools now cross-reference wallet history with network metadata. Even if your VPN works, your on-chain behavior can betray you. Some exchanges now require mobile verification. If your phone’s GPS says you’re in Dubai, but your Wi-Fi connection says you’re in Germany, and your login IP says you’re in the Netherlands-you’re not just flagged. You’re locked out until you prove your identity with government ID and a live selfie. KYC isn’t just for compliance anymore-it’s a geo-location checkpoint.

Why Exchanges Are Pushing So Hard

It’s not about controlling users. It’s about survival. In 2024, China fined one major exchange $230 million for allowing users to bypass its crypto ban. Russia has threatened to shut down any platform that doesn’t block local users. Turkey has banned crypto trading outright for non-residents. Exchanges that ignore these rules risk fines, legal action, or being blocked entirely in entire markets. That’s why Binance, Kraken, and Coinbase invest millions in detection tech. They’d rather lose a few thousand users than risk losing access to millions more in regulated markets. The global crypto exchange market is projected to hit $57 billion by 2030. That’s the prize. And the cost of failure? Billions.What Happens When You Get Caught

Getting detected doesn’t always mean instant ban. More often, you’ll get a notification: “We’ve detected unusual activity. Please verify your identity.” If you’re a casual trader, you might just upload your ID and be fine. But if your account shows repeated attempts to bypass restrictions, or if your wallet history ties back to a banned region, your account may be frozen or closed. Some users report being locked out for weeks while waiting for manual review. Others say their funds were transferred to a “restricted account” and can only be withdrawn after 30 days. There’s no standard policy. Each exchange handles it differently. But one thing’s clear: if you’re using a VPN to access restricted markets, you’re playing with fire.The Future: Decentralized Exchanges and the End of Detection?

