Why dYdX Blocks Certain Countries Even Though It Calls Itself a Decentralized Exchange

dYdX Country Block Checker

Check if Your Country is Blocked

Enter your country name to see if it's currently blocked from accessing dYdX.

Currently Blocked Countries

These regions are currently restricted by dYdX due to regulatory compliance:

Note: This list is updated quarterly and may expand with new sanctions.

Key Takeaways

- dYdX claims decentralization but runs a centralized frontend that can block users by geography.

- The platform blocks the United States, United Kingdom, Canada, Iran, Cuba, North Korea, Syria, Myanmar, Crimea, Donetsk, Luhansk and a growing list of sanctioned territories.

- Blocked wallets are put into a "close‑only" mode that lets users unwind positions but prevents new trades or deposits.

- Compliance is driven by U.S. sanctions, AML/CTF laws, and OFAC’s restricted‑person lists.

- If you live in a prohibited region, you can still exit existing positions, export your seed phrase, and consider alternative fully decentralized protocols.

What dYdX Says It Is

When you hear dYdX is a crypto derivatives exchange that markets itself as decentralized, the first image that comes to mind is a permission‑less platform where anyone can trade perpetual contracts without a middleman.

The platform was launched in 2017 by Antonio Juliano a former Coinbase engineer and Princeton CS graduate. It now offers more than 160 perpetual markets, from Bitcoin and Ethereum to newer assets like Solana, Polygon and Chainlink.

In theory, the core matching engine runs on smart contracts, which means no single entity can halt trades. In practice, the user‑facing frontends - the web app at dydx.trade and the mobile apps - are owned and operated by dYdX Operations Services Ltd. (DOS). That distinction is the root of the country‑blocking puzzle.

Which Countries Are Blocked?

dYdX’s public terms list a large set of prohibited jurisdictions. The list is not static; it expands as new sanctions are announced. As of October2025, the most common blocked regions are:

- United States

- United Kingdom

- Canada

- Iran

- Cuba

- North Korea

- Syria

- Myanmar (Burma)

- Crimea, Donetsk, Luhansk (Russian‑controlled areas)

- Iraq, Libya, Mali, Democratic Republic of Congo, Côte d’Ivoire, Nicaragua, Somalia, Sudan, Yemen, Zimbabwe

Notice that some large markets - China, Russia, South Korea, Japan, Vietnam - remain accessible, showing that the platform’s compliance strategy is selective rather than universally conservative.

How dYdX Enforces the Blocks

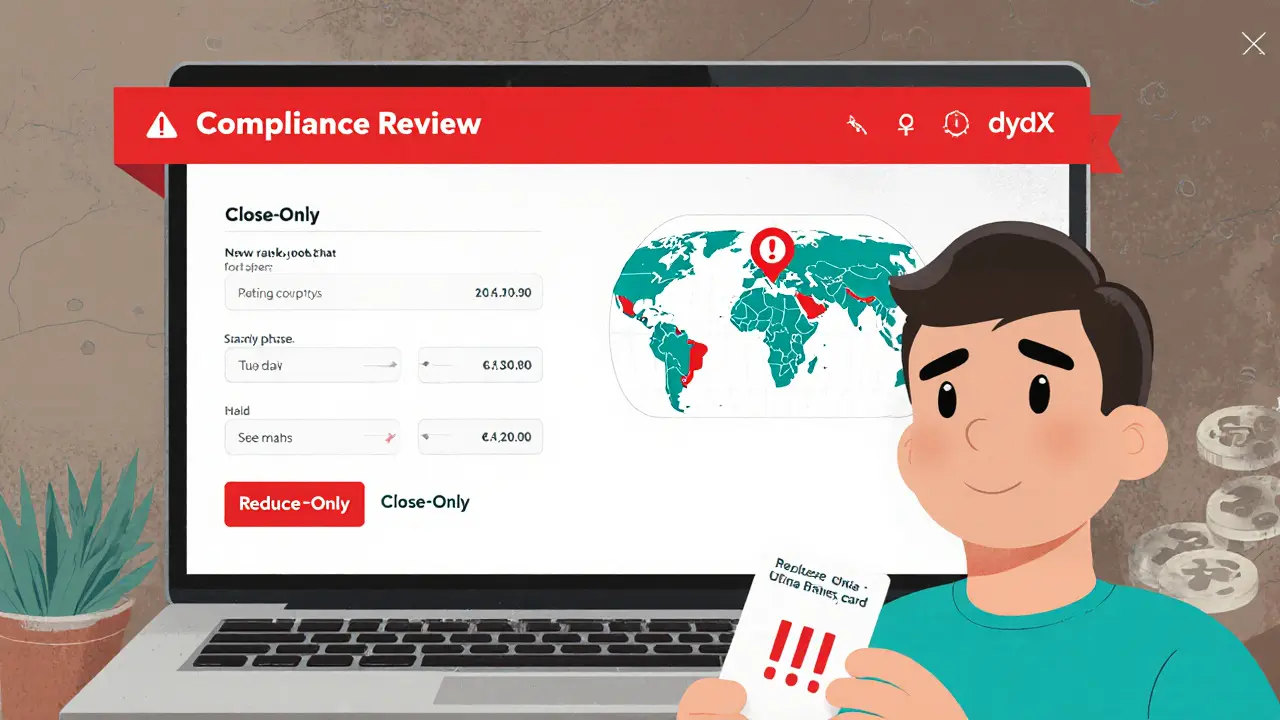

When a user’s IP address, wallet metadata or KYC data signals a prohibited location, DOS flags the wallet. The user then sees a bright red banner that says the account is under compliance review. From that moment, the interface switches to a "close‑only" mode:

- All new orders are automatically set to reduce‑only, meaning they can only shrink or close an existing position.

