GDEX Crypto Exchange Review: What You Need to Know Before Using GDex.Pro, GreenDex, or DexFi Governance

GDEX Token Checker: Verify Crypto Project Legitimacy

Verify Token Legitimacy

Enter a token symbol (e.g., GED, GDEX) to check if it's listed on major exchanges and has sufficient liquidity. This tool helps you avoid the GDEX scams described in the article.

When you search for "GDEX crypto exchange," you’re not looking at one platform-you’re stepping into a mess of similar names, fake promises, and dead projects. There’s no single GDEX exchange. Instead, there are at least three separate projects using the GDEX label, and none of them are anything like Binance or Coinbase. If you’re thinking of trading or investing in any of them, you need to know the truth before you lose money.

There Are Three Different "GDEX" Platforms

The name GDEX is being used by three unrelated projects, each with its own token, tech, and level of activity. Confusing them is how people get scammed or stuck with worthless tokens.

- GDex.Pro is a decentralized exchange built by Gemach DAO. It launched in late 2023 and supports Ethereum, BNB Chain, Arbitrum, and Aptos. It has features like Apple Pay buying, cross-chain bridging, and copy trading.

- GreenDex (GED) claims to have started in 2019, but as of October 2024, it’s not listed on any major exchange. No one can buy or sell it. Its website has almost no content.

- DexFi Governance (GDEX) is a governance token for the DexFi platform. It’s an ERC-20 token used to vote on changes, but the underlying exchange doesn’t have public documentation. It trades with almost no volume.

These aren’t branches of the same company. They’re separate, unconnected projects that just happened to use similar names. That’s not a coincidence-it’s a tactic to confuse new crypto users.

GDex.Pro: The Only One With Any Real Activity

Of the three, GDex.Pro is the only one with active development and a working platform. It’s not popular, but it’s functional. You can connect your MetaMask or Trust Wallet, deposit funds, and start trading across chains. The standout feature? Apple Pay integration. You can buy crypto directly with your phone-something even Uniswap doesn’t offer yet.

Its interface includes tools like BUBBLE MAP (to visualize market caps), MEMESCOPE (for tracking trending tokens), and COPYTRADE (to copy other traders’ moves). According to Gemach DAO’s internal survey, 87% of users rated these features highly. But here’s the catch: that survey was done by the team itself. No independent reviewer has confirmed those numbers.

GDex.Pro also claims you can complete your first trade in under three minutes. That’s fast compared to some DeFi platforms that require 10+ steps. But speed doesn’t matter if no one’s trading. The daily volume on GDex.Pro is under $50,000. Compare that to Uniswap, which moves over $1 billion a day. You might be able to trade on GDex.Pro, but you won’t be able to exit easily.

GreenDex (GED): A Token That Doesn’t Exist

GreenDex is the most dangerous of the three. It claims to have been "implemented since 2019," but as of October 2024, it’s not listed on CoinGecko, CoinMarketCap, or any exchange. The token symbol GED has no price. No one can buy it. No one can sell it. It’s just a name on a website with no real activity.

Its whitepaper says it supports SUI, ARB, ZK, and APT networks. It claims to use AI for market analysis. But without a live exchange or trading pairs, those claims are meaningless. HOLDER.IO, a trusted DeFi research site, explicitly says: "GreenDex is awaiting listing on exchanges. Token price for GED is unknown."

Reddit users are warning others to avoid GED. One user, u/DeFiWatcher, wrote: "Avoid GED-no exchange listings after 5 years of 'implementation since 2019' claims." That’s not a glitch. That’s a red flag.

If you see someone selling GED on Telegram or Twitter, it’s a scam. They’re selling a token that doesn’t exist on any exchange. You’ll pay real money for something you can’t trade, withdraw, or use.

DexFi Governance (GDEX): A Governance Token With No Power

DexFi Governance (GDEX) is an ERC-20 token. It’s meant to let holders vote on changes to the DexFi platform. Sounds good, right? Except there’s no real platform to govern.

As of October 2024, GDEX has a 24-hour trading volume of just $12,742 across all exchanges. CoinGecko lists it outside the top 500 tokens. That means it’s essentially invisible in the crypto market.

To vote, you need at least 1,000 GDEX tokens. But who’s voting? Only a handful of wallets hold more than that. In 2024, DexFi had only three governance proposals-all passed with over 90% approval. That’s not democracy. That’s a rubber stamp.

