BitForex Crypto Exchange Review: What Happened and What You Need to Know

BitForex Withdrawal Deadline Calculator

Calculate Your BitForex Funds Before Deadline

BitForex applies a 5% monthly fee (minimum $10) on remaining balances until December 25, 2025. Calculate how much you'll lose if you don't withdraw now.

Your Results

BitForex was once one of the top 10 cryptocurrency exchanges in the world, handling over $1.38 billion in daily trades in early 2023. It offered more than 500 coins, low fees, and a free copy-trading feature that let users mimic the trades of others. But by February 2024, the platform vanished. No warning. No notice. Just silence.

What Was BitForex?

BitForex was a Hong Kong-based crypto exchange registered in Seychelles. It didn’t have a clear launch date, but by 2023, it had grown to over 3 million users. It wasn’t regulated like Binance or Coinbase. Instead, it operated in the gray zone-offshore, with minimal oversight. That’s how it could offer 100x leverage on trades and list obscure altcoins no other exchange would touch.

Its main selling points were low fees and volume. Spot trading fees were 0.1% for both makers and takers-lower than the industry average of 0.25%. Perpetual contracts had even lower fees: 0.04% for makers, 0.06% for takers on BTC and ETH pairs. The platform had a TradingView-powered interface, mobile apps, and even MT5 integration for advanced traders.

But none of that mattered when the platform stopped working.

The Sudden Shutdown

On February 23, 2024, BitForex’s website and apps went offline. No announcement. No email. Just a blank screen. Users woke up to find they couldn’t log in, deposit, or withdraw. The exchange had vanished.

By March 1, 2024, Fastbull reported that $56 million in user funds had disappeared. That wasn’t a small glitch. That was a systemic failure. And it wasn’t the first time an offshore exchange collapsed like this-but it was one of the most visible.

BitForex didn’t come back online until July 24, 2024. When it did, it wasn’t the same platform. Trading was suspended. New accounts were blocked. Deposits were turned off. The only thing still working? Withdrawals-if you passed KYC.

The Withdrawal Nightmare

After the shutdown, BitForex forced all users to complete KYC before touching their funds. Sounds reasonable, right? Except no one could get through it.

Trustpilot reviews from October and December 2024 show the same story over and over: “My KYC is still pending.” “I’ve been waiting 8 months.” “They never told me what documents were missing.”

Even after submitting everything, users reported that withdrawals took weeks-or never came. One user wrote: “I sent 2 BTC from Coinbase. It never showed up. I contacted support. No reply.” Another said: “The system says my deposit is confirmed, but my balance hasn’t moved. It’s a 50/50 chance it ever appears.”

Then came the management fee.

On July 24, 2024, BitForex announced a 5% monthly fee on all remaining account balances-with a minimum $10 charge per month. That meant if you had $200 left, you lost $10 every 30 days. If you had $1,000? $50 gone. And it kept happening every month until December 25, 2025-the final deadline to withdraw everything.

By December 2025, only about half of user funds had been returned. The rest? Still stuck. Or gone.

Security Claims vs. Reality

BitForex claimed to store “the vast majority of funds in cold storage.” It offered 2FA, SMS verification, and DDoS protection. On paper, it looked secure.

But when the platform collapsed, users lost millions. If cold storage was real, where did the $56 million go? If security was strong, why did withdrawals take months? Why did users report order books being manipulated-where trades showed up as active but never executed?

Trustpilot reviews call the security system “way too tight.” That’s not a compliment. It means the platform made it hard to withdraw money-not to protect you, but to keep you from leaving.

And then there’s the silence. No press releases. No updates. No transparency. Just a countdown to December 25, 2025, with no guarantee anything will be returned.

Why BitForex Failed

BitForex didn’t fail because of a hack. It failed because it was never built to last.

It targeted retail traders who wanted high leverage and low fees. It didn’t care about regulation. It didn’t care about compliance. It didn’t care about trust. It cared about volume.

And when the market turned, or when the owners decided to walk away, there was no safety net. No insurance. No legal recourse. Just a website that said, “Withdraw by December 25, 2025-or lose it all.”

