AOFEX Crypto Exchange Review - Scam Alert & Comparison

AOFEX vs. Established Exchanges Comparison Tool

AOFEX

Closed- Trading Pairs: ~400

- Leverage: Up to 100x

- Regulation: No licenses

- Transparency: None

- Support: Unresponsive

Binance

Active- Trading Pairs: >12,000

- Leverage: Up to 125x

- Regulation: Multiple licenses

- Transparency: Regular audits

- Support: 24/7 support

Coinbase

Active- Trading Pairs: >300

- Leverage: None (spot only)

- Regulation: U.S. licensed

- Transparency: Regular audits

- Support: 24/7 support

| Feature | AOFEX | Binance | Coinbase |

|---|---|---|---|

| Operational Status | Closed / Non-operational | Active | Active |

| Trading Pairs | ~400 | >12,000 | >300 |

| Leverage Options | Up to 100x (margin & futures) | Up to 125x | None (only spot) |

| Regulatory Compliance | FinCEN violation, no licenses | Multiple global licenses, AML/KYC | U.S. Money Transmitter, extensive KYC |

| Proof-of-Reserves | Not provided | Regular audits, public reports | Regular audits, public reports |

| Customer Support | Unresponsive, email & phone dead | 24/7 live chat, email, phone | 24/7 live chat, email, phone |

| Mobile App Availability | iOS & Android (now removed) | iOS & Android | iOS & Android |

Why AOFEX Failed

AOFEX was shut down in 2022 after a suspected rug pull. Key reasons include:

- No regulatory licenses

- Failed to provide proof-of-reserves

- High-risk leverage (up to 100x)

- No customer support after shutdown

- Native token AQ became worthless

Safety Recommendations

- Always verify regulatory licensing before choosing an exchange

- Look for proof-of-reserves and transparency reports

- Avoid exchanges offering extremely high leverage without risk management

- Choose exchanges with responsive customer support

- Use established platforms with proven track records

Key Takeaways

- AOFEX launched in 2019 and shut down after a suspected rug‑pull in 2022.

- The platform offered over 400 trading pairs, up to 100x leverage, and a fiat gateway, but lacked regulatory licenses.

- User funds were frozen during a "system upgrade" that never resumed, and the native token AQ became worthless.

- Compared with Binance and Coinbase, AOFEX missed basic security checks like proof‑of‑reserves and transparent reporting.

- Current consensus: avoid AOFEX and stick to established, regulated exchanges.

When you type AOFEX crypto exchange review into a search box, you’re probably looking for a clear answer: is this platform safe or a trap? The short answer is that AOFEX is dead and its legacy is a cautionary tale about high‑leverage promises, weak compliance, and a sudden disappearance that left users without a cent.

AOFEX is a formerly UK‑registered cryptocurrency exchange that marketed itself as the first platform offering non‑standardized options trading. It operated from 2019 until a mysterious shutdown in late 2022, after which multiple watchdogs and data aggregators listed it as non‑operational.

What AOFEX Promised During Its Brief Life

At its peak, AOFEX displayed a feature list that could rival big players:

- Spot, margin, and futures trading with up to 100x leverage.

- Over 370‑400 trading pairs, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), DASH, XRP and its own token AQ.

- A fiat gateway that let users buy crypto with USD, CNY, JPY and several other major currencies.

- Desktop and mobile apps for iOS and Android, plus a decentralized exchange (DEX) module and OTC desk.

- A launchpad for new token offerings, aimed at early investors.

On paper, the platform seemed built for both beginners (with tutorials and webinars) and seasoned traders (with high‑leverage options). In June2021, CoinMarketCap recorded a 24‑hour volume of US$270million; by December2021 that figure had risen to US$1.2billion, suggesting rapid growth.

Red Flags That Should Have Raised Alarm Bells

While the numbers looked impressive, several warning signs emerged early:

- FinCEN U.S. Financial Crimes Enforcement Network reportedly listed AOFEX as having "Exceeded FinCEN license" - a clear compliance breach.

- The exchange never published a proof‑of‑reserves audit or regular transparency reports, unlike major platforms that post third‑party attestations.

- User reviews on Reddit and cryptocurrency forums mentioned a “relatively new exchange, raising concerns about track record and experience”.

- High‑leverage offerings (up to 100x) attracted speculative traders but also amplified risk, especially without robust risk‑management tools.

