FATF Blacklist: Why Iran, North Korea, and Myanmar Are Targeted for Crypto Bans

When you hear about crypto bans, you might think of governments cracking down on Bitcoin users. But the real story isn’t about ordinary people trading digital assets-it’s about FATF blacklist countries using cryptocurrency to bypass international sanctions, fund terrorism, and launder billions in stolen funds. Iran, North Korea, and Myanmar are the only three nations currently on the FATF’s highest-risk list, and their crypto activity is reshaping global financial enforcement.

What the FATF Blacklist Really Means

The Financial Action Task Force (FATF) isn’t a police force. It’s a global standard-setter that tells countries how to stop money laundering and terrorist financing. When a country ends up on its blacklist, it’s not a suggestion-it’s a red alert. Member countries are urged to apply strict countermeasures. For Iran and North Korea, that means cutting off their access to the global financial system. For Myanmar, the call is for enhanced due diligence, not full isolation. These aren’t arbitrary labels. They’re based on years of evidence: weak laws, no enforcement, and financial systems that openly enable crime. And in the last five years, cryptocurrency has become the tool of choice for these regimes to move money without banks.North Korea: The World’s Most Dangerous Crypto Hacker

North Korea doesn’t just use crypto-it steals it. The regime runs organized cyber units that target exchanges, wallets, and DeFi protocols. In February 2025, they pulled off the biggest heist in crypto history: $1.5 billion from ByBit. That’s more than the GDP of some small countries. And it’s not an outlier. Chainalysis data shows that in 2024, sanctioned countries received $15.8 billion in cryptocurrency. Nearly 40% of all illicit crypto transactions flowed to these blacklisted jurisdictions. North Korea alone accounted for over half of that. Their attacks are professional: they use phishing, malware, and fake investment platforms to lure victims, then move stolen funds through mixers and privacy coins to erase the trail. The U.S. Treasury has responded with 13 cryptocurrency address designations in 2024-the second-highest number in seven years. But it’s not enough. North Korea’s cyber units are now embedded in state-run tech schools, training hackers as part of their national defense strategy.Iran: Crypto as a Survival Tool-and a Sanctions Evasion Scheme

