How Argentines Use Crypto to Save Money When Inflation Eats Paychecks

Every month, Mariana gets paid in Argentine pesos. By the time she tries to save even a small part of it, the money has already lost value. In 2023, inflation hit 161%. Even by May 2025, it was still over 40%. Her savings didn’t just sit still-they shrank. She couldn’t open a U.S. dollar bank account. The government blocked it. So she did something else: she started converting her paycheck into USDC.

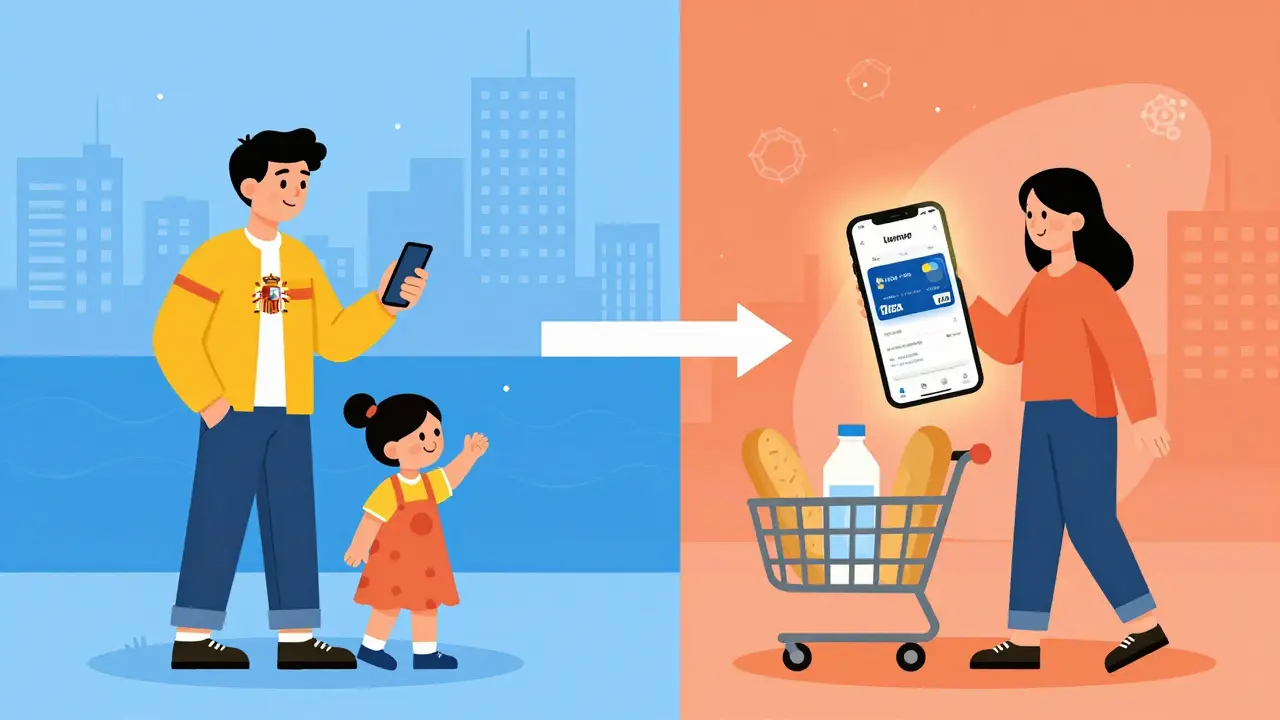

She didn’t need to understand blockchain. She didn’t need to mine Bitcoin. She just used the Lemon app, tapped a few buttons, and turned her pesos into a digital version of the U.S. dollar. That digital dollar didn’t lose 40% of its value in a year. It stayed the same. And when she needed to buy groceries, she used a prepaid Visa card linked to her USDC balance. No foreign bank account. No middlemen. No delays.

This isn’t just Mariana’s story. It’s happening across Argentina. One in five Argentines now owns some form of cryptocurrency. That’s the highest rate in Latin America-higher than Brazil, higher than El Salvador. In 2024, $91.1 billion in crypto flowed into the country. People aren’t gambling on Bitcoin like lottery tickets. They’re using it like a savings account. And the reason is simple: the peso doesn’t work anymore.

Why the Peso Can’t Be Trusted

The Argentine peso has been falling for decades. In 1989, inflation hit 2,600%. Even today, prices change every week. A loaf of bread that cost 1,000 pesos in January might cost 1,500 by March. Salaries rise, but not fast enough. People who keep cash under their mattress watch their buying power vanish. Banks don’t offer reliable dollar accounts. The government limits how much foreign currency you can buy. So people look for alternatives.

