Cross-Chain NFT Marketplace Support: Multi-Blockchain Trading Guide

Cross-Chain NFT Fee Calculator

This calculator compares total trading fees across major cross-chain NFT marketplaces based on your NFT price. It factors in marketplace fees, gas costs, and chain-specific transaction fees to show you which platform offers the best value.

Enter your NFT price below and see how the total fees compare across the leading platforms mentioned in the article.

When you hear cross-chain NFT marketplace, think of a single hub where you can buy, sell, or swap NFTs without juggling separate wallets for Ethereum, Solana, or any other chain. In 2025 this idea is no longer a prototype - it’s the new baseline for digital‑asset trading. Below you’ll learn what makes a cross‑chain marketplace tick, which platforms lead the pack, and how to pick the right one for your collection.

What is a Cross‑Chain NFT Marketplace?

Cross‑Chain NFT Marketplace is a trading platform that enables NFTs to move freely across multiple blockchain networks, offering a unified buying and selling experience. Instead of being locked to a single ecosystem, your token can live on Ethereum’s massive market, Solana’s fast lanes, or Polygon’s cheap sidechains, all from one dashboard. This interoperability eliminates the need for separate accounts, reduces friction, and opens up liquidity that was once fragmented across isolated chains.

Why Multi‑Blockchain Support Matters in 2025

The NFT market exploded on Ethereum, but high gas fees and occasional congestion pushed developers to explore alternatives. Chains like Solana offers sub‑second finality and low transaction costs attracted gaming and collectibles projects, while Polygon provides Ethereum compatibility with dramatically lower fees became the go‑to for creators who want to keep costs down. A marketplace that supports all three lets you chase the best price, reach the widest audience, and avoid being locked into a single chain’s limitations.

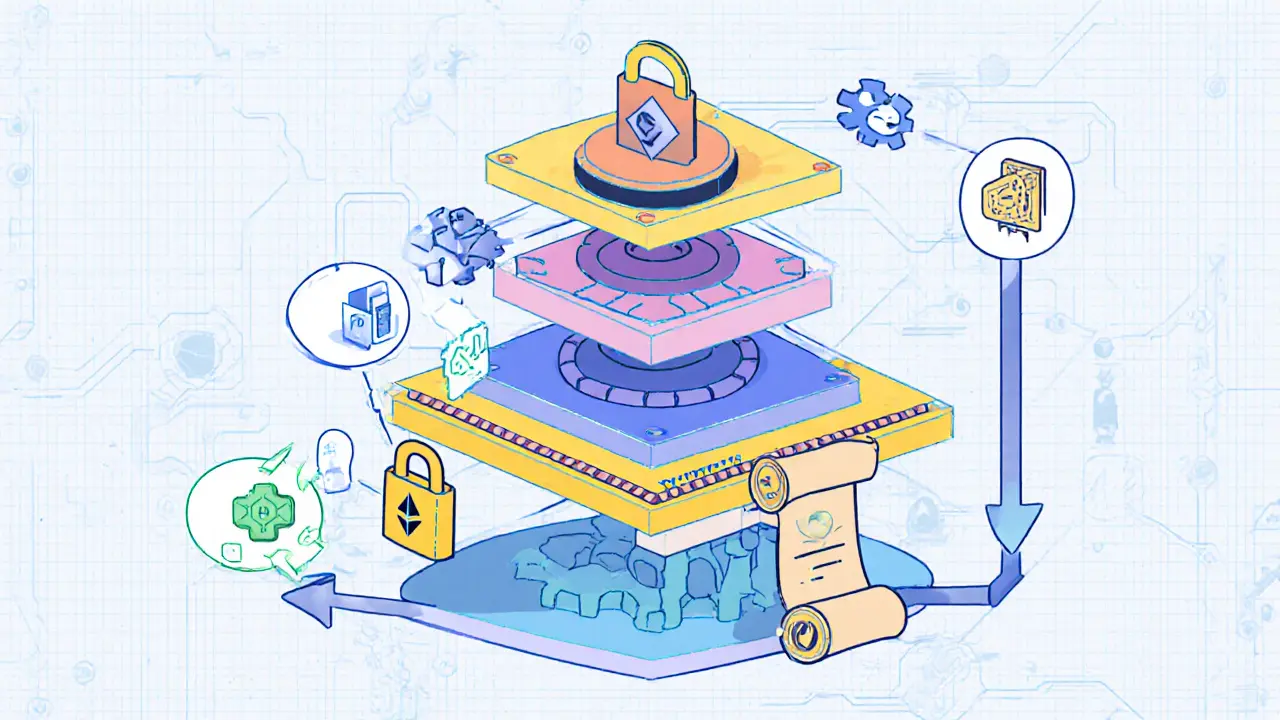

Core Architecture Behind Cross‑Chain NFT Platforms

Building a truly cross‑chain experience requires several moving parts:

- Cross‑Chain Smart Contracts: Deployed on each supported blockchain, these contracts handle token bridging, swaps, and ownership verification without relying on a central custodian.

