Understanding the Kimchi Premium and Its Role in the Korean Crypto Market

Kimchi Premium Calculator

The Kimchi premium measures the price difference between Korean and global crypto markets. Enter the current prices below to calculate the premium.

Calculation Result

When you hear about a Kimchi premium, you might picture a spicy side dish, not a price gap that can swing tens of thousands of dollars. In reality, it’s a recurring phenomenon where digital assets-most famously Bitcoin-sell for noticeably more on South Korean exchanges than they do on global platforms. This gap isn’t a fluke; it’s the product of soaring local demand, tight capital controls, and a regulatory environment that keeps the market semi‑isolated. Below, we break down what the Kimchi premium is, how it’s measured, why it sticks around, and what it tells traders and policymakers alike.

Key Points

- The Kimchi premium measures the price difference between Korean and global crypto markets, often ranging from 4‑5% in calm periods to over 50% during booms.

- High domestic demand, strict capital controls, and regulatory hurdles are the primary forces behind the premium.

- Arbitrage looks attractive on paper, but residency rules, slow cross‑border transfers, and AML checks make it extremely difficult in practice.

- Major Korean exchanges-Upbit and Bithumb-are the main venues where the premium materialises.

- Analysts use the premium as a barometer of Korean market sentiment and a signal for possible regulatory shifts.

What Exactly Is the Kimchi Premium?

Kimchi premium is a price discrepancy where cryptocurrencies trade at higher levels on South Korean exchanges compared to international platforms. The term was coined in 2016 after researchers at the University of Calgary noticed Bitcoin consistently out‑pricing outside Korea. The premium peaked at roughly 55% in January 2018, reflecting a frenzy of local buying against a backdrop of limited supply.

How Do You Calculate It?

The formula is simple:

Premium (%) = [(KRW price ÷ Exchange rate) - Global USD price] ÷ Global USD price × 100

For example, if Bitcoin the leading cryptocurrency, often used as the benchmark for premium calculations is $45,000 on Binance and $47,000 on Upbit (after converting KRW to USD), the premium works out to about 4.4%.

