Bitcoin Adoption in Venezuela Amid Economic Crisis: How Crypto Became a Lifeline

Venezuela Stablecoin Converter

In Venezuela's economic crisis, the bolívar has lost over 70% of its value between October 2023 and June 2024. Stablecoins like USDT have become a lifeline for daily transactions.

Convert Bolívar to USDT

Current Value Analysis

When your salary buys less than a loaf of bread by the end of the week, and your bank account is frozen by foreign sanctions, what do you do? For millions of Venezuelans, the answer isn’t waiting for government reform-it’s using Bitcoin and stablecoins to survive.

Why Bitcoin Became Venezuela’s Hidden Currency

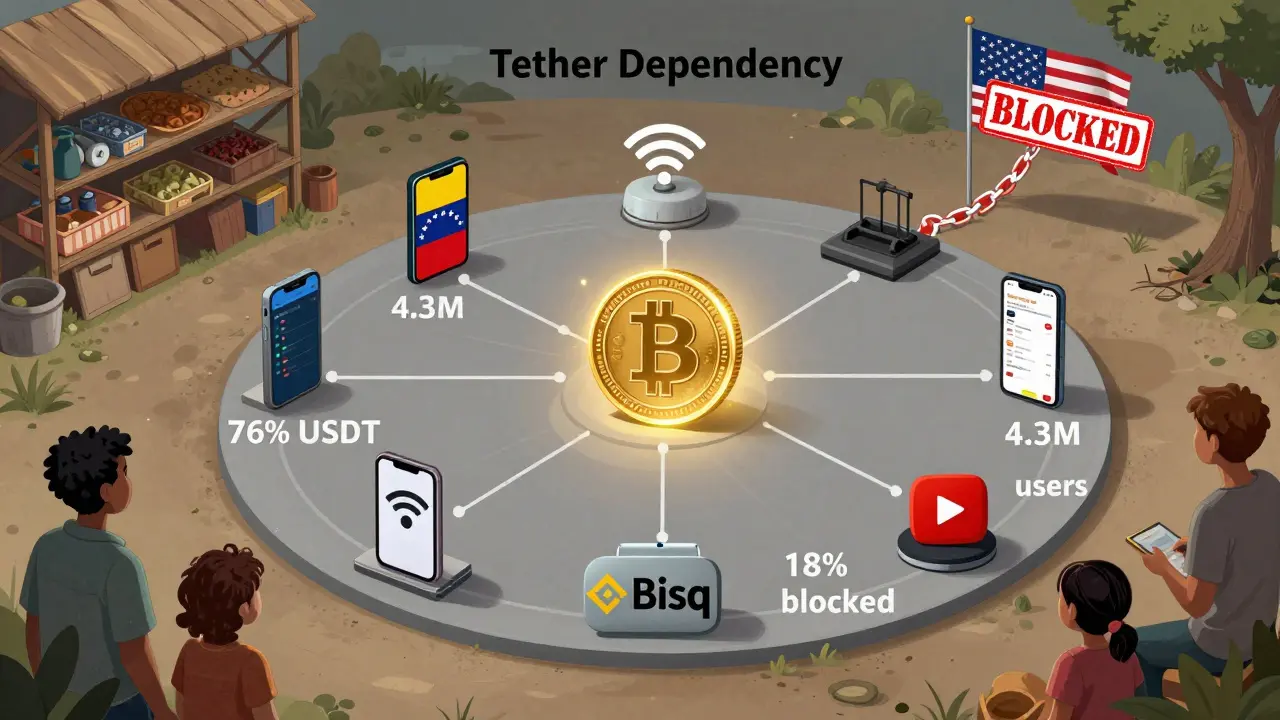

The bolívar isn’t just weak-it’s broken. In May 2024, inflation hit 229%, and between October 2023 and June 2024, the currency lost over 70% of its value. Wages didn’t keep up. Banks stopped processing international transfers. Foreign cash became nearly impossible to get. People didn’t choose Bitcoin because it was trendy. They chose it because they had no other option. By 2025, an estimated 4.3 million Venezuelans-13% of the population-were using digital wallets like Binance Wallet or Airtm. These weren’t speculators. They were teachers, mechanics, nurses, and small shop owners who needed to pay rent, buy food, or send money to family abroad. Bitcoin and, more commonly, Tether (USDT), became the only reliable store of value left. USDT, a stablecoin pegged to the U.S. dollar, is what most people actually use. Locally, it’s called "Binance dollars." Why? Because it doesn’t swing wildly like Bitcoin. It holds its value. When the bolívar drops 20% in a week, USDT stays at $1. That’s the difference between eating and going hungry.How People Actually Use Crypto in Daily Life