- Interoperability APIs: Secure, standardized endpoints that let the marketplace communicate with Ethereum, Solana, Sui a high‑throughput layer‑1 blockchain, and other networks.

- Decentralized Storage: Metadata and assets are stored on IPFS or Arweave, ensuring permanence regardless of which chain the token resides on.

- Layer‑2 Scaling Solutions: Optimistic or zk‑rollups (e.g., Arbitrum for Ethereum, zkSync) boost throughput while preserving security.

- Audit Trails: Every cross‑chain action is logged on each underlying blockchain, creating an immutable history that boosts transparency and helps regulators verify compliance.

The combination of these layers means you can list an NFT on Ethereum, then instantly sell it to a buyer who prefers paying with SOL on Solana, without ever moving the token out of the marketplace’s custody.

Leading Platforms and Their Unique Approaches

Not all cross‑chain marketplaces are built alike. Here’s a snapshot of three prominent players as of October 2025:

| Platform | Supported Chains | Core Focus | Fee Model (approx.) | Best For |

|---|---|---|---|---|

| TradePort offers analytics‑driven trading across Sui, Aptos, NEAR, and Stacks | Sui, Aptos, NEAR, Stacks | Real‑time price charts & developer APIs | 0.2% taker fee + chain‑specific gas | Traders chasing price swings |

| BlueMove focuses on search, launchpad, and creator tools for Sui & Aptos | Sui, Aptos | Discovery & minting suite | 1% mint fee, 0.15% trade fee | Creators and collectors looking for niche drops |

| OpenSea the largest global NFT marketplace with cross‑chain support for Ethereum, Solana, Polygon, and more | Ethereum, Solana, Polygon, and emerging L2s | Broad audience & extensive tooling | 2.5% total fee, variable gas | General‑purpose buying, selling, and discovery |

Each platform leans into a different niche. TradePort is the analytics powerhouse for active traders, BlueMove shines for creators who need a turnkey launchpad, and OpenSea remains the go‑to for sheer market depth.

Choosing the Right Marketplace: Key Evaluation Criteria

When you scout for a platform, weigh these factors-each carries a weight in the 2025 marketplace rating models:

- Blockchain Compatibility (15%): Does the platform support the chains you care about? Look for explicit support lists, not just “compatible” claims.

- User Experience (20%): Intuitive UI, clear wallet integration, and fast loading times keep users on the platform.

- Security & Trust (20%): Two‑factor authentication, audited smart contracts, and a transparent breach history are non‑negotiable.

- Transaction Fees (15%): Compare minting, listing, and gas costs across chains. Low‑fee chains like Polygon can dramatically improve profitability.

- Liquidity & Volume (10%): Higher trading volume means tighter spreads and quicker order fills.

- Community & Support (10%): Active Discord/Telegram groups and 24/7 technical help reduce friction when dealing with cross‑chain quirks.

Scoring a platform against this rubric helps you cut through marketing hype and land on a solution that matches your workflow.

Practical Steps to Trade NFTs Across Chains

- Connect a Multi‑Chain Wallet: Use MetaMask, Phantom, or a universal wallet like Rainbow that can manage Ethereum, Solana, and Polygon addresses simultaneously.

- Select Your Marketplace: Pick a platform that lists the NFT you want. For example, if you’re buying a Sol‑based gaming item, BlueMove’s search filters will surface it quickly.

- Verify Chain Compatibility: Confirm the seller’s token lives on a supported chain. Cross‑chain marketplaces typically display a small chain icon next to each listing.

- Initiate a Cross‑Chain Bridge: When the marketplace requires moving the token to a different chain for settlement, approve the bridge transaction. The platform’s smart contract will lock the original token and mint a wrapped version on the destination chain.

- Complete the Trade: Pay the purchase price (crypto or fiat, depending on the platform) and the bridge fee. Once confirmed, the NFT appears in your wallet on the new chain instantly.

- Track the Audit Trail: Use the marketplace’s transaction explorer to see each step recorded on the underlying blockchains. This transparency helps you dispute any irregularities.

Following this flow keeps you in control and ensures the NFT’s provenance stays intact.

Future Trends and Enterprise Use Cases

Cross‑chain capabilities are moving beyond art collectors. Luxury fashion brands are launching NFT twins of physical products on platforms that support both Ethereum’s brand cachet and Polygon’s low‑cost scaling. These twins can be verified across any chain, letting a customer in Tokyo buy with SOL while a collector in Berlin uses ETH, all without the brand maintaining separate storefronts.