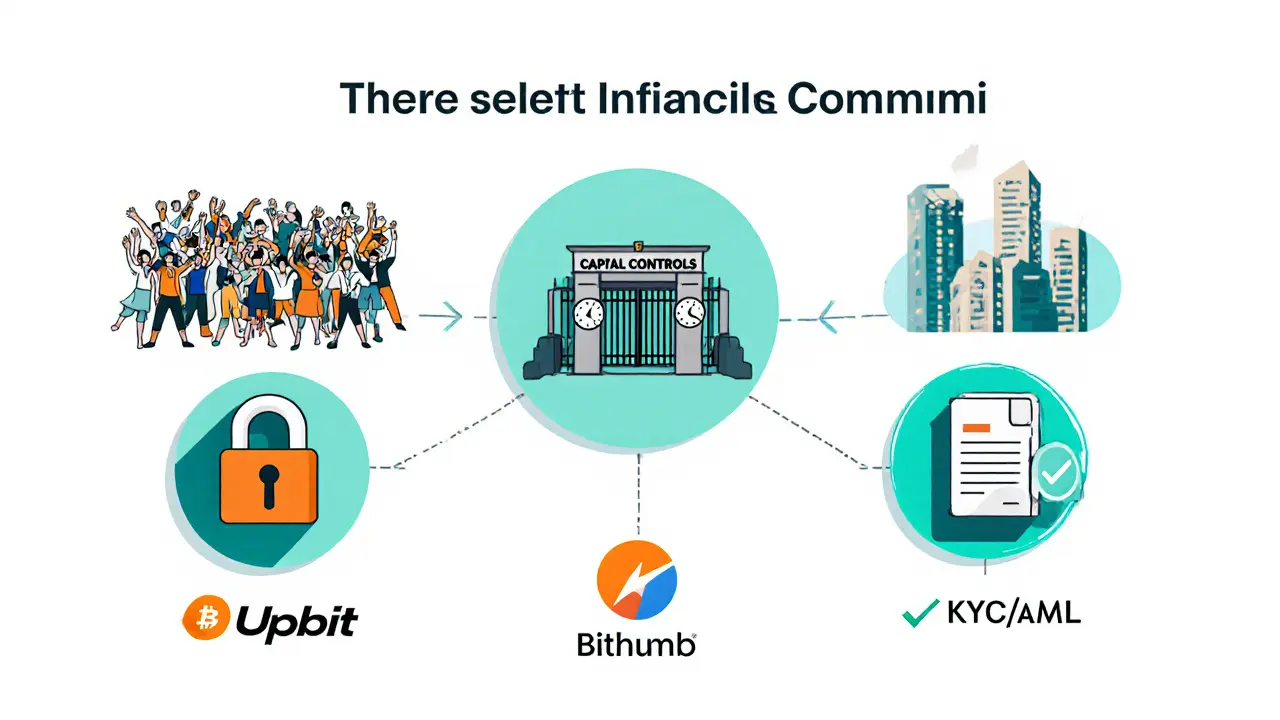

Why Does the Premium Persist?

Three big‑picture forces keep the price gap alive:

- Local demand outstripping supply. South Korean investors are notoriously enthusiastic about crypto, often allocating a larger share of their portfolio to digital assets than investors elsewhere. This demand pressure pushes prices up on domestic order books.

- Capital controls. The Korean Central Bank imposes strict limits on how quickly and how much money can cross the border. These controls lengthen settlement times, meaning an arbitrageur can’t instantly move funds to exploit a fleeting price gap.

- Regulatory barriers. The South Korean government requires residency, real‑name verification, and compliance with anti‑money‑laundering (AML) rules before anyone can trade on local platforms like Upbit or Bithumb. International traders are effectively locked out, preserving the premium.

Beyond these, speculative behaviour during volatile market phases can temporarily inflate the premium. When a new coin lists on a Korean exchange-a "listing pump"-traders rush in, spiking the price and amplifying the gap.

Major Korean Exchanges and Typical Premium Levels

| Exchange | Typical Premium Range | Key Features | Residency Requirement |

|---|---|---|---|

| Upbit South Korea's largest crypto exchange by volume, owned by Dunamu | 3‑12% (averages 5%) | Wide asset list, fast UI | South Korean ID (resident) |

| Bithumb Second‑largest Korean exchange, known for high liquidity in BTC and ETH | 2‑10% (averages 4%) | Strong security measures, mobile app | South Korean ID (resident) |

| Coinone | 1‑8% (averages 3%) | Focus on regulatory compliance | Resident ID |

Why Arbitrage Is Easier Said Than Done

On paper, buying Bitcoin on a global exchange at $30,000 and selling it on Upbit for $38,000 yields an 26% profit. In practice, a trader faces several hurdles:

- Residency verification. Korean exchanges won’t open accounts for non‑residents without a local phone number and bank account.

- Settlement delays. Capital controls mean moving KRW out of Korea can take days, during which the premium often collapses.

- AML and KYC scrutiny. Large cross‑border transfers trigger additional compliance checks, further slowing the process.

- Tax implications. South Korean tax law treats crypto gains as taxable income, adding a cost layer that erodes margins.

Professional traders therefore treat the Kimchi premium more as a market sentiment indicator rather than a direct profit source.

What the Premium Reveals About the Korean Crypto Landscape

Analysts view the premium as a real‑time pulse on Korean crypto enthusiasm. When the gap widens, it usually signals:

- Domestic bullishness-Korean investors are buying aggressively.

- Potential regulatory announcements-historically, the government tightens oversight after large premium spikes.

Conversely, a shrinking premium often precedes market cooling or the introduction of new easing measures, such as the 2024 pilot program allowing limited overseas transfers for verified institutions.

Researchers from the University of Calgary Academic institution that conducted early studies on the Kimchi premium continue to cite the premium as a case study of how regional policy can create lasting market segmentation, even in ostensibly borderless digital assets.