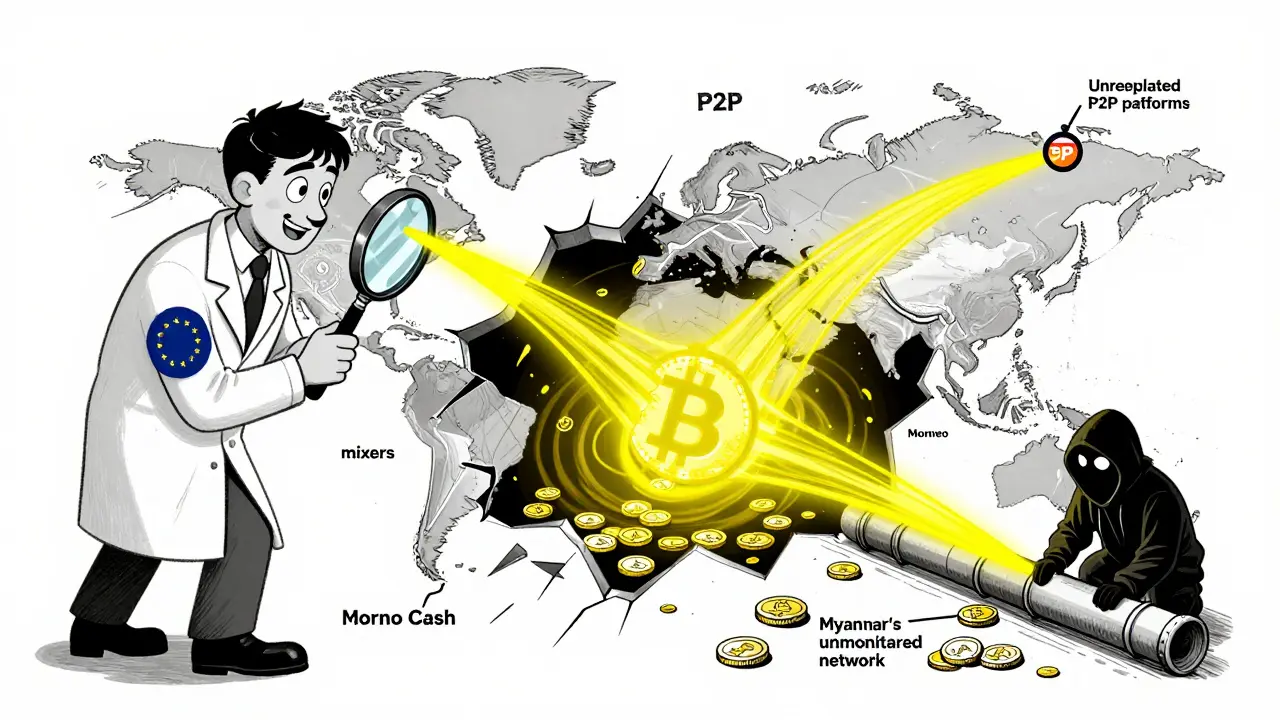

Iran’s situation is different. Its people aren’t stealing crypto-they’re using it to survive. U.S. sanctions have crippled its banking system. Inflation is over 40%. The rial has lost more than 80% of its value since 2018. So ordinary Iranians turn to Bitcoin and stablecoins to send money abroad, pay for medicine, or save their savings. But here’s the twist: while individuals use crypto for survival, the Iranian government uses it to bypass sanctions. The Islamic Revolutionary Guard Corps (IRGC) runs crypto mining operations and exchanges to convert stolen funds into hard currency. In 2024, Iranian centralized exchanges saw transaction outflows surge by 217% year-over-year. That’s not just people sending money to family-it’s capital flight backed by state actors. The U.S. has responded by targeting Iranian crypto platforms. In 2024, OFAC sanctioned three major Iranian exchanges for facilitating transactions linked to the IRGC. But enforcement is messy. Many Iranians still use peer-to-peer platforms like LocalBitcoins or decentralized wallets that don’t require KYC. The government can’t stop them-and it doesn’t want to.

Myanmar: A Military Junta’s Digital Lifeline

Myanmar’s 2021 military coup turned the country into a haven for criminal networks. The junta lost international banking access, so it turned to crypto. Criminal gangs, arms dealers, and human traffickers now use cryptocurrency to move money across borders without oversight. Unlike North Korea and Iran, Myanmar isn’t under full countermeasures-but FATF says it’s still high risk. Why? Because its financial regulators have no power. The central bank doesn’t monitor crypto transactions. Exchanges operate without licenses. And the military controls the few telecom providers that allow internet access-meaning they can shut down or monitor any crypto activity they choose. In 2024, over $1.2 billion in crypto flowed into Myanmar from neighboring countries, mostly through unregulated P2P platforms. Much of it came from phishing scams targeting Southeast Asian users. The money then gets funneled into real estate, luxury goods, or converted into cash through informal networks.Why Global Crypto Compliance Is Failing

Here’s the uncomfortable truth: most countries aren’t ready to stop this. As of April 2024, 75% of FATF member countries were either noncompliant or only partially compliant with rules for virtual asset service providers (VASPs). That means most exchanges, wallets, and payment platforms around the world don’t check if users are from sanctioned countries. Mixers-tools that scramble crypto transaction trails-are the biggest loophole. Services like Tornado Cash (now blocked in the U.S.) and newer privacy-focused platforms let criminals hide the origin of funds. Even if an exchange blocks a known Iranian wallet, a user can send funds to a mixer, then withdraw to a new address. The trail vanishes. And enforcement is uneven. The U.S. and EU have strong rules. But in places like Nigeria, Vietnam, and Indonesia, regulators lack resources, training, or political will. That creates safe zones for criminals.

What’s Being Done-and What’s Not

The U.S. Department of State and FinCEN run training programs for foreign financial intelligence units. They teach how to track crypto flows, identify mixers, and freeze assets. The Netherlands Central Bank updates its own risk models quarterly based on FATF alerts. But these efforts are like putting bandages on a bleeding artery. The real solution? Global enforcement. Right now, there’s no unified system to block sanctioned addresses across all exchanges. A wallet blacklisted in the U.S. might still work on a Thai exchange. A mixer based in Panama can still route funds to a North Korean wallet. Some exchanges are stepping up. Binance, Coinbase, and Kraken now screen all transactions against OFAC lists. But thousands of smaller platforms don’t. And many users don’t even know they’re violating sanctions-until their funds get frozen.Bitcoin’s Double-Edged Role

Bitcoin is at the center of this conflict. For Iranians fleeing economic collapse, it’s a lifeline. For North Korean hackers, it’s a weapon. The same technology that empowers people under repression also enables state-sponsored crime. What makes Bitcoin dangerous in this context? It’s censorship-resistant. You don’t need a bank. You don’t need permission. Just a seed phrase. That’s why people in war zones, dictatorships, and hyperinflation economies rely on it. But that same feature makes it perfect for criminals who want to move money without detection. The answer isn’t to ban Bitcoin. It’s to fix the system around it. Better KYC. Global watchlists. Real-time monitoring. And international cooperation that actually works.What Comes Next?