These issues weren’t just theoretical; they foreshadowed what happened when the platform announced a "system upgrade" in early 2022.

The Rug Pull - How AOFEX Disappeared

In March2022, AOFEX posted a notice saying the site would be offline for a week to implement critical upgrades. Users were instructed to stay logged in and wait. The site went dark for ten days and never resurfaced.

Community members reported:

- Unable to withdraw any funds - balances were frozen.

- Customer‑support emails and the advertised 24/7 phone line went silent.

- The native token AQ plummeted to zero, wiping out holders.

Crypto‑review outlet CaptainAltcoin labeled the event a "rug pull" and warned that the exchange “barely legit, more likely a scam”. Subsequent investigations confirmed that the domain remained inactive, and no official statement was ever released.

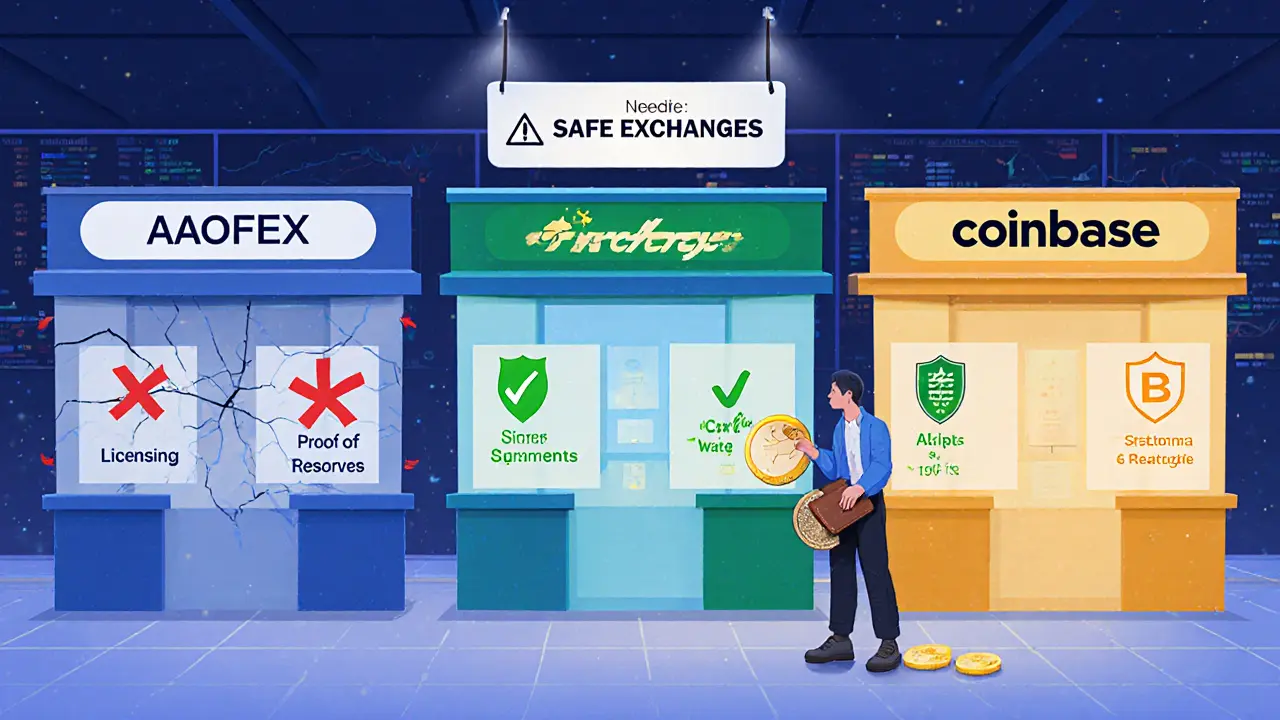

Side‑by‑Side: AOFEX vs. Established Exchanges

| Feature | AOFEX | Binance | Coinbase |

|---|---|---|---|

| Operational status (2025) | Closed / non‑operational | Active | Active |

| Trading pairs | ~400 (incl. BTC, ETH, LTC, DASH, XRP, AQ) | >12,000 | >300 |

| Leverage options | Up to 100x (margin & futures) | Up to 125x | None (only spot) |

| Regulatory compliance | FinCEN violation, no licenses | Multiple global licenses, AML/KYC | U.S. Money Transmitter, extensive KYC |

| Proof‑of‑reserves | Not provided | Regular audits, public reports | Regular audits, public reports |

| Customer support (post‑shutdown) | Unresponsive, email & phone dead | 24/7 live chat, email, phone | 24/7 live chat, email, phone |

| Mobile app availability | iOS & Android (now removed) | iOS & Android | iOS & Android |

The table makes it clear: AOFEX fell short on every metric that serious traders use to gauge safety. While Binance and Coinbase charge fees, they at least provide transparency, regulatory oversight, and a track record of staying open.