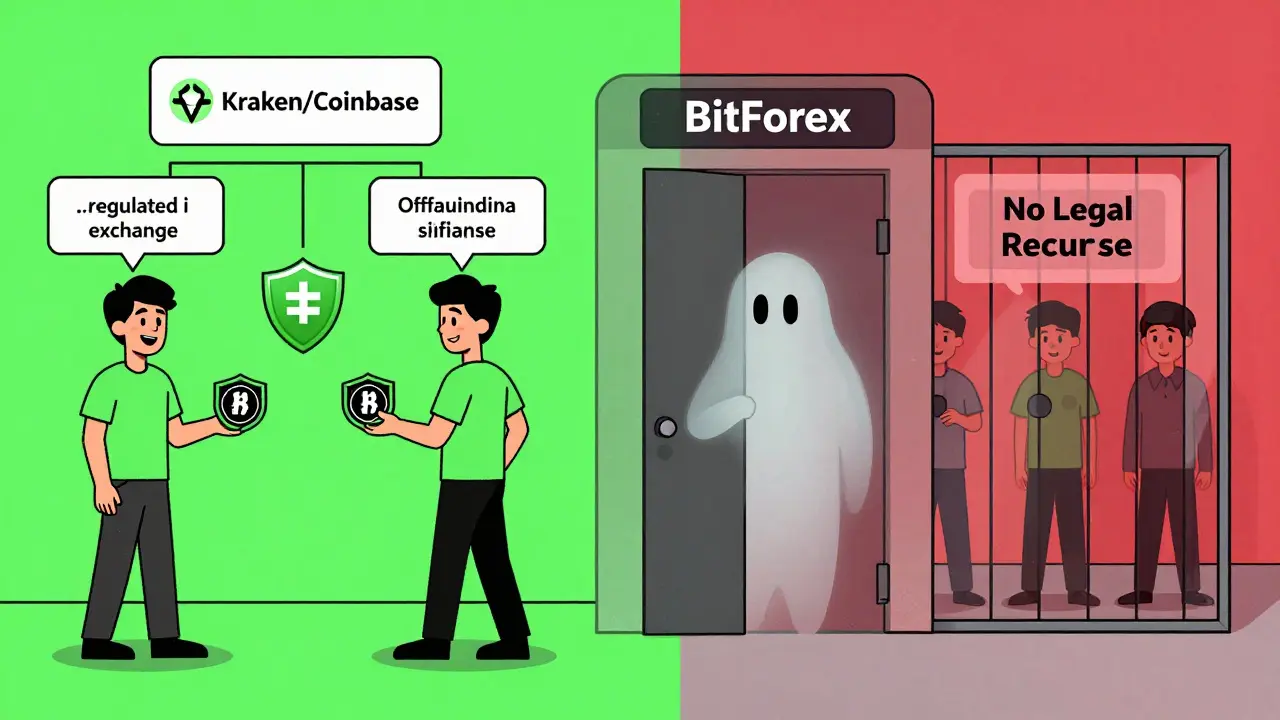

Compare that to exchanges like Kraken or Coinbase. They’re regulated. They have insurance. They have customer support teams that answer emails. BitForex had none of that.

What Happened to the Users?

Over 3 million people used BitForex. Most were small investors. People who put in $500, $1,000, maybe $5,000. Not institutions. Not whales. Just everyday people trying to get into crypto.

Now, they’re stuck in limbo. Some got their money back. Many didn’t. Others are still waiting for KYC approval. A few have filed complaints with regulators-but with BitForex registered in Seychelles, there’s little legal ground to stand on.

Reddit threads from 2024 are full of people asking: “Is this a scam?” The answer isn’t clear-cut. It’s not a classic scam where the site disappeared overnight. It’s worse. It’s a slow-motion collapse. A company that kept the lights on just long enough to drain your wallet with fees, while pretending to help you get out.

Should You Use BitForex Today?

No.

Even if you still have funds there, the platform is not a functioning exchange. It’s a recovery portal with a ticking clock. Trading is disabled. New users are blocked. Deposits are gone. The only thing left is a forced withdrawal process-with a monthly fee eating away at what’s left.

If you still have assets on BitForex, act now. Complete KYC. Withdraw everything by December 25, 2025. Don’t wait. Don’t hope. Don’t trust their promises.

If you’re looking for a new exchange, pick one with regulation, insurance, and a track record. Avoid offshore platforms that promise high leverage and low fees without explaining how they stay solvent.