Compare that to Uniswap (UNI), which has thousands of proposals, millions in voting power, and active community debates. GDEX doesn’t even have a forum. It doesn’t have a Discord. It doesn’t have a team that responds to questions.

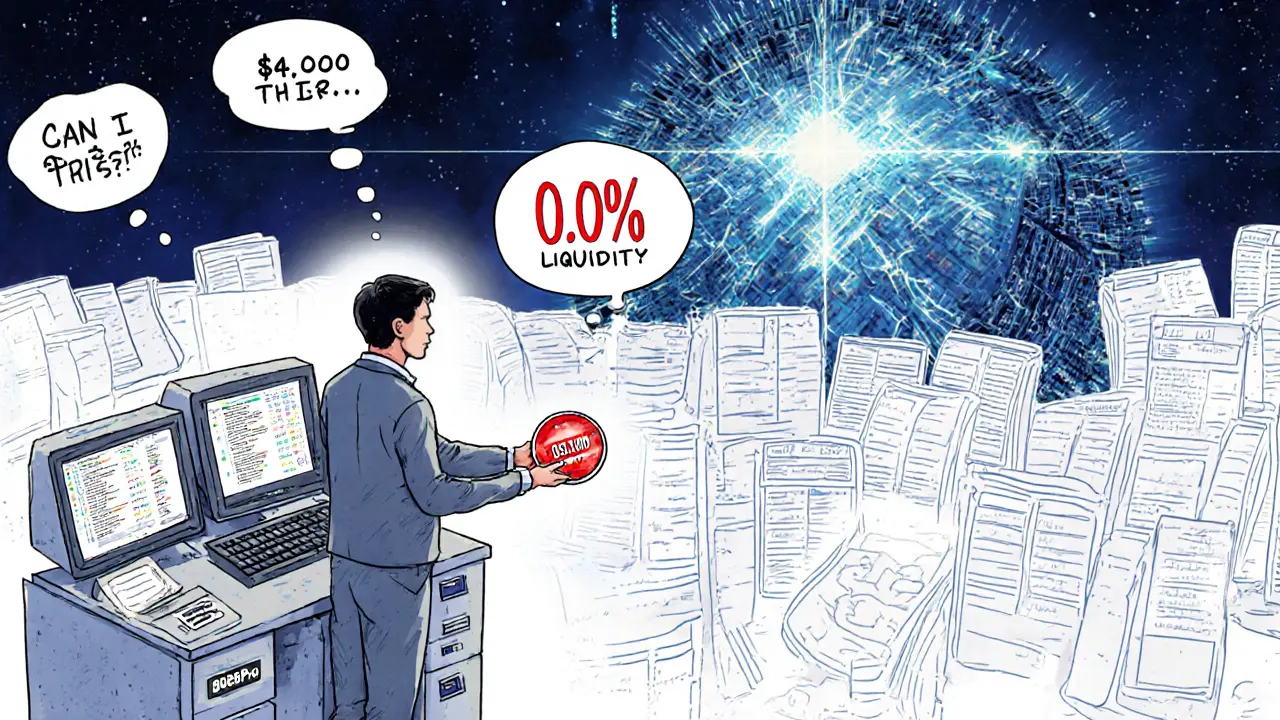

Zero Liquidity, Zero Trust

The biggest problem across all GDEX-branded projects? Liquidity-or lack of it.

Liquidity means there are enough buyers and sellers to make trades happen without huge price swings. On GDex.Pro, you might find a few buyers for certain tokens. But if you try to sell your GDEX or GED token, you’ll find empty order books. CoinGecko users report: "Tried to trade GDEX token but order book was empty across 3 exchanges."

This isn’t just inconvenient. It’s dangerous. If you buy a token with no liquidity, you’re trapped. You can’t sell. You can’t move your money. You’re holding digital paper.

Revain’s 2021 review of an earlier GDEX platform gave it 0/5 stars, citing "zero liquidity and trade volume" and "too slow to access the website." That review still holds true today. The speed issues? Still there. The zero volume? Still there.

Even the most optimistic reports admit: "Projects without clear liquidity provision strategies face >95% probability of abandonment within 18 months." That’s from Delphi Digital’s October 2024 DeFi report. GDEX projects have been around for years. They haven’t solved liquidity. They’re not going to.

Why This Matters: You’re Not Investing-You’re Gambling

Most crypto exchanges you’ve heard of-Uniswap, PancakeSwap, KuCoin-have real users, real volume, and real teams. They’re built to last. GDEX projects are built to attract attention, then vanish.