Should You Still Trade on AOFEX?

Short answer: absolutely not. The platform is officially listed as "no longer operational" by CoinCodex and several data aggregators. Any attempt to create a new account will be blocked, and the original URL redirects to a dead page.

If you somehow still hold AQ tokens or have funds tied to an old AOFEX address, your options are limited:

- Check if the wallet address is still accessible on the blockchain. If you control the private keys, you can move the tokens, but AQ has essentially zero market value.

- Monitor legal forums for any class‑action lawsuits against the former owners. Occasionally, victims receive modest compensation after court rulings.

- Report the incident to your local financial‑crime regulator to help build a case against the operators.

For anyone looking to start trading, stick with exchanges that publish audit reports, have clear licensing, and respond to support tickets promptly.

Lessons From the AOFEX Fallout

Every crypto trader learns from a bad experience. Here are three actionable takeaways:

- Verify licensing and compliance. Look for references to FinCEN, FCA, or local financial regulators. Missing information is a red flag.

- Check for proof‑of‑reserves or third‑party audits. Exchanges that openly share balances on a public ledger are far less likely to disappear with users’ money.

- Be wary of "too‑good‑to‑be‑true" leverage offers. High leverage can magnify profits, but it also magnifies loss - especially on platforms without insurance funds.

Finally, keep a diversified approach. Don’t keep all your crypto on a single exchange; use hardware wallets for long‑term holdings, and only allocate a small portion for active trading.

Frequently Asked Questions

Is AOFEX still operational in 2025?

No. Multiple sources, including CoinCodex and official domain checks, list AOFEX as permanently shut down. The site has been inaccessible since a failed upgrade in 2022.

Can I recover funds lost on AOFEX?

Recovery is unlikely. If you still control the private keys for the wallet where your funds were stored, you can move them, but most users lost access because the exchange held the assets. Monitoring legal actions is the only other avenue.

What made AOFEX’s leverage offering risky?

AOFEX allowed up to 100x margin on volatile assets without a clear insurance fund or automated liquidation system. That combination means a small price swing can wipe out an entire position, leaving users with negative balances.

How does AOFEX compare to Binance in terms of security?

Binance publishes regular audits, holds multiple licenses, and offers a Secure Asset Fund for Users (SAFU). AOFEX provided no audits, had known regulatory violations, and vanished without notice, making its security record effectively non‑existent.

Should I consider other lesser‑known exchanges?

If you explore smaller platforms, verify their licensing, check community sentiment on Reddit or Trustpilot, and ensure they have a clear, public proof‑of‑reserves. Avoid any exchange that cannot answer basic compliance questions.

17 Comments

We can’t keep turning a blind eye to foreign crypto outfits that operate in the shadows, especially when they leave American investors high‑and‑dry. The lack of a solid U.S. licensing regime is a red flag that gets ignored far too often. If regulators don’t step in, the community itself must call out these scams and protect fellow traders.

It’s absolutely infuriating to see how easily people were lured into a false sense of security, only to watch their hard‑earned money vanish like smoke. 😡 The moral of the story is crystal clear: demand transparency before you deposit a single cent. 📢 Trust must be earned, not promised with flashy leverage ads.

Hey folks, if you’re still curious about how to stay safe, start by verifying the exchange’s regulatory status on official financial authority sites. Look for published proof‑of‑reserves and third‑party audit reports; if they’re missing, treat the platform as hostile. Diversify your holdings across reputable wallets and keep only a small fraction on any trading site. Remember, a cautious approach today saves a lot of headaches tomorrow.

Let’s keep the conversation constructive and focus on what really matters: solid security practices and clear communication. Think of the exchange landscape as a garden-only the well‑tended, properly‑fed plants flourish, while the wilted ones are left to wither. If an exchange can’t provide basic support, it’s a sign the soil is already poisoned.