Enterprises are also eyeing Layer‑2 solutions that bundle thousands of NFT transfers into a single rollup, cutting fees by up to 90 % and speeding settlement to under a minute. Developers from companies like Calibraint specialize in building enterprise‑grade NFT marketplaces with cross‑chain support are already offering white‑label solutions that integrate with corporate ERP systems, allowing businesses to treat NFTs as tradable inventory assets.

Looking ahead, we expect three big shifts:

- Standardized Bridge Protocols: Initiatives like IBC for non‑Ethereum chains will make token wrapping a behind‑the‑scenes event.

- Zero‑Gas Chains for NFTs: Emerging ecosystems like Sui and Aptos promise sub‑cent gas, forcing marketplaces to re‑price their fee models.

- Regulatory Harmonization: As auditors can trace cross‑chain movements, regulators will likely demand compliance reporting that spans multiple ledgers.

Quick Checklist for Multi‑Chain NFT Trading

- Use a wallet that supports all target chains.

- Confirm the marketplace’s supported chain list.

- Check bridge fees and estimated settlement time.

- Verify smart‑contract audit reports.

- Keep an eye on community channels for real‑time support.

What does “cross‑chain” actually mean for NFTs?

It means you can buy, sell, or move an NFT across different blockchain networks (like Ethereum, Solana, or Polygon) without leaving the marketplace. The platform handles bridging, wrapping, and verification behind the scenes.

Do I need to hold multiple native tokens to pay fees?

Most cross‑chain marketplaces let you pay fees in the native token of the source chain, but many also accept stable‑coin equivalents or let you pre‑pay gas on a low‑cost chain like Polygon.

Is my NFT still safe after it’s bridged?

Yes. The original token is locked in a smart contract on its home chain, and a wrapped version is minted on the destination chain. Both are provably linked on the blockchain, so ownership cannot be duplicated.

Can I list a wrapped NFT for resale?

Absolutely. Once the wrapped token appears in your wallet, you can list it on any marketplace that supports that destination chain, just like a native NFT.

What are the biggest risks of cross‑chain trading?

Bridge exploits, mismatched contract versions, and higher latency on slower chains are the main concerns. Stick to platforms with audited bridge contracts and keep transaction amounts modest until you trust the system.

11 Comments

Ugh, another ‘cross-chain’ article that makes it sound like magic. I tried it once, got stuck with a wrapped NFT on a chain I didn’t even know existed. Now it’s just sitting there, useless. 😴

bro u need to use phantom wallet for solana nfts n meta mask for eth its not that hard. i lost 0.5 sol once bc i used wrong chain n the bridge timed out. always check the chain icon!!

Really appreciate this breakdown. I’ve been using OpenSea for years but didn’t realize how much better BlueMove is for Sui drops. The search filters alone saved me hours last week. Also, the fee structure comparison is spot-on-most guides skip that part. Thanks for keeping it real.

Why are we letting Sui and Aptos steal our NFT market? Ethereum built this. Polygon’s fine for cheap junk, but real art belongs on ETH. This ‘cross-chain’ stuff is just dilution. Stick to the original. America first. 💪

I’ve been thinking a lot about how this changes ownership. If my NFT can exist on five chains at once, is it still *mine*? Or is it just a signal passing through different systems? Feels less like owning a thing and more like renting access to a shared dream.

OMG this is SOOOO important!!! 🌟✨ As an Indian creator, I was stuck on Ethereum gas fees for ages… then I discovered Polygon + BlueMove and my art finally found buyers! 🙌 India is ready for Web3-let’s make it inclusive, not just for the rich! 💸🇮🇳

Wow, a guide that doesn’t say ‘decentralized future’ 47 times. 🙏 And yes, I *do* need to hold SOL to pay fees… no, MetaMask won’t magically turn your ETH into SOL. 🤦♀️

As someone from Nigeria, I’ve seen how these platforms exclude us with KYC and high min balances. But this? This changes everything. If I can list my digital art on a chain that accepts USDT and let someone in Berlin buy it with ETH, that’s liberation. Let’s make sure the tools are accessible-not just for the tech elite.

Anyone else notice TradePort doesn't support BSC? That's a huge gap. I use BSC for low-cost mints and it's not even on their list. Wonder if it's intentional or just oversight...

While the technical architecture is well-documented, I would encourage readers to consider the environmental impact of bridging across multiple chains. Each cross-chain transaction involves multiple validations and consensus mechanisms. Sustainability should be part of the evaluation criteria, not an afterthought.

OpenSea is the only one that matters. Everything else is noise.