Real Estate Tokenization Explained: NFTs Made Simple

Real Estate Tokenization Comparison Tool

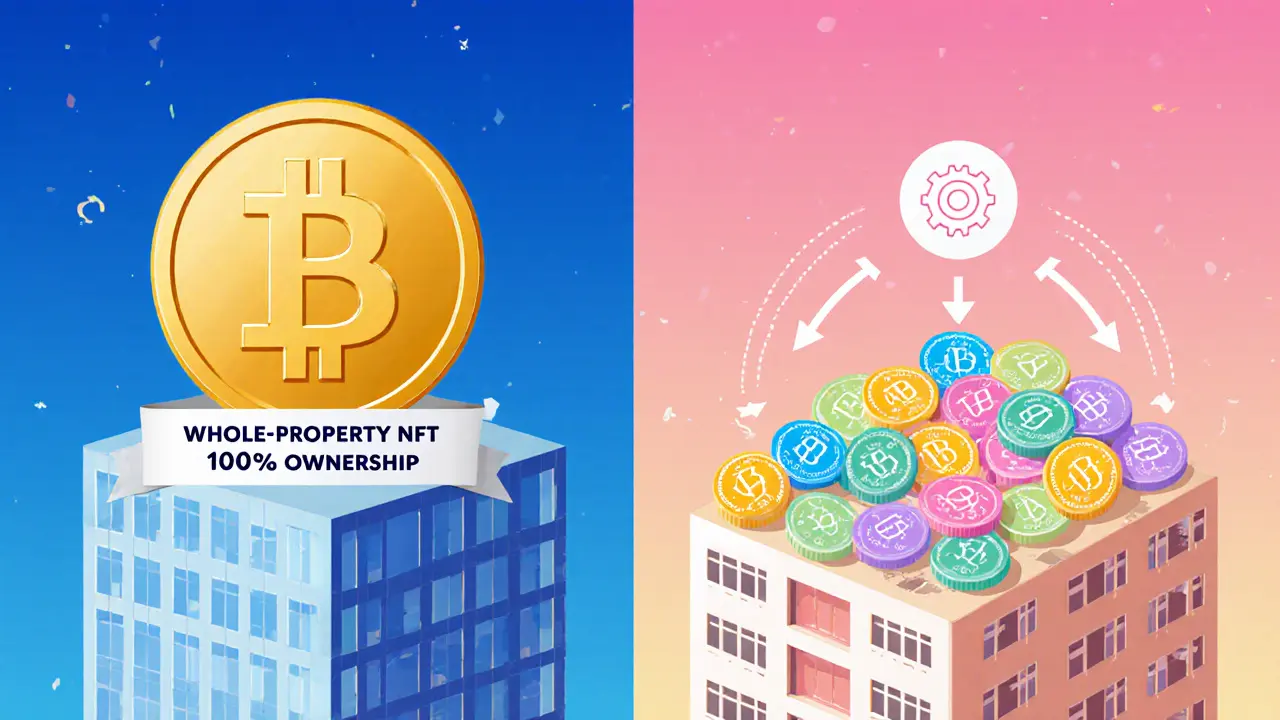

Represents ownership of the entire property as a single, unique token.

- One token = 100% ownership

- Ideal for high-net-worth investors

- Simpler management

- Limited liquidity

Splits property into multiple identical shares for fractional ownership.

- Each token = small percentage (e.g., 0.1%)

- Accessible to retail investors

- Higher liquidity

- Requires governance mechanisms

| Aspect | NFT (Whole-Property) | Fungible Tokens (Fractional) |

|---|---|---|

| Ownership granularity | One token = 100% of the property | Each token = a small percentage (e.g., 0.1%) |

| Liquidity | Limited - buyer must take full ownership | High - tokens trade on secondary markets |

| Regulatory treatment | Often classified as a security if sold to the public | Same, but many jurisdictions have clearer guidance for fractional securities |

| Use case | High-net-worth investors, property-level control | Retail investors, diversified portfolios |

| Management complexity | Simple - one owner handles decisions | Requires governance layer (voting, dividend distribution) |

Match your investment goals with the right tokenization model:

Select your preferences and click "Find My Ideal Model" to see which tokenization approach suits you best.

Quick Takeaways

- Tokenization turns a physical building into a digital asset on a blockchain.

- When an NFT represents a whole property, the owner of the NFT owns the underlying real estate.

- Fractional ownership lets investors buy tiny slices of high‑value assets.

- Smart contracts automate transfers, dividend payouts, and compliance checks.

- Regulatory and technical hurdles still limit mass adoption.