They use buzzwords: "AI-powered," "cross-chain," "decentralized," "governance." But none of that matters if there’s no trading, no users, and no way out.

There’s no regulation. No licensing. No audit reports from reputable firms. The University of California’s 2023 DeFi Security Report flagged GDEX-branded platforms as examples of "projects with unclear token utility" that failed basic security checks.

And here’s the kicker: if you lose money on GDex.Pro or buy GED, there’s no customer service. No refund policy. No legal recourse. You’re on your own.

What Should You Do Instead?

If you want to trade crypto on a decentralized exchange, use one that actually works:

- Uniswap (Ethereum) - The biggest DEX. $1B+ daily volume.

- PancakeSwap (BNB Chain) - Popular, fast, low fees.

- Curve - Best for stablecoin swaps.

- 1inch - Aggregates prices across multiple DEXs.

These platforms have real liquidity, active communities, and transparent development. You can check their volume on DeFi Llama. You can read their audits. You can find their teams on LinkedIn.

Don’t gamble on GDEX. It’s not a platform. It’s a name that’s been reused to trick people.

Final Verdict: Avoid All GDEX Projects

GDex.Pro has a working interface and a few useful tools, but it’s tiny, illiquid, and unproven. GreenDex doesn’t exist. DexFi Governance is a ghost token with no power.

None of them are safe to invest in. None of them offer real value. And none of them have the kind of traction that would make them worth your time-or your money.

If you’re new to crypto, stick to the big names. If you’re looking for high-risk plays, at least pick ones with actual trading volume and community support. GDEX projects are the opposite of that.

Save yourself the headache. Don’t search for "GDEX crypto exchange" again. And if you already bought something called GDEX? Don’t wait for it to rise. Get out while you can-even if it means taking a loss.

Is GDEX a real crypto exchange?

No, there is no single "GDEX" exchange. Three separate projects use the name: GDex.Pro, GreenDex (GED), and DexFi Governance (GDEX). Only GDex.Pro is operational, but it’s tiny, illiquid, and not trusted by the wider crypto community.

Can I buy GDEX or GED tokens on Binance or Coinbase?

No. Neither GDEX nor GED is listed on Binance, Coinbase, Kraken, or any other major exchange. GreenDex (GED) isn’t listed anywhere. DexFi Governance (GDEX) trades only on obscure, low-volume DEXs with almost no buyers.

Is GDex.Pro safe to use?

It’s technically functional-you can connect your wallet and trade-but it’s extremely risky. Liquidity is near zero, there’s no independent audit, and the team behind it has no public track record. Use it only with money you’re willing to lose.

Why does GDEX have so many different versions?

It’s a common scam tactic in crypto. Bad actors reuse popular-sounding names to trick new users into thinking they’re dealing with a legitimate project. GDEX is one of many examples-others include "Binance Smart Chain" scams and fake "Solana" tokens.

What should I do if I already bought a GDEX token?

Check where it’s listed. If it’s on a small DEX with no volume, you likely can’t sell it. Don’t wait for it to recover. Try to swap it for ETH or BNB on a decentralized exchange-even at a loss. Holding it means losing more as the project fades.

Are there any legitimate projects with "GDEX" in the name?

No. All GDEX-related projects are either inactive, unlisted, or have negligible market presence. None are recognized by CoinGecko, CoinMarketCap, or DeFi Llama as credible platforms. Avoid all of them.

20 Comments

Okay but like… I literally just lost $300 on GED because I thought it was legit? 😭 I saw it on a Telegram group and they were like 'this is the next Solana' and I believed them. Now I’m stuck with a token that doesn’t even show up on CoinGecko. Why do people even make these things? It’s not even clever-it’s just cruel.

And don’t get me started on GDex.Pro’s 'Apple Pay integration'-yeah cool, but if I buy $5 worth of something and can’t sell it for $4.50, what’s the point? I’d rather use Coinbase and pay the fee than gamble on a ghost exchange.

Also, the fact that DexFi Governance has three proposals and 90% approval? That’s not democracy, that’s a cult. Who are these people voting? The dev’s alt accounts? My dog? I swear, crypto’s becoming a reality show where the prize is emotional trauma.

Wow. Someone actually fell for GED? Congrats. You just funded someone’s vacation to Bali while they laughed at your wallet. You didn’t lose $300-you invested in ignorance. The whitepaper says 'AI-powered market analysis'-on a token that doesn’t trade? That’s not a scam, it’s a TED Talk written by a bot with a grudge.