You won’t find Bitcoin ATMs in Caracas. You won’t see crypto logos on store windows. But you’ll see people scanning QR codes on their phones to pay for groceries, medicine, or bus fare. A 2025 survey of 1,200 businesses in Caracas found that over 65% accepted cryptocurrency for everyday purchases. A butcher might quote prices in USDT. A mechanic might ask for payment in Bitcoin. A landlord might require rent in stablecoins. Transactions happen through peer-to-peer (P2P) platforms like Binance P2P and LocalBitcoins. No bank account needed. No government approval required. Victor Sousa, a Caracas resident, told the Financial Times: "There’s lots of places accepting it now. The plan is to one day have my savings in crypto." Carlos, another user quoted by CoinCentral, said: "I use USDT for everything-buying food, paying rent. It is much more reliable than the bolívar." Reddit’s r/BitcoinVenezuela community has over 42,000 members. One user, "CryptoSurvivorVE," posted in June 2025: "Without USDT, I couldn’t feed my family after my bolívar salary became worthless overnight."The Infrastructure That Keeps It Running

This system doesn’t run on fancy tech. It runs on smartphones, Wi-Fi hotspots, and sheer necessity. Venezuela’s average internet speed is just 14.79 Mbps-153rd in the world. Many people rely on public Wi-Fi or mobile data that cuts out mid-transaction. Bitcoin transactions can take 10 to 60 minutes to confirm. USDT on the Tron network? Under two minutes. That’s why stablecoins dominate. Binance P2P handles 63% of all crypto trading in Venezuela. LocalBitcoins has 22%. The rest go to decentralized exchanges like Bisq. These platforms connect buyers and sellers directly. You send bolívares to someone’s bank account (if they still have one), and they send you USDT to your wallet. It’s messy, but it works. The government tried to control this. In 2018, it launched its own cryptocurrency, the Petro, backed by oil. It collapsed by 2024 amid corruption scandals. Then, in 2023, it shut down SUNACRIP, the agency meant to regulate crypto. The message? We don’t control it, but we won’t stop you either.

Who’s Getting Left Behind

Crypto isn’t magic. It doesn’t fix broken supply chains or create jobs. It doesn’t bring back factories that shut down. It just lets people move value when the system won’t. In rural areas, internet access is worse than in cities. Only 45% of Venezuelans have reliable connectivity. That leaves millions without access to digital wallets. Elderly people, low-income families without smartphones, and those in remote towns still rely on barter or cash-when they can find it. And then there’s the risk of sanctions. U.S. restrictions block about 18% of transactions on Binance for users linked to sanctioned banks. Sometimes, a wallet gets frozen. Sometimes, a payment fails with no explanation. People lose money. No one is there to help. The Venezuelan Finance Observatory recorded 1,247 complaints about crypto transactions in early 2025. Most were about price swings during conversion, platform crashes, or scams. One user lost $200 when a P2P seller disappeared after receiving bolívares.Why Stablecoins Are the Real Stars

Bitcoin gets the headlines. But USDT is the workhorse. Tether controls 76% of Venezuela’s stablecoin market. That’s a problem. Tether is a private company based in the British Virgin Islands. It answers to no one in Venezuela. If Tether decides to freeze accounts-because of U.S. pressure-it could shut down half the country’s digital economy overnight. That’s why some are exploring alternatives. Decentralized exchanges like Bisq let users trade directly without intermediaries. But they’re harder to use. Most Venezuelans need simple apps with Spanish support. Binance’s Spanish interface scores 4.2 out of 5 on Trustpilot. LocalBitcoins? Only 3.1. YouTube channels like "Cripto Para Todos" (with 127,000 subscribers) and free university courses at Universidad Central de Venezuela have filled the education gap. People learn how to set up wallets, avoid scams, and manage volatility in just two or three weeks.

