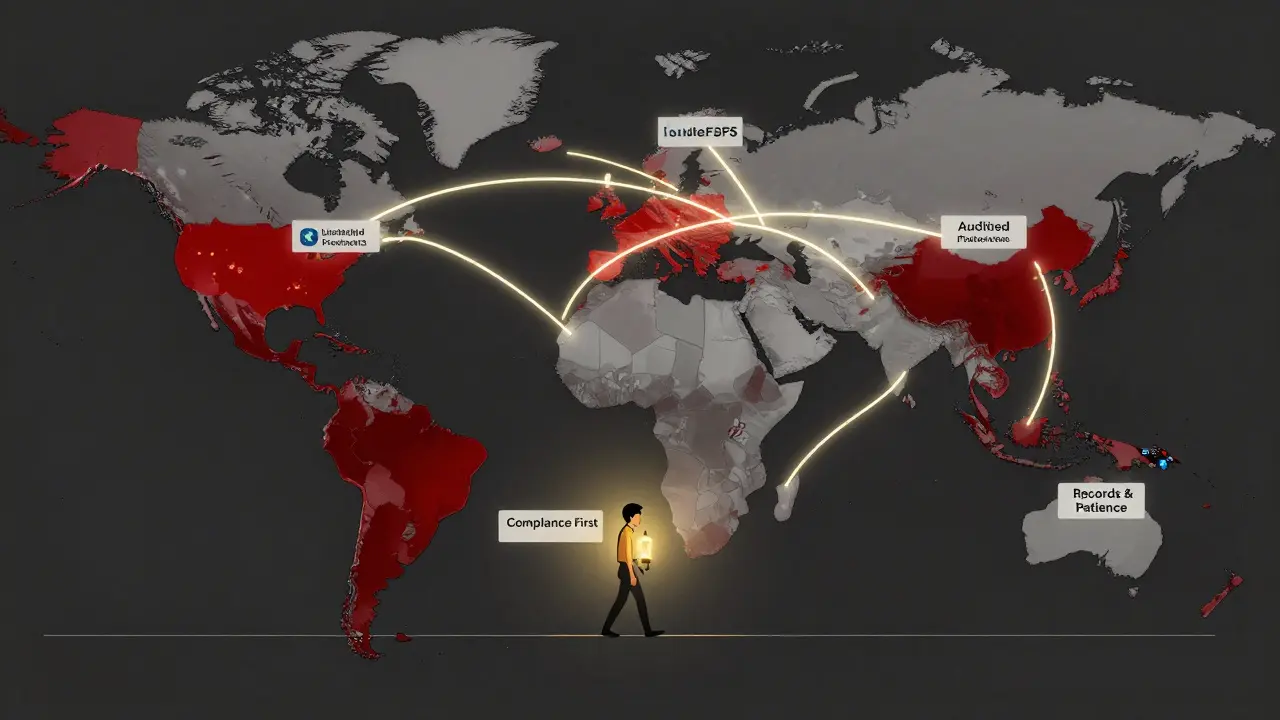

Compliance-First Approach to Crypto Trading in Restricted Countries

When you live in a country where crypto trading is banned or heavily restricted, the last thing you want is to get caught in a legal mess. But if you still want to participate in the crypto market, there’s a way to do it without risking fines, asset seizures, or worse-criminal charges. It’s called a compliance-first approach. This isn’t about finding loopholes. It’s about working within the rules, even when those rules feel unfair or outdated.

What Does "Restricted Country" Really Mean?