Imagine buying a house the same way you buy a digital artwork on OpenSea. That’s the promise of real estate tokenization-a process that converts a brick‑and‑mortar property into a blockchain‑based token. When the token is an NFT, the buyer receives a unique, non‑fungible record that proves ownership of the entire property. In the next few minutes you’ll learn how the tech works, why it matters, and what pitfalls to watch out for.

What Is Real Estate Tokenization with NFTs?

Real Estate Tokenization with NFTs is a method of digitizing property rights by issuing a non‑fungible token on a blockchain. The NFT’s metadata contains critical details-address, legal description, appraisal value, insurance status, and a history of past owners. Because blockchain records are immutable, anyone can verify the token’s authenticity without a title company.

Two token models exist. The NFT model treats a property as a single, unique asset; the token holder owns the whole building. The fungible‑token model slices the property into many identical shares (e.g., 1,000 tokens each representing 0.1% of a $1million condo). Both models rely on the same underlying technology but serve different investor goals.

How the Process Works

Behind the scenes, three core components make a tokenized sale possible:

- NFT creation - A developer writes a smart contract that mints an NFT, locks the property’s legal title in a custodial entity, and embeds the property’s metadata.

- blockchain registration - The NFT is recorded on a public ledger (Ethereum, Polygon, or a permissioned chain), making ownership transparent and transferable.

- smart contract enforcement - Rules for future actions (sale, rental income distribution, voting rights) are coded into the contract, so they execute automatically once conditions are met.

Investors first complete a KYC check to satisfy local anti‑money‑laundering laws. Once approved, they connect a crypto wallet, pay the purchase price in fiat or stablecoin, and receive the NFT in their wallet. The transfer is recorded instantly, eliminating the weeks‑long escrow process typical of conventional real estate deals.

Benefits Over Traditional Real Estate Investment

Tokenization tackles three age‑old pain points:

- Liquidity - Traditional property can sit idle for months while finding a buyer. An NFT can be listed on a secondary market and sold 24/7, often within minutes.

- Lower Costs - By cutting out escrow agents, title insurers, and many middlemen, transaction fees can drop from 5‑6% to under 1% of the sale price.

- Access - Fractional ownership means a first‑time investor can buy a $10,000 slice of a $2million office tower instead of saving for a full down payment.

Compared with Real Estate Investment Trusts (REITs), tokenized assets give you direct ownership of the underlying land or building, not just shares of a management company. This eliminates corporate overhead, reduces management fees, and provides clearer exposure to property‑specific appreciation.

Challenges and Risks

Despite the hype, several roadblocks remain:

- Regulatory uncertainty - Securities regulators in the U.S., EU, and Asia treat tokenized property differently. Some classify NFTs as securities, demanding registration and ongoing reporting.

- Technical complexity - Investors must manage a crypto wallet, understand gas fees, and protect private keys. A lost key equals a lost property claim.

- Scalability - Current blockchains handle a limited number of transactions per second. Mass adoption would require layer‑2 solutions or specialized real‑estate chains.

- Custodial risk - The legal title is often held by a special purpose vehicle (SPV). If the SPV defaults, token holders may face unexpected legal battles.

These risks mean tokenized real estate is still best suited for tech‑savvy investors who can afford to lose the entire amount.

Real‑World Use Cases (2024‑2025)

Several platforms have launched pilot projects:

- Propy tokenized a luxury condo in Miami, issuing a single NFT that transferred ownership in under an hour.

- RealT uses fungible tokens for U.S. rental properties, allowing investors to earn monthly rent in stablecoins.

- Frontier partnered with a European developer to mint NFTs representing entire commercial blocks, each NFT bundled with a smart‑contract‑driven revenue‑share model.

Early adopters report fast settlement times and transparent title histories, but they also note limited property selection and occasional delays in dividend payouts due to integration with legacy banking systems.

Getting Started as an Investor

If you’re curious about buying a tokenized property, follow these steps:

- Research platforms - Look for regulated entities with clear SPV structures and audited smart contracts.

- Complete KYC - Upload ID, proof of address, and source‑of‑funds documents.

- Set up a compatible wallet - MetaMask, Trust Wallet, or a hardware wallet that supports the blockchain the platform uses.

- Fund your wallet - Transfer fiat via a stablecoin bridge or use a platform‑offered fiat‑on‑ramp.

- Buy the NFT or fractional tokens - Review the property’s appraisal report, insurance policy, and any scheduled maintenance costs.

- Monitor post‑sale - Smart contracts will automatically distribute rental income or sale proceeds. Keep an eye on gas fees and any platform updates.

Remember, the most critical skill is protecting your private key. Treat it like a physical deed: store it offline, back it up, and never share it.