FATF’s June 2025 update added the British Virgin Islands and Bolivia to its “increased monitoring” list-showing that even offshore financial centers are under scrutiny. But Iran, North Korea, and Myanmar remain unchanged. That means the pressure will keep building. Expect more sanctions on crypto exchanges linked to these countries. More arrests of mixers. More freezes on wallet addresses. And more pressure on global platforms to enforce compliance-or lose access to U.S. and EU markets. For ordinary users, the message is simple: if you’re in a sanctioned country, your crypto activity is under watch. If you’re outside, make sure your exchange checks sanctions lists. Because the next big crypto heist might not come from a hacker in a basement-it might come from a state actor with billions in stolen funds and no one to stop them.Why are Iran, North Korea, and Myanmar still on the FATF blacklist?

They remain on the list because they have failed to meet international standards for anti-money laundering and counter-terrorist financing. Iran and North Korea have weak or nonexistent enforcement of crypto regulations, and both use cryptocurrency to evade sanctions and fund illicit activities. Myanmar’s military government lacks any functional financial oversight, allowing criminal networks to operate freely. FATF has repeatedly called for reforms, but none have been implemented effectively.

Is it illegal to use crypto in Iran or North Korea?

Technically, yes-both countries have banned financial institutions from handling crypto. But in practice, individuals still use it. In Iran, citizens rely on crypto to bypass economic sanctions and access global goods. In North Korea, the government itself runs crypto operations. So while the rules say it’s illegal, enforcement is inconsistent or nonexistent for ordinary people. The real targets are exchanges and platforms that facilitate large-scale transactions linked to the state.

How much crypto has North Korea stolen?

According to Chainalysis and U.S. Treasury reports, North Korean cyber units have stolen over $3 billion in cryptocurrency since 2017. The largest single heist was $1.5 billion from ByBit in February 2025. These thefts are highly organized, often involving months of planning, insider access, and laundering through multiple mixers and privacy coins like Monero.

Do U.S. crypto exchanges block users from these countries?

Yes, major U.S.-based exchanges like Coinbase, Kraken, and Binance US block users from Iran, North Korea, and Myanmar. They use geolocation, KYC data, and sanctions lists to prevent access. However, smaller exchanges, peer-to-peer platforms, and decentralized wallets don’t always enforce these rules. That’s why criminals still find ways to move funds-especially through non-KYC services.

Can I send crypto to someone in a FATF blacklist country?

If you’re using a regulated exchange, you likely can’t-your transaction will be blocked. If you use a non-KYC wallet or P2P platform, it’s technically possible, but you risk violating U.S. or EU sanctions. Doing so could result in asset freezes, fines, or even criminal charges. Even if you’re sending money to family, regulators treat it the same as funding a sanctioned entity. The risk isn’t worth it.

Are privacy coins like Monero banned because of these countries?

Not outright banned, but heavily restricted. Many exchanges have delisted Monero and other privacy coins because they’re the preferred tool for laundering stolen funds from sanctioned jurisdictions. The FATF recommends strict controls on privacy coins, and the U.S. Treasury has flagged them as high-risk. While they’re still traded on some platforms, their use is declining due to regulatory pressure.

What’s the difference between the FATF blacklist and the greylist?

The blacklist (High-Risk Jurisdictions) includes countries that pose severe threats and are subject to countermeasures-like Iran and North Korea. The greylist (Jurisdictions Under Increased Monitoring) includes countries that have committed to fixing their weaknesses but haven’t done so yet-like the British Virgin Islands or Bolivia. Being on the greylist means you’re under pressure to reform. Being on the blacklist means you’re isolated.

18 Comments

It's wild how the same tech that lets a grandmother in Tehran pay for her insulin also funds a cyber army that steals billions. No easy answers here, just messy reality.

People on both sides are just trying to survive, one way or another.

So let me get this straight - we're banning crypto because bad actors use it, but we still let banks launder billions in drug money? Classic.

The core failure isn't crypto - it's the fragmentation of global regulatory architecture. VASPs operate in a patchwork of compliance regimes where jurisdictional arbitrage is trivial.

Until FATF enforces a unified AML/CFT protocol with binding penalties - not recommendations - the system remains gamed.