Not all restricted countries are the same. Some ban crypto entirely-like Bangladesh, where owning or trading Bitcoin can lead to legal action. Others, like China, only block centralized exchanges and mining, but let you hold crypto in your own wallet. Then there are places like Nigeria, where banks can’t touch crypto, but peer-to-peer trading thrives underground. The key is knowing exactly what’s prohibited. Is it trading? Mining? Using crypto to pay for goods? Or just holding it? In China, you can legally own Bitcoin as long as you don’t use a local exchange. In Indonesia, crypto isn’t legal tender, but it’s classified as a commodity-so you can buy and sell it through licensed platforms, just not use it to buy coffee. If you don’t know the difference, you’re playing Russian roulette with your assets. A compliance-first approach means you start by mapping out your country’s exact restrictions. Don’t guess. Don’t rely on forum posts. Check official sources: central bank announcements, financial regulator websites, or legal notices published in government gazettes.Self-Custody: The Quiet Workaround

One of the most powerful tools in a restricted country is self-custody. That means holding your crypto in a wallet you control-like a hardware wallet or a non-custodial software wallet-instead of leaving it on a local exchange. Why does this matter? Because most bans target intermediaries. In China, exchanges like Huobi and OKX were shut down. But your personal wallet? Not illegal. In Argentina, where inflation is crushing the peso, people use self-custody wallets to store value. The government doesn’t go after individuals-it goes after businesses that facilitate trades. This isn’t a loophole. It’s a legal distinction. When you hold crypto yourself, you’re not using a regulated service. You’re not depositing fiat through a bank. You’re not converting crypto to local currency on a platform that’s under regulatory scrutiny. You’re just holding digital assets. But here’s the catch: self-custody doesn’t make you invisible. If you buy crypto using a peer-to-peer platform and then move large sums into your wallet, that transaction can still be traced. That’s why compliance isn’t just about what you do-it’s about how you do it.How to Buy Crypto Without a Bank

In countries like Nigeria and Tanzania, banks are legally barred from processing crypto transactions. That means you can’t just link your bank account to Binance or Coinbase and buy Bitcoin with a debit card. So how do people do it? Most rely on peer-to-peer (P2P) platforms like LocalBitcoins, Paxful, or Binance P2P. These platforms connect buyers and sellers directly. Sellers accept cash deposits, mobile money, or even gift cards. In Nigeria, traders use bank transfers to friends or family members who then send crypto in return-creating a human layer between the transaction and the bank. But this introduces risk. Scams are common. Disputes are hard to resolve. That’s why compliance-first traders avoid high-volume P2P trades. They stick to small, consistent purchases. They use platforms with escrow protection. They keep records of every transaction-screenshots, chat logs, payment receipts. Why? Because if authorities come knocking, you need to prove you weren’t laundering money-you were just buying Bitcoin for savings.

Compliance Isn’t Just About Avoiding Punishment

Many people think compliance is about staying under the radar. But the smarter players see it as a long-term strategy. Look at Indonesia. In 2023, the government didn’t ban crypto-it reclassified it. By labeling it a commodity instead of a currency, they created a legal path for regulated exchanges to operate. Traders who followed the rules, registered with Bappebti, and kept records of their trades were able to operate openly. The same is happening in Hong Kong. As of August 2025, stablecoin issuers must be licensed by the HKMA. They must back every token with real reserves. They must follow strict AML rules. But they can operate legally. Retail investors can now trade Bitcoin and Ethereum on licensed platforms. The door is open-not wide, but open. If you’re in a restricted country, your goal shouldn’t be to outsmart the system. It should be to help change it. By staying compliant, documenting everything, and avoiding any activity that looks like money laundering or tax evasion, you’re building a case for future reform.What About DeFi and Cross-Border Tools?

Decentralized finance (DeFi) looks like a perfect escape hatch. You connect your wallet to Uniswap or Aave, swap tokens, earn interest-no bank, no exchange, no government oversight. But here’s the reality: DeFi isn’t always safer. In countries with strict capital controls, like Iran or Venezuela, using DeFi can trigger red flags. Transactions on public blockchains are visible. If your wallet receives large amounts from known exchanges or mixers, you could be flagged. Plus, most DeFi protocols don’t offer consumer protections. If you lose your private key, you lose everything. No customer service. No chargebacks. No recourse. A compliance-first approach doesn’t mean avoiding DeFi entirely. It means using it carefully. Stick to well-known, audited protocols. Avoid high-yield yield farms that look too good to be true. Don’t use DeFi to move money across borders unless you understand the legal implications in both countries.

What Happens When Rules Change?