There’s a hidden network of shadowy operators pulling strings behind the glossy marketing of platforms like AOFEX, and the average trader is none the wiser. First, the fact that the exchange operated without any recognizable license is not a coincidence but a deliberate maneuver to evade oversight. Second, their refusal to publish proof‑of‑reserves aligns perfectly with the playbook of years‑old Ponzi schemes that thrive on secrecy. Third, the sudden “system upgrade” that froze funds was not a technical glitch but a scheduled exodus engineered by insiders. Fourth, the unresponsive customer service mirrors what we see in other infamous collapses, where silence is a tactic to discourage inquiry. Fifth, the native token AQ turning worthless overnight is a classic symptom of a deliberately inflated asset designed to attract speculative capital. Sixth, the alleged 100x leverage is a tantalizing bait, but without a robust insurance fund it’s a guarantee of catastrophic loss for users. Seventh, the removal of the mobile apps after the shutdown is evidence that the operators wanted to erase any trace of their digital presence. Eighth, regulatory bodies like FinCEN flagged the platform, yet the warning went largely unheeded by the community, exposing a deeper failure in information dissemination. Ninth, many users reported that the exchange’s domain remained dormant, a digital graveyard that speaks volumes about the finality of the fraud. Tenth, the absence of any legal recourse or restitution plan underscores the premeditated nature of the entire operation. Eleventh, the pattern of false promises followed by a rapid disappearance is not unique to AOFEX; it mirrors historical scams that have been documented for decades. Twelfth, the lack of transparent leadership or accountable corporate structure makes it impossible to hold anyone responsible. Thirteenth, the whole episode serves as a stark reminder that the crypto space is still a Wild West where the lawless can thrive. Fourteenth, the best defense against such machinations is collective vigilance, thorough due‑diligence, and an uncompromising demand for accountability. Fifteenth, until regulators step up and enforce strict licensing, platforms like AOFEX will continue to lure the unwary into their trap, and we, as a community, must remain skeptical and protective of each other.

Honestly, the whole AOFEX saga reads like a low‑budget thriller written by a clueless copy‑cat. Their “high‑leverage” promise is nothing but a reckless stunt designed to melt wallets faster than a summer snowball. The lack of audits is a glaring sign they were hiding something far uglier than just a bad business model. If you want a platform that respects your capital, steer clear of this cardboard castle.

It’s disheartening, really, to see yet another exchange vanish without a trace; the community deserves better, and the warnings were plentiful, yet many ignored them, perhaps hoping for a miracle that never arrived.

Let’s turn this lesson into a brighter future 🌟-by sharing reliable resources and supporting exchanges that are open, audited, and responsive. Together we can build a safer crypto world 💪.

Picture this: a trader steps into the wild frontier of crypto, eyes wide with hope, only to be snared by a phantom exchange that disappears like smoke. But the phoenix rises when we learn, adapt, and choose platforms that stand on solid ground. Keep the fire of curiosity burning, but let wisdom be the wind that guides your sails.

Honestly, the hype around AOFEX was just smoke and mirrors.

i think it’s a good reminder to always check if an exchange has real support, cuz you never know when you’ll need them.

It’s a disgrace how these foreign scams prey on American investors, thinking they can get away with no retribution. The US has strict regs for a reason, and when platforms ignore them they’re just asking to be crushed. We need tougher enforcement, pronto.

Upon meticulous examination of the operational framework of AOFEX, one observes a conspicuous absence of verifiable compliance documentation; furthermore, the platform’s abrupt cessation of services, without remedial communication, indicates a systemic failure of fiduciary responsibility; consequently, the entity should be unequivocally classified as non‑viable for prudent investment.

Check the exchange’s licensing status and look for third‑party audit reports before depositing any funds.

While many dismiss AOFEX as just another failed startup, the pattern of clandestine offshore registration and sudden disappearance aligns with a larger, coordinated effort to siphon capital from unsuspecting traders under the guise of high‑leverage excitement.

I can sense the frustration many felt when their assets were frozen, and it’s understandable to seek clarity on whether any legal avenues remain open for recovery.

Crypto can be a wild ride, but every stumble teaches us something valuable. By sharing experiences like the AOFEX fallout, we help each other spot red flags earlier. Keep researching, stay curious, and remember that the community thrives when we lift each other up.