Comparison: NFT‑Based vs. Fungible Token Real Estate

| Aspect | NFT (Whole‑Property) | Fungible Tokens (Fractional) |

|---|---|---|

| Ownership granularity | One token = 100% of the property | Each token = a small percentage (e.g., 0.1%) |

| Liquidity | Limited - buyer must take full ownership | High - tokens trade on secondary markets |

| Regulatory treatment | Often classified as a security if sold to the public | Same, but many jurisdictions have clearer guidance for fractional securities |

| Use case | High‑net‑worth investors, property‑level control | Retail investors, diversified portfolios |

| Management complexity | Simple - one owner handles decisions | Requires governance layer (voting, dividend distribution) |

Future Outlook

Analysts at KPMG predict that as regulatory frameworks solidify and layer‑2 scaling solutions mature, tokenized real estate could capture up to 2% of the global market by 2030. Institutional players are already testing private‑placement token offerings, which suggests retail participation will follow once best‑practice standards are published.

For now, the technology sits at a crossroads: it offers undeniable efficiency gains but still needs legal certainty and user‑friendly tooling. If you can navigate the current complexities, tokenized property may become the most accessible way to own a slice of the world’s $29trillion real‑estate portfolio.

Frequently Asked Questions

Do NFT real‑estate tokens count as securities?

In most jurisdictions, an NFT that represents ownership of a profit‑generating property is treated as a security, meaning the issuer must comply with securities registration or qualify for an exemption. Some countries are drafting specific token‑specific regulations to clarify the rules.

Can I use a regular bank account to buy a real‑estate NFT?

Most platforms require a crypto wallet, but many now offer fiat‑on‑ramps that let you fund the purchase with a bank transfer or credit card, converting the money to a stablecoin behind the scenes.

What happens if the underlying property is damaged?

The SPV that holds the title is responsible for insurance. The policy details are stored in the NFT metadata, and any claim payout is automatically routed to token holders via the smart contract.

How are rental incomes distributed?

Smart contracts receive rent in a stablecoin, calculate each holder’s share (based on token balance), and execute periodic transfers-usually monthly-directly to investors’ wallets.

Is there a risk of the blockchain failing?

Public blockchains like Ethereum have proven resilience over a decade, but technical upgrades (e.g., hard forks) can introduce risk. Most platforms build in migration paths and keep off‑chain backups of critical documents.

19 Comments

Looks like another buzzword‑filled piece about tokenized real estate.

One might contemplate the ontological shift that occurs when property rights are abstracted onto a decentralized ledger, thereby challenging traditional notions of ownership and sovereignty 🙂.

The whole NFT real‑estate hype feels like a fad that will fade faster than a summer meme. It promises liquidity but delivers illiquidity for most retail investors. The legal scaffolding behind these tokens is shaky at best. Every new platform seems to reinvent the wheel only to drop it later. You end up paying gas fees that dwarf the actual property value. The promise of democratization is just a marketing gloss. In practice, the token holders still need a custodian to enforce deed rights. So far, the market is a playground for tech‑savvy speculators.

It is hard not to notice the hidden agenda behind every glossy brochure, especially when the same entities keep re‑branding the same assets. I suspect that a small cabal of developers and regulators are quietly colluding to bypass conventional oversight. The "smart contract" narrative masks a centralized off‑ramp that can freeze or seize assets at will. Every token sale is a potential data‑harvest operation, feeding the surveillance state. The lack of transparent audits only fuels these doubts. Remember the 2022 fiasco where a purported tokenized condo vanished overnight? That was a warning. The industry thrives on the illusion of decentralization while retaining control behind the scenes. Until we get real jurisdictional clarity, skepticism is warranted.

Great points, and it’s always good to stay grounded while exploring new tech 😊. If you decide to dip your toes in, start with platforms that publish third‑party audits and have clear escrow mechanisms. Remember, the community thrives when we share knowledge and support each other’s learning curves.

I’m fascinated by how tokenization can lower the barrier to entry for ordinary folks. The idea of owning a slice of a downtown office building with a few hundred dollars sounds like a win‑win. Of course, the technical side can feel intimidating, but there are plenty of tutorials out there that break it down step‑by‑step. I’d recommend anyone curious to start with a small, well‑audited project before scaling up. That way you get comfortable with wallets, gas fees, and the whole KYC process without risking a lot of capital.

The protocol layer introduces a myriad of complexities such as nonce management, re‑entrancy safeguards, and state channel optimizations. Without rigorous formal verification, the smart contracts governing property tokens are vulnerable to lattice attacks and front‑running exploits. Moreover, the interplay between off‑chain legal frameworks and on‑chain token mechanics creates a regulatory gray zone that can precipitate compliance breaches. Investors must scrutinize the tokenomics, especially the fee structures and dividend distribution algorithms, to avoid hidden erosion of yields. In short, the ecosystem demands a deep dive into both cryptographic primitives and real‑estate jurisprudence.