What the Experts Say

Chainalysis, which tracks global crypto usage, says Venezuela’s adoption is one of the most dramatic examples of digital money replacing a failed state currency. Sarah Blake, author of their 2024 report, called it "a critical economic lifeline." But the IMF disagrees. David Lipton, senior advisor, warned: "Digital assets provide tactical relief but cannot substitute for sound monetary policy." Economist María Fernández from the University of Caracas puts it bluntly: "Crypto helps people survive, but it doesn’t fix the economy. The bread is still missing. The medicine is still scarce. The fuel is still gone." And Carlos Hernández from the University of Zulia says: "Crypto adoption in Venezuela is a symptom of economic failure, not a solution." Binance’s Diego Morales has a different take: "Digital assets have become Venezuela’s de facto parallel banking system. They’re processing transactions that traditional finance can’t handle."The Road Ahead: Survival or Transition?

As of July 2025, Venezuela’s monthly crypto transaction volume hit $119 million-91% of it in stablecoins. That’s up from $54 million in early 2024. It’s growing, not slowing. But it’s fragile. If the bolívar stabilizes-even slightly-adoption could drop fast. Most people use crypto because they have to, not because they want to. If inflation falls below 50% annually, as the IMF predicts won’t happen before 2027, the urgency fades. There’s one glimmer of hope: Venezuela is now part of BRICS discussions on cross-border payment systems. If a new, non-U.S.-controlled network emerges, it could reduce dependence on Tether and Binance. But that’s years away. For now, crypto isn’t the future of Venezuela’s economy. It’s the present. It’s the only thing keeping millions from starvation. It’s the only way to send money to relatives abroad. It’s the only way to save what little you earn. As long as the bolívar keeps losing value, Bitcoin and USDT will keep running. Not because they’re perfect. But because nothing else works.What This Means for the Rest of the World

Venezuela isn’t an outlier. It’s a warning. When governments lose control of money, people find alternatives. If inflation hits elsewhere-whether from war, mismanagement, or debt-crypto won’t be a luxury. It’ll be a necessity. The lesson from Venezuela isn’t that Bitcoin will replace the dollar. It’s that when trust in institutions vanishes, people turn to code. And code, unlike politicians, doesn’t lie.Why do Venezuelans prefer USDT over Bitcoin?

Venezuelans use USDT because it’s pegged to the U.S. dollar and stays stable. Bitcoin’s price swings too much for daily purchases. If you need to pay rent or buy groceries, you can’t risk losing 10% of your payment overnight. USDT confirms in under two minutes on the Tron network, making it faster and more reliable than Bitcoin, which can take up to an hour to confirm.

Is Bitcoin legal in Venezuela?

Bitcoin isn’t illegal, but it’s not officially recognized either. The government banned its own Petro cryptocurrency in 2024 and shut down the main crypto regulator, SUNACRIP, in 2023. There’s no clear law, so crypto operates in a gray zone. People use it anyway because they have no other choice.

Can Venezuelans cash out crypto for physical cash?

Yes, but it’s risky. People use P2P platforms to trade USDT for bolívares from local sellers. Sometimes, they meet in person. Other times, they transfer to a bank account. But if the seller disappears or the bank freezes the transaction, the money is gone. There’s no consumer protection. About 22% of users report losing money during these conversions.

How do Venezuelans learn to use crypto?

Most learn from YouTube channels like "Cripto Para Todos," which has over 127,000 subscribers. Universities, including Universidad Central de Venezuela, now offer free courses. Community groups on WhatsApp and Telegram share tips. Binance’s Spanish app is user-friendly, so many start there. It usually takes 2-3 weeks to get comfortable.

Are U.S. sanctions blocking crypto use in Venezuela?

Yes. U.S. sanctions under Executive Order 13850 block transactions involving sanctioned banks and individuals. Binance reports that about 18% of attempted transactions are blocked. Some wallets get frozen without warning. This creates uncertainty-users never know if their next payment will go through.