Regulations in crypto move fast. In 2021, China banned mining. In 2023, Indonesia reclassified crypto as a commodity. In 2025, Hong Kong launched its stablecoin licensing regime. If you’re trading in a restricted country, you can’t set it and forget it. You need to monitor changes monthly. Subscribe to official regulatory updates. Follow your country’s central bank. Watch for announcements from financial intelligence units. A single new law can turn your routine into a crime overnight. In Bangladesh, possession of crypto was never explicitly illegal-until a 2024 court ruling classified it as “unauthorized financial activity.” Suddenly, holding Bitcoin became grounds for prosecution. Compliance-first traders don’t wait for enforcement. They adapt before it’s too late. They keep their holdings low. They avoid public trading activity. They don’t brag about their crypto on social media. They treat their portfolio like a quiet savings account-not a status symbol.When to Walk Away

Not every country is worth the risk. In places like Afghanistan, North Korea, or Algeria, the penalties for crypto trading include imprisonment. There’s no gray area. No compliance path. No regulatory evolution in sight. If you’re in one of those nine countries with a full ban, the only truly safe option is to avoid trading entirely. No self-custody. No P2P. No DeFi. The risk isn’t just financial-it’s personal. For others, relocation might be an option. Countries like Panama, Australia, and Bermuda offer clear crypto regulations, no capital gains tax, and legal protection for holders. But moving isn’t simple. You need to understand immigration rules, tax residency, and whether your home country restricts you from taking assets abroad.Final Thought: Compliance Is Power

In restricted countries, the most dangerous thing isn’t holding crypto. It’s acting like you’re above the law. The traders who thrive aren’t the ones who hack the system. They’re the ones who respect it-even when it’s unfair. They keep records. They avoid banks. They use licensed platforms when available. They don’t gamble with their freedom. Crypto adoption is rising everywhere-even in places that ban it. Chainalysis data shows Nigeria, Vietnam, and Ukraine are among the top adopters, despite legal barriers. Why? Because people want financial freedom. But the smart ones know: freedom without responsibility is just chaos. A compliance-first approach doesn’t mean giving up. It means choosing safety over speed. Long-term security over short-term gains. And sometimes, that’s the only way to win.Is it legal to hold crypto in a restricted country?

It depends. In countries like China and Argentina, holding crypto in a personal wallet is not illegal-even if trading on exchanges is banned. In Bangladesh and Afghanistan, possession itself is prohibited. Always check your country’s specific laws, not just general rumors.

Can I use Binance or Coinbase in a restricted country?

If your country bans centralized exchanges, using Binance or Coinbase directly can get you flagged. But you can still access them via P2P trading or self-custody. Just avoid linking your local bank account. Use cash, mobile money, or trusted intermediaries. Never trade large sums at once.

What’s the biggest mistake people make in restricted countries?

They assume the rules don’t apply to them. They use unregulated exchanges, mix funds through tumblers, or brag about their holdings online. These actions make them targets. Compliance isn’t about being perfect-it’s about being predictable and traceable in a way that proves you’re not breaking the law.

How do I know if my country is moving toward crypto regulation?

Look for signs: official committees studying crypto, central bank white papers, or licensed exchanges launching. Indonesia reclassified crypto as a commodity in 2023. Hong Kong launched its stablecoin license in 2025. These aren’t accidents-they’re signals. If your country is forming a regulatory body around crypto, it’s a sign change is coming.

Should I use DeFi to avoid restrictions?

DeFi can be useful, but it’s not a magic shield. Transactions are public. Large transfers can trigger AML alerts. If you’re using DeFi to move money across borders or hide funds, you’re risking exposure. Use it for simple swaps or earning interest, not for circumventing capital controls.

What should I do if authorities ask about my crypto?

Stay calm. Don’t lie. Don’t volunteer information. If asked, state clearly that you hold crypto for personal savings and have not used any banned services. Keep all records-wallet addresses, transaction dates, P2P receipts. If you’ve stayed compliant, you have nothing to hide.