Interesting overview, helped me understand the basics without the jargon overload.

i think you miss some point like its not alwys about tech but also about law and taxs im not sure but i guess its more compicated then you think

Thanks for laying it out. I’d add that community governance can really make or break a fractional token project. When token holders have a clear voting mechanism, the whole thing feels more democratic.

Overall, the piece is solid but could use more concrete case studies.

One cannot ignore the clandestine orchestration that underpins many of these tokenization ventures. The veil of decentralization often masks a hierarchically controlled consortium that silently dictates terms. It is a pattern repeated across numerous platforms, where the founders retain disproportionate voting rights while presenting an illusion of egalitarianism. The regulatory landscape, while ostensibly evolving, is being subtly steered by lobbyists embedded within blockchain think‑tanks. Moreover, the data streams harvested from wallet interactions feed sophisticated profiling engines, enabling targeted financial manipulation. The very architecture of certain public blockchains facilitates untraceable siphoning of funds, a fact that is glossed over in promotional materials. In the same vein, the security token exemptions exploited by some issuers skirt the spirit of securities law, if not the letter. This creates a feedback loop where institutional actors can covertly benefit from the hype, all while the average investor remains oblivious. Add to this the risk of smart contract bugs that, despite audits, can be introduced through later upgrades, opening a back‑door for malicious actors. The cumulative effect is a fragile ecosystem that could collapse under the weight of its concealed power structures. Vigilance, therefore, is not merely advisable but essential for anyone considering participation. Finally, an informed community is the only antidote to these systemic vulnerabilities.

This article does a good job of simplifying a complex topic. For newcomers, focusing on reputable platforms and understanding basic wallet security is a solid first step.

Sure, but the whole token thing is just another fad to get crypto believers to throw cash at anything shiny.

Let me be crystal clear: tokenization is not a magic bullet, and anyone claiming otherwise is either uninformed or intentionally deceptive,; the reality is that the market is riddled with speculative noise,; proper due diligence involves scrutinizing the legal structure of the SPV,; you must verify that the smart contract code has undergone multiple independent audits,; never ignore the importance of liquidity pools and their impact on price stability,; be aware that gas fees can erode returns, especially on congested networks,; finally, always keep a cold‑storage backup of your private keys to protect against loss or theft,; only then can you responsibly engage with this emerging asset class.

The systemic risk inherent in tokenized real estate cannot be overstated; when you embed physical assets within smart contracts, you inherit both blockchain volatility and traditional property market fluctuations. Moreover, the interplay between custodial SPVs and decentralized registries creates a dual‑layer of governance that is prone to misalignment. If the off‑chain custodian defaults or faces litigation, token holders may find themselves without recourse, despite the on‑chain record. In addition, interoperability between different blockchain standards (ERC‑721 vs ERC‑1155) introduces fragmentation that can hinder secondary market liquidity. The scarcity of standardized legal frameworks means each jurisdiction may interpret tokenized ownership differently, leading to regulatory arbitrage and potential enforcement gaps. Investors should also consider the impact of oracle failures, which can deliver erroneous property valuations into automated dividend calculations. The sheer complexity of these interdependencies warrants a multidisciplinary approach, combining legal, technical, and financial expertise before committing capital.

Stop cherry‑picking data and calling this a revolution; it’s just hype.

Looks like another buzzword‑driven article.

To wrap things up, it’s essential to underline a few practical takeaways for anyone eyeing tokenized real estate. First, always verify that the platform you’re using has a transparent audit trail for both its smart contracts and its custodial entities. Second, understand the fee structure: transaction fees, management fees, and any hidden costs can significantly affect net returns. Third, consider the jurisdictional implications; some regions have clearer regulatory guidance on tokenized assets, which can reduce legal risk. Fourth, never underestimate the importance of secure wallet practices-use hardware wallets for long‑term holdings and keep backups of your seed phrases in multiple secure locations. Fifth, evaluate liquidity options; fractional tokens typically offer better secondary market access, but the depth of that market can vary widely. Sixth, be aware of tax obligations-token sales, rental income distributions, and capital gains may be subject to different tax treatments depending on your country. Seventh, monitor the underlying property’s performance and any associated maintenance costs that could impact cash flow. Eighth, stay informed about evolving standards like ERC‑4626, which aim to improve token interoperability and composability. Finally, adopt a diversified approach: don’t allocate all your capital to a single tokenized asset, but spread it across different property types and geographies to mitigate risk. By following these guidelines, you’ll be better positioned to navigate the nascent yet promising world of tokenized real estate.