- Deposits and transfers are disabled - you can’t add more collateral.

- You can still withdraw the funds that are already on‑chain, but only after closing all positions.

- If the wallet stays in close‑only mode for seven days, it turns to Blocked status, which hides trading history and sub‑accounts.

The only way out is to export the Secret Recovery Phrase, move the assets to a personal wallet, and stop using the dYdX frontend altogether.

Why the Platform Needs to Follow the Rules

The enforcement isn’t a hobby project; it’s driven by real legal obligations. The United States’ Office of Foreign Assets Control (OFAC) maintains a list of sanctioned individuals, entities and regions. Violating OFAC rules can result in civil penalties of up to $1million per transaction and criminal penalties that include imprisonment.

In addition to OFAC, the platform must adhere to the Bank Secrecy Act, AML (Anti‑Money‑Laundering) and CTF (Counter‑Terrorism Financing) requirements. Those laws require a "Know Your Customer" (KYC) approach that filters out users from high‑risk jurisdictions.

Because dYdX has corporate entities - dYdX Trading Inc. in New York and dYdX Foundation in Zug, Switzerland - it cannot claim the legal immunity that a purely permission‑less protocol enjoys. Those entities need to be able to show regulators that they are not facilitating prohibited activity.

Comparison: dYdX vs a Purely Decentralized Exchange

| Feature | dYdX (Hybrid) | Pure Decentralized Exchange (e.g., Uniswap) |

|---|---|---|

| Order Matching | Smart‑contract engine + centralized order‑book UI | On‑chain AMM or order‑book without UI control |

| Geographic Blocking | Implemented via DOS front‑end; wallets enter close‑only mode | Not possible - no central server to block IPs or wallets |

| Regulatory Exposure | Subject to US, EU, and Swiss regulations | Limited; depends on user’s jurisdiction and local law |

| Token Governance | DYDX token managed by dYdX Foundation | Governance token (if any) runs on‑chain, community‑driven |

| Derivative Products | Perpetual contracts on 33 active markets | Typically spot swaps; derivatives require separate protocols |

The table shows why dYdX can enforce borders while a protocol like Uniswap cannot - there is simply no centralized point of control to receive a compliance request.

What Users in Blocked Regions Can Do

If you discover that your wallet is flagged, here’s a practical checklist:

- Check the status banner. The interface will tell you whether you’re in close‑only or fully blocked mode.

- Close all open positions. Use reduce‑only orders; the platform will refuse any increase‑size orders.

- Withdraw remaining collateral. Once positions are zero, hit the withdraw button and move funds to a personal wallet.

- Export your Secret Recovery Phrase. This is the only way to regain full control of the assets.

- Consider alternative platforms. Fully decentralized exchanges like Uniswap or dYdX v4 (future) (if it ever becomes fully permission‑less) do not enforce geographic blocks.

While the process may feel restrictive, it protects you from accidentally violating sanctions that could lead to frozen assets or legal trouble.

Broader Implications for the DeFi Space

The dYdX case is a micro‑cosm of a larger debate. On one side, developers want to keep the original DeFi promise: open, borderless finance. On the other side, regulators are tightening the net around high‑value derivatives, AML, and sanctions compliance.

Hybrid platforms like dYdX illustrate a pragmatic path: they keep the core trading logic on‑chain (preserving liquidity and innovation) while adding a compliant front‑end layer that can be shut down if required. The trade‑off is that users have to accept some central control - the very thing that pure DeFi seeks to eliminate.

As more jurisdictions publish clear guidance on crypto derivatives, we may see two trends:

- New protocols that deliberately avoid any centralized UI, forcing users to interact through self‑hosted wallets only.

- Existing platforms building “decentralized modules” that can be swapped out if regulators demand changes.

Until that future arrives, dYdX’s dYdX restricted countries policy will remain a reality for many traders.

Frequently Asked Questions

Why does dYdX block the United States if it’s a decentralized platform?

dYdX operates a centralized frontend run by dYdX Operations Services Ltd. That entity is subject to U.S. sanctions, AML and CTF laws. To avoid legal penalties, the platform must block U.S. residents, citizens and entities.

Can I trade on dYdX from a blocked country using a VPN?

Technically, a VPN can hide your IP, but the platform also checks wallet metadata and KYC data. If it detects a prohibited jurisdiction, it will still place your wallet in close‑only mode.

What happens to my open positions if my wallet is blocked?

You can only use reduce‑only orders to shrink or close the positions. New positions cannot be opened, and you cannot add more collateral.