25 Comments

India still bans crypto but everyone’s using P2P. 😎 Just don’t post about it on Twitter.

Ah yes, the classic 'compliance-first' approach. Like wearing a seatbelt while driving a tank through a minefield. 🤷♂️ At least you’re not *technically* breaking the law... until you are.

The ethical imperative of compliance, even under unjust regulatory frameworks, reflects a deeper commitment to social contract theory. One cannot undermine institutional legitimacy while simultaneously seeking its protection. The paradox is profound.

Bro, self-custody is the only way to go. I’ve been holding BTC since 2020 in a Ledger-no bank, no drama. Just remember: if you lose your seed phrase, you’re not getting it back. No one’s coming to save you. 😅

Compliance isn’t weakness. It’s strategy. The system changes. The smart ones adapt before the crackdown.

i just use p2p with my cousin who works at a bank lol he sends me money and i send him btc. its chill. no one gets hurt. 🙏

Let’s be real-this whole compliance-first thing is just a fancy way of saying ‘I’m too scared to get arrested.’ But hey, if you’re keeping your head down, documenting everything, and not doing anything sketchy? You’re already ahead of 90% of the crypto crowd. Respect. 🙌

The notion that regulation inherently stifles innovation is a myth. In Hong Kong, the licensing regime has created a stable environment for institutional adoption. Compliance isn’t surrender-it’s infrastructure.

i think u r right about self custody but i keep forgetting my passpharase. oops. 🤦♂️

You think you’re safe? Wait till the government starts tracking wallet-to-wallet transfers. They already have the tools. You’re just delaying the inevitable.

This is all a distraction. The real goal? The Fed’s digital dollar. They let you hold crypto so they can track you. One day, your wallet gets frozen. You’ll thank them for the ‘compliance’.

People think they’re being clever by using P2P. But you’re still enabling a system that bypasses financial oversight. You’re not a rebel-you’re a liability. And your ‘savings’? They’re just gambling with someone else’s future.

So you’re telling me if I hold Bitcoin in a wallet in Nigeria, I’m not breaking the law? Cool. So what’s the difference between that and holding a gun in a school? Both are technically legal if you don’t use them. 🤡

I appreciate the nuance. Many assume compliance means submission. But in restricted environments, it’s often the only path to legitimacy. Quiet persistence > loud rebellion.

YES! This is the energy we need. Not fear. Not chaos. Just steady, smart, responsible action. You’re not hiding-you’re building a foundation for the future. Keep going!

The AML/KYC architecture is being retrofitted to blockchain analytics. Your ‘compliant’ P2P trades are being flagged by Chainalysis and sold to regulators. You’re not invisible-you’re a data point.

i just use binance p2p with my uncle who lives in dubai. he sends me usdt and i send him cash. it’s lowkey. 🤫 and i always screenshot everything. i’m not trying to be a hero, just a normal person trying to save.

Self-custody is the only real freedom in crypto. The rest is theater. Regulators can shut down exchanges, but they can’t seize what you hold.

You call this compliance? This is just cowardice dressed in legal jargon. Real freedom doesn’t require permission slips. If your government bans something, the only moral choice is to defy it-not document your compliance.

There’s a quiet dignity in choosing safety over spectacle. The world doesn’t need more martyrs. It needs people who survive long enough to see the system change.

In Nigeria, P2P is the backbone of survival. We don’t trade for speculation-we trade to protect our savings from inflation. The regulators may not like it, but they can’t stop us. Not really.

Compliance-first? More like compliance-last. The second you use a P2P platform, you’re already in violation. This whole article is just crypto PR with a side of fearmongering.

This is exactly the kind of disciplined thinking the crypto space needs. Not hype. Not speculation. Strategy. Clarity. Long-term vision. Thank you for this.

i just use my mom’s bank account to buy usdt on p2p. she thinks i’m buying ‘digital stamps’. lol. 🤭 always keep records. always.

You think you’re being smart by staying compliant? You’re just training the system to control you better. One day, they’ll say ‘you followed the rules, so now you owe us 30% of your crypto.’ 😈