Final Thoughts

BitForex was a warning sign disguised as an opportunity. It offered everything retail traders wanted: low fees, lots of coins, copy trading. But it had no accountability. No oversight. No backup plan.

Its collapse isn’t just about one exchange. It’s about the risk of trusting your money to anyone who says, “Trust us, we’re legit.”

The lesson? Not your keys, not your coins. If you can’t withdraw your crypto without jumping through 10 hoops, you don’t own it. And if the exchange shuts down without warning, you’ll be left with nothing.

BitForex is over. The clock is ticking. And the only thing you can do now is get out while you still can.

Is BitForex still operational?

BitForex is not operational as a trading platform. Trading, deposits, and new account creation were suspended in July 2024. The only active function is withdrawal processing for users who complete KYC. The platform will fully shut down after December 25, 2025.

Can I still withdraw my funds from BitForex?

Yes-but only if you complete mandatory KYC verification. Withdrawals are open to verified users only, and a 5% monthly fee (minimum $10) is applied to any remaining balance. The final deadline to withdraw is December 25, 2025. After that, access to funds will be permanently cut off.

Why did BitForex shut down?

BitForex shut down due to operational collapse, not a hack. The exchange failed to maintain financial integrity, lost user trust, and faced a $56 million shortfall in user funds. Its offshore registration in Seychelles and lack of regulation meant there was no legal obligation to protect customer assets. The shutdown appears to be a slow exit scam.

Was BitForex a scam?

It wasn’t a classic scam where the site vanished overnight. But its behavior after February 2024-lack of communication, forced KYC, monthly fees on remaining balances, and failure to return all funds-matches patterns seen in exit scams. The $56 million in missing assets and unresponsive support strongly suggest intentional mismanagement.

How can I check if my funds are still on BitForex?

Log in to your BitForex account. If you see a balance, you still have funds. Check your email for any KYC requests. If you haven’t completed verification, do it immediately. If your balance is zero or you can’t log in, your funds may have been lost or never deposited. Contact support only if you have a verified account and pending withdrawal issues.

What should I do if I still have money on BitForex?

Complete KYC verification immediately. Withdraw all your funds to a personal wallet you control-never leave crypto on an exchange. Do not delay. The 5% monthly fee will keep draining your balance. After December 25, 2025, there will be no way to recover your assets. Treat this like a deadline, not a suggestion.

Are there any alternatives to BitForex?

Yes. Use regulated exchanges like Kraken, Coinbase, or Binance (where available). These platforms offer insurance, customer support, and legal recourse. Avoid offshore exchanges with no clear regulatory standing. Look for platforms that support fiat deposits, have transparent ownership, and publish regular audits.

21 Comments

BitForex wasn't a scam it was a slow burn con. They knew people would wait hoping for a miracle and charged fees until the last cent was drained. Classic.

Man I still remember logging in one day and seeing that blank screen. No warning. No email. Just... gone. Like someone pulled the plug on a party and nobody told you it was over. I lost my entire crypto stash. I was just trying to make a few bucks on altcoins. Now I'm just mad.

I'm from Canada and I followed this whole saga from afar. It's heartbreaking. So many small investors - moms, dads, students - who trusted this platform because it looked shiny and offered copy trading. The 5% monthly fee? That's not a fee, that's psychological warfare. And the KYC delays? Pure extraction. I just hope someone finds a way to hold them accountable. 💔

Look - if you're still holding crypto on any exchange that doesn't let you withdraw without jumping through 15 hoops, you don't own it. You're renting it. And BitForex was the worst kind of landlord - the one who changes the locks, charges you rent for the space you're locked in, and then says 'sorry, we forgot the key.' Move your coins. Now. To a wallet you control. No exceptions.

Wow. So we're supposed to feel bad for people who got greedy and trusted an offshore exchange with 100x leverage? This is why crypto is a casino. If you didn't know better than to use BitForex, you deserved to lose. No sympathy here. My wallet? Cold storage. My keys? In a hardware device. My peace of mind? Priceless.

Not your keys, not your coins isn't just a slogan. It's the first rule of crypto survival. BitForex didn't fail - it was designed to fail. The fees, the KYC delays, the silence - it was all part of the exit plan. The real tragedy? Millions didn't know any better. Education matters more than leverage.