Industry bodies like the Corporate Finance Institute Provider of finance education that documented historic premium extremes note that the premium’s persistence pushes global firms to factor Korean price feeds into their risk models.

Current Landscape (2025) and Future Outlook

As of Q32025, the Kimchi premium still fluctuates, though it rarely hits the 50%+ highs of 2018. Average levels sit around 4‑6% for Bitcoin, with occasional spikes up to 15% during major market news or new token listings.

The South Korean government has introduced a “crypto sandbox” that lets approved fintech firms test cross‑border settlement solutions. While this could ease arbitrage friction, the core capital‑control framework remains, meaning the premium is unlikely to disappear entirely.

International investors are watching Korea closely because the premium acts as a natural hedge: when global crypto markets dip, Korean prices often stay buoyant, offering a divergent exposure point for diversified portfolios.

In summary, the Kimchi premium is both a pricing anomaly and a useful market barometer. Understanding its drivers-demand, regulation, and speculative dynamics-helps traders avoid costly missteps and gives policymakers a real‑world gauge of how their rules impact digital‑asset ecosystems.

Frequently Asked Questions

What causes the Kimchi premium to appear?

The premium stems from three main forces: high local demand for crypto, strict capital‑control policies that limit rapid cross‑border fund movement, and regulatory requirements that restrict who can trade on Korean exchanges.

How is the premium calculated?

You compare the price of a cryptocurrency on a Korean exchange (converted to USD) with its price on a major global exchange. The percentage difference is the premium.

Can I arbitrage the Kimchi premium as a foreign trader?

In theory, yes, but in practice it’s extremely hard. You need a Korean resident account, you must navigate AML/KYC checks, and capital‑control delays often dissolve the price gap before you can settle the trade.

Which Korean exchanges show the biggest premiums?

Upbit and Bithumb are the primary venues where the premium is most evident, with typical gaps ranging from 3‑12% for Bitcoin, depending on market conditions.

Has the premium been decreasing over time?

The extreme spikes of 2017‑2018 have not returned, but a modest premium persists. Recent regulatory tweaks have slightly narrowed the gap, yet the underlying demand‑supply imbalance keeps it alive.

21 Comments

Hey folks, just wanted to point out that the Kimchi premium isn't some mysterious crypto‑only fairy tale, it's largely a result of capital controls, tax incentives, and the fact that Korean exchanges have different liquidity pools; in other words, supply‑demand dynamics plus a bit of regulatory friction, which together create that price gap you're seeing.

It's also worth noting that the premium can swing wildly during market stress, as arbitrageurs rush in or get blocked by transaction limits.

What they don't tell you is that behind those numbers lies an entire cabal of shadowy financial entities, manipulating Korean exchange rates to siphon wealth from everyday investors; the premium is just the tip of the iceberg, a smokescreen for deeper power plays orchestrated by unseen hands.

Oh great another calculator, because we all needed more spreadsheet drama in our lives.

Honestly this whole premium thing is just a fancy way of saying "Korea has different market conditions," but who needs simplicity when you can have jargon and a dash of pretentiousness, right? The crypto world loves to overcomplicate the obvious.

Picture this: a bustling Seoul market, neon lights flickering over a sea of traders, each one frantically checking their phones for the latest BTC price, while a hidden thread of algorithmic bots quietly siphons the disparity between global and local exchanges, creating what we call the Kimchi premium.

It isn't just a numbers game; it's a cultural phenomenon where the hunger for crypto meets the rigidity of local regulations, producing a price gap that can be as volatile as a kimchi fermentation process.

The premium often spikes during global market downturns, as Korean investors, driven by FOMO and a deep-rooted belief in crypto as a hedge, rush in, inflating local prices.

Conversely, during bullish global runs, the premium can shrink, as arbitrageurs exploit the gap, moving funds across borders, but only if the Korean government doesn't slap on new caps.

Regulatory quirks, such as capital controls and tax incentives, act like a secret sauce, seasoning the premium with unpredictability.