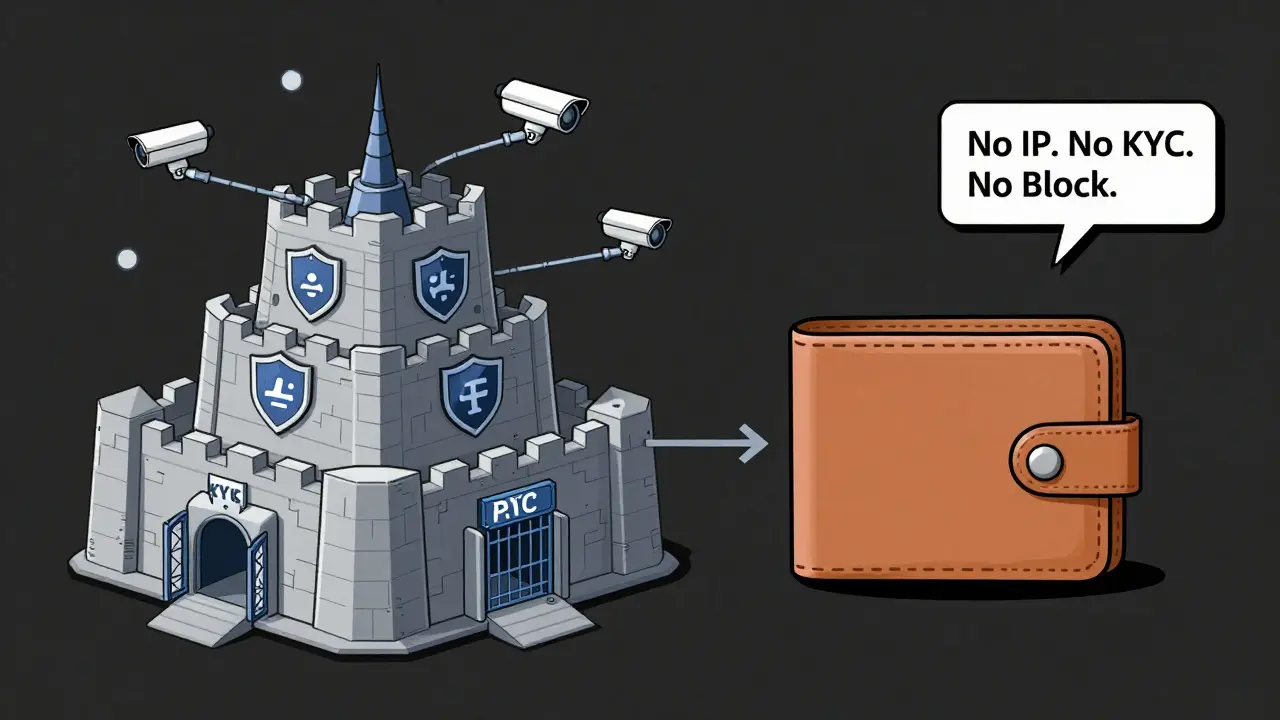

Here’s the twist: the most effective way to avoid VPN detection might be to stop using centralized exchanges altogether. Decentralized exchanges (DEXs) like Uniswap or dYdX don’t require sign-ups, don’t collect KYC data, and don’t monitor your IP. You connect your wallet, trade directly on the blockchain, and walk away. No detection system can block you if there’s no central server to block from. But even here, regulators are catching up. Some countries are starting to target wallet providers and DeFi protocols. The next wave of restrictions may not be about your connection-it’ll be about your wallet’s history. If your wallet has ever interacted with a banned exchange, you might be flagged anyway. The arms race isn’t slowing down. Exchanges are building AI models that predict user intent based on trading patterns. Privacy networks are getting smarter. The line between compliance and control is blurring. And users? They’re caught in the middle, trying to trade freely while staying out of legal trouble.There’s no perfect solution. Using a VPN to access crypto exchanges is risky. The detection systems are too advanced, too interconnected, and too well-funded to be easily fooled. If you need access to restricted markets, your safest bet isn’t a better VPN-it’s understanding the rules, knowing the risks, and considering alternatives like DEXs that don’t ask for your location in the first place.

Can crypto exchanges detect if I’m using a VPN even if I’m not doing anything illegal?

Yes. Exchanges don’t care why you’re using a VPN-they only care that you’re using one. Even if you’re just trying to access a service from abroad, their systems flag the connection as a potential compliance risk. Detection is automated and doesn’t require proof of wrongdoing. Simply connecting from a known VPN IP can trigger account restrictions or verification requests.

Which VPNs work best with crypto exchanges in 2026?

No VPN guarantees success, but premium services like NordVPN and ExpressVPN have the most consistent results because they rotate server IPs frequently and offer obfuscation features. However, success depends on the exchange and server selection. Some users report better luck with servers in countries like Germany, Japan, or Switzerland. Free VPNs almost always fail, and even premium ones can be blocked within hours. There’s no permanent solution-just trial and error.

Why does my account get flagged even when my VPN seems to be working?

Because detection isn’t just about your IP. Exchanges use behavioral analysis: your login times, trading habits, device fingerprint, and even how you type your password. If your behavior suddenly changes-like switching from a Brazilian account to trading at 3 AM New York time-the system flags it. Your VPN might hide your location, but it can’t hide your patterns.

Can I use a VPN with decentralized exchanges (DEXs)?

Technically yes, but it’s unnecessary. DEXs like Uniswap or PancakeSwap don’t require sign-ups or KYC, and they don’t monitor your IP. You connect your wallet directly to the blockchain. There’s no central server to bypass, so a VPN adds no benefit-and may even slow down your transactions. The only reason to use a VPN with a DEX is if your local internet provider is blocking blockchain access.

What happens if I’m caught using a VPN on a regulated exchange?

Outcomes vary. You might get a simple verification request, a temporary lock, or a full account freeze. In extreme cases, especially if your wallet history links to banned jurisdictions, your funds could be held indefinitely until you prove compliance. Some exchanges will close your account entirely and require you to reapply under a new identity-which is against their terms of service and can lead to permanent bans.

Are there any legal ways to access crypto exchanges from restricted countries?

Yes-but only if you’re a legal resident. Some exchanges allow users to open accounts if they can prove residency through official documents, even if they’re living abroad temporarily. Others partner with local payment processors or licensed custodians to offer compliant access. The only safe path is to comply with local laws. Using a VPN to bypass restrictions is a violation of terms and carries legal and financial risk.