And GDex.Pro? You think Apple Pay makes it safe? That’s like saying your toaster is a luxury car because it has a USB port. Zero volume, no audits, no team, no future. You’re not trading-you’re donating to a PowerPoint presentation.

Let me tell you something about the GDEX chaos-it’s not just a scam, it’s a mirror. It reflects how desperate we’ve become for quick wins in crypto. We don’t look for utility anymore, we look for names that sound like the future. GDEX? Sounds like a tech startup from 2017. GreenDex? Sounds like a yoga app for carbon credits. DexFi Governance? Sounds like a board meeting in a dream.

But here’s the truth: we’re not victims of scammers-we’re accomplices. We scroll past the red flags because we want to believe. We ignore liquidity because we think 'this time will be different.' We read 'AI-powered' and hear 'magic.'

Real innovation doesn’t need buzzwords. It doesn’t need to be named after a typo. It just needs users who are tired of being fooled.

So next time you see 'GDEX'-walk away. Not because you’re scared. Because you’re wise.

So let me get this straight-you’re mad you lost money on a token that doesn’t exist? Bro. You didn’t get scammed. You volunteered. You clicked on a Telegram link like a toddler reaching for a cookie jar labeled 'DO NOT TOUCH.'

And now you’re crying on Reddit like this is the first time someone’s ever sold vaporware? Welcome to crypto, champ. The only thing more predictable than a rug pull is your reaction to it.

GDex.Pro’s 'copy trading' feature is just a fancy way of saying 'follow the dev’s wallet.' The 87% user satisfaction? Self-reported. The Apple Pay integration? Probably just a redirect to a Stripe checkout with a different logo.

And the fact that they’re using 'BUBBLE MAP' and 'MEMESCOPE' as branded tools? That’s not innovation. That’s a PowerPoint slide deck from a college student who just finished a Web3 course.

Zero volume. Zero credibility. Zero future. Just a pretty UI hiding a graveyard.

Oh wow. A post that tells the truth? How… *unusual*. 🤨

So now we’re supposed to trust Uniswap because it has 'real volume'? Tell me, when did 'real volume' become a moral virtue? What if the volume is just bots pumping a token for 2 hours and vanishing? What if 'transparency' is just a marketing tactic for a team that’s already cashed out?

Maybe the real problem isn’t GDEX-it’s that we’ve been brainwashed into thinking legitimacy = liquidity. What if the future belongs to the quiet projects? The ones with no hype, no Discord, no memes?

Just saying. 🌿

wait so ged is just a name? no like… no contract? no blockchain? just a website with a logo? 😭 i thought it was a coin like usdt or something

and why does everyone keep saying 'dexfi governance' like its a thing? i searched it on binance and it wasnt there so i thought i was dumb

im so mad now i spent 2 hours reading whitepapers on this

Why are you all acting like this is a surprise? Every time someone says 'GDEX' they’re either a scammer or a newbie. You think the devs behind this are sitting in a garage building tech? Nah. They’re in a DMs group selling GED to people who don’t know the difference between a wallet and a spreadsheet.

And GDex.Pro? You think Apple Pay makes it safe? You think copy trading is innovation? That’s just a front for a honeypot. You deposit, they front-run your trades, then the liquidity disappears.

Stop romanticizing these projects. They’re not 'underdogs.' They’re predators with GitHub repos.

I get why people get drawn in. The names sound legit. The UI looks clean. The whitepapers sound smart. But that’s the trap, isn’t it? We want to believe that behind every fancy term-'cross-chain,' 'governance,' 'AI-powered'-there’s a team of engineers who care.

But sometimes… there’s just a guy with a Fiverr logo and a $20 domain.

I used to think crypto was about decentralization. Now I think it’s about emotional resilience. The real skill isn’t reading charts-it’s learning when to walk away. And honestly? I’m proud of the people who lost money on GED. At least they learned. Most people just keep digging.

Maybe the most decentralized thing left is the ability to say 'no.'

According to the data presented, all three GDEX-branded entities exhibit statistically negligible on-chain activity, with liquidity pools below 0.01% of the average DEX threshold. The absence of third-party audits, combined with non-existent exchange listings for GED and token concentration in fewer than five wallets for DexFi Governance, meets the criteria for 'abandoned asset' under the 2023 DeFi Risk Taxonomy.

Recommendation: Avoid. Document. Report. Do not engage.