Historical data shows that during the 2017 crypto boom, the premium regularly hovered between 20% and 45%, occasionally spiking over 70% when news broke about South Korean bans on anonymous trading.

It's also worth noting that exchange fees, withdrawal limits, and the relative scarcity of fiat gateways in Korea amplify the effect, making the premium a barometer for both market sentiment and policy shockwaves.

One could argue that the Kimchi premium is a micro‑cosm of broader macro‑economic tension: a clash between open‑border digital assets and a nation trying to control capital flow.

In practical terms, if you spot a 30% premium on an exchange like Upbit versus a global reference price, you might consider an arbitrage loop-buy low abroad, sell high locally-provided you can navigate the legal labyrinth without tripping Korean anti‑money‑laundering alarms.

But beware: the premium can evaporate within hours, especially if the Korean won strengthens or if the government tightens its grip, turning potential profit into loss faster than you can say "hodl."

In short, the Kimchi premium isn't just a metric; it's a living, breathing reflection of policy, psychology, and market mechanics all mashed together in a spicy digital stew.

From a formal perspective, the Kimchi premium represents a quantifiable divergence between South Korean cryptocurrency exchange rates and those prevailing on international platforms.

Such a divergence can be attributed to a confluence of regulatory constraints, market liquidity disparities, and investor sentiment specific to the Korean jurisdiction.

In analytical terms, this premium serves as an indicator of systemic inefficiencies within the global crypto market architecture, warranting rigorous examination.

The premium is basically a reflection of demand‑supply plus some local rules.

Sounds like a fancy math thing.

One must consider, in the grand tapestry of financial ecosystems, that the Kimchi premium is not merely a statistical anomaly but a profound manifestation of socio‑economic stratification, wherein the voracious appetites of a technologically adept populace intersect with labyrinthine regulatory architectures, forging a price differential that transcends mere arbitrage potential.

Indeed, the very nomenclature-Kimchi-evokes a cultural symbol, yet its appropriation in the cryptographic lexicon signals the commodification of national identity within the volatile sphere of digital assets.

Such a phenomenon demands a nuanced discourse that interrogates the ethical implications of capital flows, the moral responsibilities of market makers, and the latent power dynamics that perpetuate wealth concentration under the veneer of market efficiency.

Sure, the premium exists, but let's not pretend it isn't just a side‑effect of Korean bots doing what they do best-swinging the market while the rest of us just watch and shrug.

Haha, totally! It's wild how quickly things can flip when those bots decide to take a coffee break.

Keep your chin up, the market always finds a way.

The premium can be useful for traders looking for arbitrage opportunities, but it also reminds us that local market conditions matter a lot; it's not just about global trends.

From a coaching standpoint, understanding the Kimchi premium equips investors with a more holistic view of market dynamics, encouraging strategic planning rather than impulsive decisions.

Exactly, it's like adding another tool to your toolbox-use it wisely.

In a highly formal analysis, one observes that the Kimchi premium functions as a stochastic variable within the broader stochastic differential equations governing cryptocurrency price movements; its magnitude, albeit temporally volatile, can be incorporated into risk‑adjusted return models to enhance portfolio optimization.

The premium shows how interconnected the world is-local policies can ripple through global markets, reminding us that crypto isn't isolated.

It is profoundly unethical for ordinary investors to be lured by the glitter of a premium that is, in essence, a symptom of regulatory overreach and market manipulation; the moral imperative is to demand transparency and equitable access, lest we perpetuate a system where only the privileged reap the benefits of arbitrage while the rest are left grappling with inflated costs and hidden fees.

Don't be fooled, the premium is just a distraction from the real agenda: global elites wanting to control capital flows and keep ordinary people in the dark while they profit behind the scenes.

Look, while you’re all debating premiums, the real issue is the lack of education; people jump in without understanding the mechanics, and that’s a problem only a handful of so‑called experts want you to ignore.

Ah, another perspective added to the mix-thanks for the insight.