That’s where crypto comes in. Not as a speculative gamble. Not as a get-rich-quick scheme. But as a tool to hold value. Stablecoins-digital tokens tied to the U.S. dollar-are the real heroes here. Tether (USDT), USD Coin (USDC), and DAI are the most popular. They don’t swing like Bitcoin. They stay steady. If you buy $100 worth of USDC, you still have $100 worth of USDC tomorrow, even if the peso crashes.

DAI is especially interesting. It’s not backed by a company. It’s backed by collateral locked on the Ethereum blockchain. Anyone can check how much collateral backs each DAI coin. That transparency builds trust. Argentines buy DAI with pesos, then instantly convert it to dollars. No paperwork. No waiting. No government interference.

How It Actually Works: The Lemon Example

Lemon is the most common app for this. It’s like a bank, but built for crypto. You link your bank account. When your salary hits, you choose to convert it to USDC. The app does it automatically. Your money is now in a digital dollar. You can leave it there. You can send it to family abroad. Or you can spend it.

How? Through a prepaid Visa card linked to your USDC balance. At the supermarket, you swipe it like any other card. The app converts your USDC to pesos at the real-time exchange rate and pays the store. No extra fees. No delays. No need to go to a black-market exchange.

Before Lemon, people used to drive to cash-exchange shops called "cuevas"-shadow markets where you traded pesos for dollars at rates far worse than the official one. Now, they just open an app. It’s faster. Safer. Cheaper.

More Than Savings: Sending Money Home

Over 1.5 million Argentines now live abroad. Many send money back to family. Traditional remittances cost 10% or more in fees. And they take days. With crypto, it’s different.

Someone in Spain sends $200 in USDT to their sister in Córdoba. She gets it in minutes. She converts it to pesos or keeps it in USDC. The fee? Less than $1. No forms. No limits. No bank approval needed.

Remittances to Argentina jumped 25% in 2021 and another 11% in 2022. By 2023, they hit $156 billion. Crypto didn’t cause all of that-but it made it easier. Faster. Cheaper. For families relying on that money, it’s life-changing.

Why Stablecoins, Not Bitcoin?

Bitcoin is popular too. Many Argentines buy it as a long-term store of value. But Bitcoin swings wildly. One day it’s $60,000. The next, $55,000. That’s fine if you’re investing. But if you need to pay rent next week, you can’t afford to lose 10% of your savings overnight.

Stablecoins fix that. They’re the bridge between the crypto world and real life. You use them to save, pay, and send money without the rollercoaster. That’s why USDT and USDC are used for 80% of daily crypto transactions in Argentina. Bitcoin is for savings. Stablecoins are for living.

Regulation Is Catching Up

For years, crypto in Argentina existed in a gray zone. No one stopped you-but no one protected you either. That changed in March 2025. The National Securities Commission (CNV) released Resolution 1058/2025. For the first time, crypto exchanges and platforms had to register and follow rules. The CNV became the official regulator.

This wasn’t a crackdown. It was a legitimation. President Javier Milei, who took office in late 2023, is openly pro-crypto. He’s pushed for Bitcoin to be recognized as legal tender. He wants Argentina to become a crypto hub. The new rules give businesses confidence. They give users protection. It’s not perfect-but it’s progress.

Platforms like Binance and Lemon now operate under clear rules. That means fewer scams. Fewer frozen accounts. More trust.

What’s Next?

Argentina’s crypto use isn’t slowing down. Inflation is still high. The peso is still weak. People still can’t access dollars through normal channels. And the tools are getting better.

More apps are launching. More employers are paying in crypto. More stores are accepting USDC. Even small businesses in Rosario and Mendoza now accept crypto payments through QR codes. The ecosystem is growing-not because it’s trendy, but because it works.

Other countries are watching. Venezuela, Nigeria, Turkey-they all have inflation problems too. But none have built a system as widespread, as practical, or as deeply integrated into daily life as Argentina. It’s not about Bitcoin being the future. It’s about people finding a way to survive today.

Crypto in Argentina isn’t a financial experiment. It’s a survival tool. And it’s working.

Why don’t Argentines just use U.S. dollars directly?

The Argentine government limits how much foreign currency citizens can buy through banks. You can’t open a U.S. dollar account without special permission, and even then, the process is slow and restricted. Crypto bypasses those rules. Stablecoins like USDC act as digital dollars you can hold without needing a bank account abroad.