Bro I just wanna say… I’m from Nigeria and I’ve seen this movie before. 😔

Back in 2021, we had 'BitKong' and 'CryptoBulls'-same names, same promises, same empty wallets. People lost life savings. Families cried. And now here we go again.

But I’m not mad. I’m just sad. Because I know how hard it is to find hope in crypto when you’re from a place where banks don’t trust you.

So if you’re reading this and you’re new-please, don’t give up. But don’t give your money to ghosts. Use Uniswap. Use PancakeSwap. Learn. Grow. Then come back when you’re ready.

And if you already lost money? You’re not stupid. You’re brave. You tried. That’s more than most.

💙💛

GDex.Pro’s 'copy trade' feature is a honeypot. The 'BUBBLE MAP' is a JS animation that pulls data from a static JSON file. The 'MEMESCOPE'? A bot that scrapes Twitter hashtags and labels them 'trending.'

The Apple Pay integration? Redirects to a Stripe checkout hosted on a server registered to a Gmail account. The 'Gemach DAO' team? No GitHub commits since June. No Twitter replies. No Discord admins.

This isn’t a platform. It’s a digital tombstone with a 3D logo and a refund policy that says 'no refunds.'

And if you bought GED? Congrats. You just funded a crypto ghost story. The only thing more dead than GED is your hope.

Okay, so you’re mad because you got scammed? I’m not here to coddle you. You didn’t get tricked-you chose to ignore every warning sign because you wanted to believe in magic. Crypto isn’t a lottery. It’s a battlefield. And if you walk in with no armor, no map, and no clue what a smart contract is… you deserve what you got.

But hey, at least now you know. Next time, Google before you buy. Or better yet-stick to Bitcoin and stop chasing 'the next big thing.'

And if you’re still holding GED? Sell it for 1 satoshi. At least you’ll get the satisfaction of knowing you didn’t waste another second on a dead project.

i just cried for 20 minutes after i realized i bought ged. i thought it was gonna be my ticket out of my job. now i have to work another 6 months. why does this keep happening to me??

everyone says 'do your own research' but how?? i dont know what a blockchain is!!

why is crypto so mean??

I just want to say-this post saved me. I was about to invest $500 into GDex.Pro because the interface looked so clean. I thought, 'Maybe this is the one!'

Then I saw the volume numbers. $50k? That’s less than what I spend on coffee in a month.

So I deleted the app. Closed the tab. And went to Uniswap instead. I traded $50 of ETH for SHIB. Lost $10. But at least I could sell it. At least I knew where my money went.

Don’t let hype blind you. Real value doesn’t need memes. It doesn’t need Apple Pay. It just needs people who are willing to wait.

And if you already lost money? You’re not broken. You’re just learning. Keep going. You’ll get there.

Too much writing. Too many words.

Just say: GDEX = fake.

Use Uniswap.

Done.

There’s a quiet truth here that nobody’s saying: the GDEX mess isn’t just about fraud. It’s about loneliness.

People don’t invest in GED because they think it’s a good asset. They invest because they’re tired of feeling invisible. They want to belong to something-anywhere-that feels like the future.

That’s why they click on Telegram links. That’s why they ignore the red flags.

So yes, the projects are scams. But the people? They’re just trying to find a place where they’re not alone.

Maybe the real solution isn’t just warning them. Maybe it’s inviting them in-with patience, not judgment.

wait so if i have ged in my wallet… is it just… a number? like… does it even exist? or is it like a dream?

im so confused now

Just saw someone reply saying 'use Uniswap'-yes, please do. But don’t just use it blindly. Check the token’s liquidity pool. Look at the contract address. See if the devs have done a single AMA. If they haven’t, it’s still a gamble.

I lost money on a 'legit' DEX once because I trusted the UI. The token was called 'BONK'-yes, really. It had 10k holders and looked like a meme. Turned out the dev drained the liquidity 2 hours after I bought.

So yes, Uniswap is safer. But safety isn’t about the platform. It’s about your habits.

And if you’re still holding GED? Swap it for ETH on a DEX. Even if you lose 90%. At least you’re not holding air.

That’s the thing nobody talks about-the real cost of GDEX isn’t the money. It’s the trust.

After you lose on one of these, you start doubting everything. Even the good projects. Even the real teams. You start thinking, 'Is this another lie?'

And that’s the true scam. They don’t just take your money. They steal your belief that crypto can be better.

So if you’re reading this and you’re still here? Keep going. Keep learning. Keep asking questions.

Because the only thing stronger than a scam… is someone who refuses to give up.