Privacy coins aren't the problem; they're a symptom of a broken trust infrastructure.

What we need is a global UTXO registry with zero-knowledge verification, not blanket bans.

Current policy is reactive, not systemic.

And yes, I've read the FATF guidance. It's 2019 with a 2025 sticker on it.

Iranians using crypto to buy food = hero. North Korea stealing it = villain. Same tech. Same blockchain. Same rules. LOL.

This hit me right in the soul.

Bitcoin is like a river - it doesn't know if it's feeding a village or washing away a dam.

We can't blame the water. We have to fix the banks.

And honestly? I'm tired of pretending this is about crime. It's about power.

❤️

Okay, so here's the thing: we need to make sure that every single exchange, everywhere, checks the OFAC list. Every. Single. One.

And if they don't? Fine them. Big time.

Also, people should stop using mixers. They're bad. Just stop.

And yes, I know it's hard, but we have to try.

It's not that hard, really.

Just follow the rules.

That's all.

Thanks.

Let’s be honest - the only reason these countries are on the list is because they don’t bow to Washington.

Meanwhile, Switzerland and Singapore let dirty money dance through their vaults like it’s a ballet.

It’s not about crime.

It’s about control.

And the whole thing is a farce.

Regulatory arbitrage in the context of decentralized financial infrastructure represents a fundamental challenge to the legitimacy of state-centric monetary sovereignty.

One must question the efficacy of sanctions when the underlying asset class is inherently non-sovereign.

Furthermore, the conflation of individual survival mechanisms with state-sponsored illicit activity constitutes a dangerous moral hazard.

One might argue that the FATF’s approach is anachronistic in the face of cryptographic primitives that render traditional KYC/AML paradigms obsolete.

Most people don’t realize that Iran’s crypto mining is mostly done by small home rigs - not state labs. The real money is in the exchanges that export it. Fix those, not the people.

They should just ban Bitcoin entirely. Problem solved.

Why are we even having this conversation?

It's digital gold for criminals. End of story.

Can we just take a second to appreciate how cool it is that someone in Myanmar can send money to their sister in Thailand without a bank?

Yes, bad people use it too.

But so do moms, students, refugees, artists.

Let’s not throw the baby out with the bathwater.

Love you all 💕

It’s like giving a flashlight to someone in a dark tunnel - they’ll use it to find their way out... or to rob the next person.

But you don’t take the flashlight away.

You teach them to see in the dark.

And you make sure the tunnel has guards who aren’t corrupt.

That’s the real work.

Wait, so you’re saying Iranians are using crypto to survive - but the government is using it to fund terrorism? So… they’re both using the same thing? That’s not a problem with crypto - that’s a problem with Iran! Why are you blaming Bitcoin? It’s not even alive! It doesn’t have a will! It’s code! Code doesn’t choose! You people are insane.

And also, I heard Monero is made by a guy in Canada who hates the FBI. That’s why it’s private. So? What’s your point?

It’s not that the FATF is ineffective - it’s that the entire paradigm of financial oversight is built on centralized, analog assumptions.

On-chain analytics are still in their infancy.

And the regulatory appetite for innovation is zero.

So we get this - a patchwork of half-measures and performative sanctions.

It’s not crypto that’s failing.

It’s the system.

North Korea steals billions? Good.

Let them take it from the West.

They’re the only ones with the guts to stand up to these sanctions.

Meanwhile, the U.S. is busy bombing countries that don’t use our banks.

Who’s the real criminal here?

And why are we pretending this is about money?

It’s about empire.

Bro, in India we’ve got 500 million people using UPI without banks - crypto is just the next step.

But you Americans act like it’s magic.

It’s not.

It’s math.

And if you can’t understand math, don’t ban it - learn it.

Also, your banks are way worse than Iran’s exchanges.

Just saying.

Peace out 🙏

The notion that decentralized technologies can be regulated through sovereign fiat is a fundamental misapprehension of the ontological nature of cryptographic consensus mechanisms.

One might posit that the FATF’s current strategy constitutes a form of epistemological violence - imposing hierarchical governance structures upon inherently horizontal systems.

Furthermore, the moral equivalence drawn between state actors and individual users reflects a troubling conflation of agency and structure.

One must question whether the remedy is proportionate to the pathology.

Bitcoin is the last great equalizer - a silent revolution written in code.

It doesn’t care if you’re a refugee, a hacker, or a dictator.

It only cares if you hold the key.

And that’s why it terrifies the powerful.

Not because it’s dangerous.

But because it’s free.