Is crypto safe in Argentina?

It’s safer than keeping cash at home or trusting unregulated exchange shops. With regulated platforms like Lemon and Binance, your funds are protected under new 2025 rules. You still need to use strong passwords and avoid phishing scams-but the system is far more secure than the old black-market peso exchanges.

Do I need to be tech-savvy to use crypto in Argentina?

No. Apps like Lemon are designed like regular banking apps. You link your bank account, choose to convert your paycheck to USDC, and use a Visa card to spend it. You don’t need to know what a wallet is, what a blockchain is, or how to send crypto. It’s hidden behind a simple interface.

Can I use crypto to pay bills in Argentina?

Yes. Many utility companies, internet providers, and even some landlords now accept payments in USDT or USDC. You pay through the same apps you use to save. The system converts your stablecoin to pesos at the current rate and processes the payment automatically.

Is Bitcoin the best crypto to save in Argentina?

Bitcoin is good for long-term savings because it’s decentralized and has limited supply. But for everyday use-paying for groceries, sending money to family, or keeping emergency funds-stablecoins like USDC are better. They don’t swing in value. Bitcoin is a store of value. Stablecoins are a tool for daily life.

What happens if the Argentine government bans crypto?

It’s unlikely. The government now recognizes crypto’s role in stabilizing the economy. President Milei supports it. The CNV regulates it. Banning it would hurt millions of citizens who rely on it to survive. Instead, the trend is toward more integration, not less.

20 Comments

Man, this is wild-people are just bypassing broken systems with apps like Lemon. No banks? No problem. Just tap, convert, and spend. It’s not crypto magic-it’s survival. And honestly? It’s beautiful.

This is the future. Simple, fast, and real. No fluff. Just money that doesn’t vanish.

Oh please. This isn’t innovation-it’s desperation dressed up as tech. Next they’ll be trading goats for USDC. At least the peso has history. This? It’s digital colonialism with a app icon.

I’ve seen this in my cousin’s family in Buenos Aires. They used to drive an hour to cuevas just to get cash. Now? Five minutes on their phone. No one’s rich-but they’re not starving either.

So happy to see people finding real solutions 💙 It’s not about crypto hype-it’s about dignity. Keep going, Argentina!

Let’s be real-this isn’t just about inflation. It’s about trust. People don’t trust their government, their banks, or even their own currency. So they built a parallel economy with their thumbs. That’s not crypto-it’s civil disobedience with a QR code.

Stablecoins are the quiet revolution. Bitcoin’s for speculators. USDC? That’s the new peso. And honestly? It’s smarter.

How ironic. A country drowning in economic incompetence finds salvation through decentralized finance. The irony is thick enough to spread on toast. And yet… it works.

Someone’s gonna come along and say ‘this is why we need a CBDC!’ and ruin it. But for now? Let them have their digital dollars. It’s the only thing keeping families fed.

People think crypto is about decentralization but here it’s just about not being robbed by your own government

The philosophical underpinning of this phenomenon is not technological, but existential: when institutions fail to preserve value, individuals are compelled to construct alternative ontologies of economic being. The stablecoin, therefore, is not merely a financial instrument-it is an epistemological assertion of autonomy against systemic collapse.

Argentina didn’t invent crypto. They just used it right. No hype. No NFTs. Just survival. That’s the lesson here.

im so glad people are finally figuring out how to not lose everything 😭 this is the real crypto revolution

Wait… what if this is all a CIA psyop to destabilize the peso further? I read somewhere that the IMF is secretly funding Lemon’s servers. They want Argentina dependent on dollar-backed crypto so they can control the economy from afar. Think about it.

India should do this. Our rupee is falling too. But no one here has the guts.

It’s funny how people call this ‘crypto’ like it’s new. In the 90s, we used to buy gold coins in envelopes. Now it’s USDC on a phone. Same need. Different tool.

Let me be clear: this is not a triumph of technology. It is a damning indictment of Argentina’s leadership. When citizens must turn to foreign digital currencies to preserve their earnings, the state has failed in its most basic duty. This is not innovation. It is surrender.

What’s fascinating is how this evolved organically. No central bank. No legislation. Just people using tech to solve a problem. That’s the real power of open systems.

my mom just started using lemon last month. she thought crypto was for ‘tech bros’ but now she says it’s the only reason she can buy milk without crying. 🥲

Argentina is just lucky the US dollar exists. If they had to use Ethereum or Dogecoin, this whole thing would’ve collapsed. Don’t glorify this-it’s just dollar arbitrage with extra steps.