THEY KNEW. THEY KNEW. THEY KNEW. And they still let people deposit. They had the money. They had the time. They had the chance to warn people. But no. They let the fees roll in. Every. Single. Month. This isn't negligence - it's theft with paperwork. 🤬

Everyone's calling it a scam but that's too simple. It's a system. A system designed to extract value from the naive while pretending to be a marketplace. The regulators didn't stop it because they didn't want to. The offshore shell made it untouchable. The real crime? The silence. No one said anything until it was too late. And now we're all just arguing about who's to blame.

US citizens should never touch offshore exchanges. Period. If it's not registered with the SEC, it's not legal. If it's not legal, it's a trap. BitForex was a foreign shell game. And people fell for it because they thought crypto was a shortcut to wealth. It's not. It's a minefield. And you're the target.

Let me guess - someone’s still waiting for their withdrawal. Still checking their email. Still hoping the ‘system’ will fix itself. Wake up. That’s not a platform. That’s a graveyard with a login page. The fee? That’s the tombstone charge. Pay it. Then get out.

i just wanna say… i lost $800 and i still have the email they sent saying ‘your kyc is under review’… it’s been 10 months. i don’t even know if they got my docs. i feel so stupid. but i’m not alone right? right??

THIS WAS ALL A COORDINATED ATTACK BY THE FEDS AND THE BIG EXCHANGES TO CRUSH DECENTRALIZATION!!! BITFOREX WAS THE ONLY ONE THAT LET SMALL PEOPLE TRADE WITHOUT KYC!!! THEY TOOK IT DOWN TO FORCE US INTO THE SYSTEM!!! THE 5% FEE? THAT'S A TAX TO FUND THE ELITE'S NEW CRYPTO BOND MARKET!!!

Hey, if you still have funds on BitForex - I know it’s scary, I’ve been there - but don’t panic. Do the KYC. Get your docs ready. Don’t wait for a perfect moment. Do it today. Even if it takes weeks, it’s the only path. And if you’re stuck? Join the Reddit recovery group. People are sharing tips. We’re in this together. You’re not alone. I believe you can get your money back. Just don’t give up.

Oh look, another crypto martyr. You trusted a platform with no regulation, no insurance, and a CEO who probably lives in a beach house in Seychelles. You didn't get scammed - you got outsmarted by capitalism. Congratulations. Now go cry into your Coinbase app.

I used BitForex because I was new and they had copy trading. I followed a guy who made 500% in a week. Turned out he was a bot. Or a shill. Or both. I lost everything. But here's the thing - I didn't learn from it. I went to another exchange. Then another. Then I realized - I didn't need any of them. I bought a Ledger. I moved my coins. I stopped chasing returns. I started learning. That's the real win. Not the money. The mindset.

There’s a difference between trusting too much and trusting nothing. BitForex wasn’t the problem. The problem is the culture that says ‘low fees = good’ without asking ‘who’s behind it?’ We need more transparency. Not more regulation. More visibility. More accountability. Not more fear.

What’s haunting about BitForex isn’t the missing money - it’s the silence. No apology. No explanation. No one even said ‘we’re sorry.’ That’s the real loss. Not the coins. The humanity. We treat crypto like a game, but it’s people’s savings. And when platforms vanish, they don’t just take money - they take trust. And trust is harder to rebuild than wallets.

Did anyone else notice that the withdrawal portal still shows ‘last updated 2 days ago’? Even though the site is basically a ghost town? That’s not a system. That’s theater. They’re keeping the illusion alive just long enough to collect the last round of fees. It’s cold. And calculated.

Just finished my KYC after 6 months. Took 3 tries. They asked for a selfie with my ID and a handwritten note. Weird. But it worked. Got my ETH out yesterday. Took 72 hours to arrive. Worth it. Don’t wait. Do it now. Even if it’s annoying. Your coins are worth more than your patience.

BitForex was a regulatory arbitrage play disguised as a trading platform. They exploited jurisdictional gray zones, attracted retail with leverage, then systematically drained liquidity through fees and delays. This isn't an anomaly - it's the business model of unregulated crypto. The only surprise? It took this long for someone to notice.

It is my solemn duty to inform you that the structural deficiencies inherent in unregulated digital asset intermediaries render them fundamentally incompatible with the fiduciary responsibilities expected of financial institutions. The precipitous collapse of BitForex exemplifies the catastrophic consequences of market participants' failure to adhere to principles of prudent capital stewardship.