Is there any way to use dYdX without agreeing to the geographic restrictions?

Not while you use the official dYdX web or mobile frontends. The only alternative is to switch to a fully decentralized exchange that does not enforce any country blocks.

How often does dYdX update its list of restricted territories?

The list is reviewed quarterly and updated whenever new sanctions are issued by OFAC or the United Nations. Users should check the Terms of Service regularly.

19 Comments

I think the whole block list is just a publicity stunt. They claim decentralization but the moment you step outside the US they slap a banner on your screen. It's like a club that lets you in through the front door but shuts you down at the bar. The irony is delicious.

dYdX is a joke they just copy paste compliance fluff they don’t care about real users they’re scared of regulators

Wow, this breakdown really helps! 🌟 If you're stuck in a blocked region, remember you can still exit your positions and move your funds. Keep your chin up, the crypto world always finds a way! 😊

I get how frustrating this feels. The platform should be more transparent about why they block certain places. Still, you can close positions and protect your assets.

Oh sure, a decentralized exchange that decides who gets to trade based on a spreadsheet. Because nothing screams freedom like a corporate front‑end gatekeeper. Maybe next they’ll ban coffee lovers too. At least they’re consistent with their “decentralized” branding.

If you’re from the US you should understand why we need strict rules. Our regulators demand it.

Indeed, the list is extensive; it covers many jurisdictions, and that’s intentional,; to stay compliant with global sanctions. Users must accept that restriction,; otherwise the platform risks legal action. It’s a trade‑off between openness and safety,; and the developers chose safety. So, while it hurts some traders, it protects the whole ecosystem.

The compliance narrative is just a veneer for deeper control mechanisms. Remember, every new regulation often follows a hidden agenda – a power consolidation scheme. Those behind dYdX likely have ties to larger financial institutions seeking to dominate the derivatives market. :)

From a protocol architecture perspective, the bifurcation between on‑chain execution and off‑chain orchestration introduces an attack surface that regulatory bodies can exploit. The risk vector is amplified when the front‑end layer integrates KYC modules, effectively bridging decentralized liquidity with centralized user verification. Consequently, the sanctions compliance matrix becomes an integral component of the system’s threat model. Moreover, the operational overhead associated with continuous jurisdictional updates can affect latency and throughput, potentially impacting market efficiency. In essence, the hybrid design imposes a compliance‑driven governance layer that redefines the traditional DeFi trust assumptions.

In the grand scheme of finance, borders are but an illusion; yet we see them enforced by code. It provokes a thought: can true liberty exist when the very tools we use are shackled? The answer may lie in our willingness to adapt, even if the path is riddled with odderies.

Seeing the block list can feel overwhelming, but remember that every challenge is an opportunity to learn. You can still protect your assets by moving them to a personal wallet. The crypto community is full of resources to help you navigate these restrictions. Stay positive and keep exploring alternative platforms. Together we can find a solution that works for everyone.

This is the drama of modern finance! They say it's free but then lock you out. It's just a big show.

I hear the concerns and it's valid, the system tries to balance safety and freedom. We can all support each other in finding workarounds that respect the rules. Let's share knowledge and keep the ecosystem thriving.

Blocked or not you still own your keys there’s no losing that

Interesting to see how dYdX navigates compliance while keeping a decentralized core. Have you considered using a self‑hosted front‑end to bypass the restrictions? It could give you more control over your trading experience.

That’s a solid point, exploring self‑hosted options might indeed reduce reliance on the main UI. We should test if the contract layer truly operates independently of the front‑end. Sharing findings would benefit the whole community.

Wow another 'mega' solution from dYdX? Like that really solves anything

Honestly, the whole blocking saga is just a textbook case of regulatory overreach. If you read the fine print you'll see they're protecting exactly what they claim to protect.

The tension between decentralization and regulatory compliance is a defining narrative of our era. While dYdX's hybrid model may appear contradictory, it also showcases the ingenuity of developers seeking a middle ground. Each country block represents a legal checkpoint, not an insurmountable barrier. Traders can view this as an invitation to explore alternative pathways within the broader crypto ecosystem. Self‑custody wallets empower individuals to retain full control over their assets, regardless of platform restrictions. By exporting your secret recovery phrase, you detach from any centralized gatekeeper. Open‑source projects like Uniswap or 0x offer truly permission‑less swapping that sidesteps geographic bans. Moreover, layer‑2 solutions are emerging that embed compliance modules directly on‑chain, reducing reliance on off‑chain front‑ends. The community's collaborative spirit ensures that knowledge about these tools spreads rapidly. Educational resources, tutorials, and forums become the new bridges over regulatory walls. In this light, dYdX's constraints can be reframed as a catalyst for innovation. Developers are motivated to design more resilient, user‑owned interfaces. Users gain the confidence to experiment with decentralized finance without fearing sudden denial of service. Regulators, too, can observe the evolution and adapt policies that protect consumers while fostering growth. The ultimate goal remains a financial system that is open, secure, and accessible to all. Stay curious, stay resilient, and remember that technology always finds a way to democratize access.