Is crypto adoption in Venezuela growing or declining?

It’s growing. Monthly crypto transaction volume jumped from $54 million in early 2024 to $119 million in July 2025. Over 65% of businesses in Caracas now accept crypto. But growth is driven by desperation, not choice. If inflation drops significantly, adoption could fall quickly.

What’s the biggest risk for crypto users in Venezuela?

The biggest risk is dependence on Tether and Binance. Tether controls 76% of the stablecoin market. If Tether freezes accounts or Binance pulls out due to U.S. pressure, Venezuela’s entire crypto economy could collapse overnight. There’s no backup system.

18 Comments

lol so now crypto is the new welfare? 🤦♂️ guess i’ll start mining bitcoin in my basement while my taxes pay for your groceries. 🍞

USDT is the real MVP here. Meanwhile in India we’re still arguing about whether UPI is ‘colonial’ or not. At least they’re not waiting for permission to eat.

This is beautiful. People taking control of their own survival. No government. No banks. Just code and courage. I’m not even mad anymore. 🙌

It’s wild how tech becomes humanity’s last resort. 🌍❤️🩹 When institutions fail, the internet doesn’t. This isn’t crypto-it’s dignity with a QR code.

Let me tell you something-this isn’t about Bitcoin. It’s about people refusing to be erased. Teachers paying rent. Nurses buying insulin. Mechanics feeding kids. That’s not a trend. That’s a revolution in quiet socks.

The structural dependency on Tether is a catastrophic vulnerability. A single regulatory intervention by the U.S. Treasury could collapse the entire economic ecosystem, rendering millions of digital wallets instantly worthless. The absence of decentralized alternatives and the centralized governance of stablecoin issuers renders this entire model inherently unstable and ethically indefensible.

The article romanticizes desperation. Crypto isn’t a solution-it’s a symptom of state failure. And relying on a private entity in the British Virgin Islands to stabilize your food supply is not innovation. It’s feudalism with blockchain.

Let’s cut the fluff. Venezuela’s crypto scene is just a high-risk P2P black market with a tech veneer. No regulation. No recourse. Just people gambling with their last bolívars hoping the seller doesn’t ghost them. This isn’t finance. It’s survival roulette.

Oh wow, another ‘crypto saves the day’ piece. Meanwhile, the U.S. is printing trillions and nobody’s crying. Hypocrites.

Nigeria knows this pain. We use USDT too. But we don’t call it ‘lifeline’-we call it ‘how we don’t starve while politicians party’. Same script. Different country.

The notion that decentralized finance solves systemic collapse is a naive illusion. True economic recovery requires institutional reform-not private stablecoin protocols.

I just cried reading this. My cousin in Maracaibo uses USDT to buy her daughter’s asthma inhalers. She doesn’t care about blockchain. She cares about breathing. That’s all that matters.

So people are using crypto because the government is trash. Big deal. That’s not a win. That’s just a bandaid on a gunshot wound. And now they’re hooked on a private company’s whim? Pathetic.

This is why America needs to stop pretending it’s above this. We’re one hyperinflation away from this exact chaos. And when it happens, you’ll be begging for USDT too. Stop acting like you’re better.

I just want to say thank you to every Venezuelan parent who’s figured out how to pay for milk with a QR code while the world ignores them. You’re not just surviving-you’re rewriting the rules of what human resilience looks like. I’m in awe. And I’m so sorry we didn’t see this coming sooner. 🌟

I’ve taught crypto basics to 3 Venezuelan refugees here in Texas. One guy told me he sent $150 in USDT to his mom in Caracas last week-she bought rice and chicken. He cried. I cried. That’s the real ROI of crypto. Not charts. Not lambo dreams. Just… food.

This is the future. Not in 10 years. Now. 🌐❤️ When your government betrays you, you don’t wait for permission-you code your own freedom. Venezuela isn’t an exception. It’s the prototype.

The real story here isn’t crypto. It’s the quiet, daily courage of ordinary people refusing to be broken. They didn’t ask for this. But they built something anyway. That’s not tech. That’s human.