2025 Outlook: Future of Crypto Securities Law in the US

Crypto Token Classification Tool

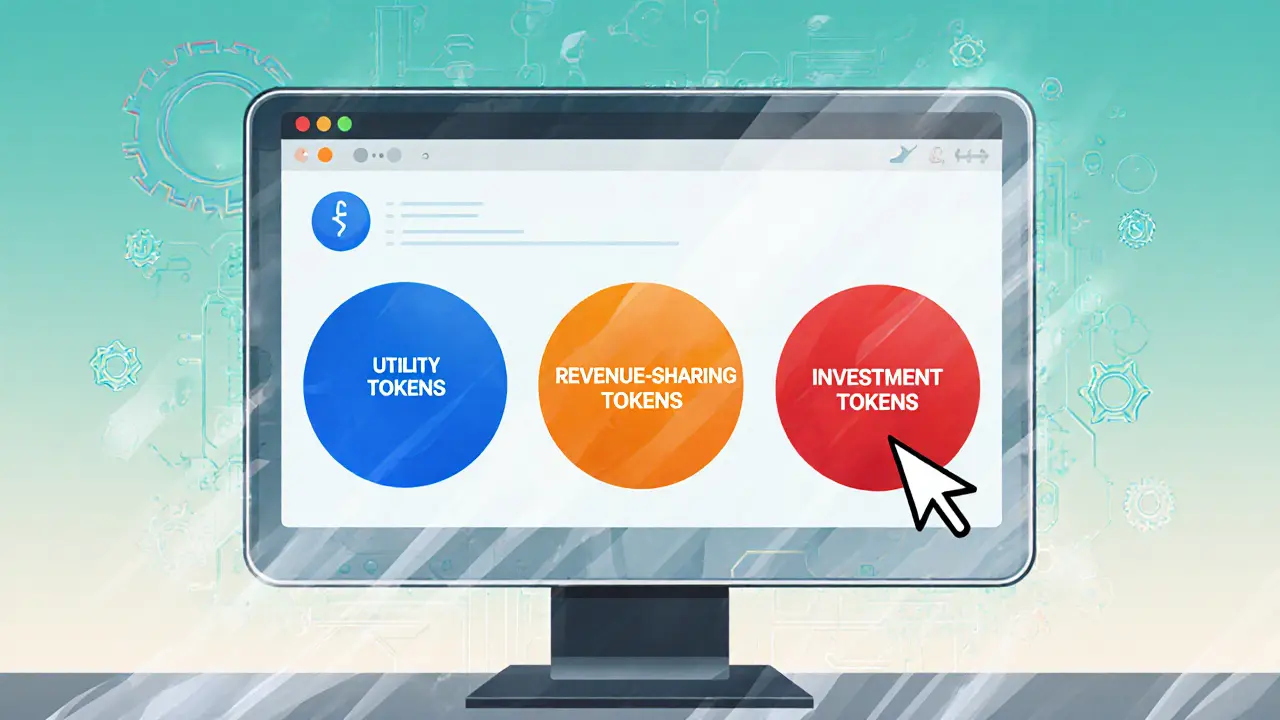

Use this tool to understand how your digital token might be classified under the 2025 regulatory framework. Based on the Project Crypto initiative and new legislation, tokens are categorized into three tiers:

Tier 1

Utility Tokens

Tier 2

Revenue-Sharing Tokens

Tier 3

Investment Tokens

Classification: Exempt from Securities Regulation

Tokens that primarily serve as access to a product or service, with on-chain governance rights but no expectation of profit from the efforts of others.

- Examples: Governance tokens for decentralized platforms

- Regulatory Status: Exempt from securities laws

- Requirements: Must not promise returns or profit expectations

Classification: Subject to Tailored Registration

Tokens that provide a share of future platform revenue, often with some governance rights but not full ownership.

- Examples: Platform usage fees, staking rewards

- Regulatory Status: May require registration or exemptions

- Requirements: Must disclose revenue-sharing models clearly

Classification: Full Securities Treatment

Tokens marketed primarily as investment opportunities, with a significant expectation of profit from the efforts of others.

- Examples: ICOs, token sales with promises of returns

- Regulatory Status: Fully regulated as securities

- Requirements: Must comply with full SEC registration and disclosure obligations

Answer the following questions to determine your token’s tier:

Crypto securities law is a framework of rules that decides whether a digital asset counts as a security and how it must be offered, traded, and supervised in the United States. After years of back‑and‑forth between regulators, courts, and industry, 2025 has turned into a watershed moment. New federal bills, a bold SEC overhaul, and coordinated state action are converging to give the market the predictability it has long craved.

Key Takeaways

- The GENIUS Act, signed July2025, is the first comprehensive federal crypto statute, focusing on stablecoins and consumer safeguards.

- SEC Chair Paul Atkins’ Project Crypto flips the traditional “most crypto assets are securities” stance, promising clearer guidance on the Howey test.

- State regulators, organized through NASAA, are pushing for strong antifraud powers while shaping federal language.

- Three bills-GENIUS, CLARITY, and the Anti‑CBDC Surveillance State Act-create a legislative triad that addresses stablecoins, market structure, and digital‑currency policy.

- Banking integration and safe‑harbor provisions are poised to let traditional institutions offer crypto custody without drowning in regulatory risk.

Legislative Breakthroughs of 2025

July18,2025 will be remembered as "Crypto Week" on Capitol Hill. Lawmakers delivered three major proposals that together sketch the future of crypto securities law.

The Guiding and Establishing National Innovation for US Stablecoins Act, known as the GENIUS Act, was signed into law by the President. It sets a clear definition for "stablecoin", imposes reserve‑backing requirements, and creates a federal licensing regime for issuers. The act also earmarks a $200million grant program to help fintech startups develop compliant stablecoin products.

The Digital Asset Market Clarity Act of 2025 (CLARITY Act) passed the House on the same day and now awaits Senate approval. Its core goal is to codify the definition of a "digital asset security" and to grant the SEC authority to issue purpose‑fit exemptions for ICOs, airdrops, and network rewards.

Finally, the Anti‑CBDC Surveillance State Act blocks the Federal Reserve from launching a central bank digital currency without explicit congressional authorization, reflecting concerns about privacy and monetary control.

Senator Bill Hagerty (R‑TN) summed up the atmosphere: "2025 is a pivotal year for digital‑asset legislation; these bills keep America at the forefront of innovation while protecting investors." The Senate Banking Committee aims to move market‑structure legislation out of committee by September30,2025, signaling rapid momentum.

SEC’s Project Crypto Initiative

On July31,2025, SEC Chair Paul Atkins announced Project Crypto, a sweeping regulatory reform designed to modernize securities law for on‑chain activity. The initiative stems from President Trump’s January executive order that declared America the "crypto capital of the world".

Project Crypto’s headline shift is simple yet profound: "most crypto assets are not securities." Rather than applying the Howey test mechanically, the SEC will publish a decision‑tree that weighs factors such as token utility, governance rights, and the presence of profit‑expectation mechanisms. The rulemaking process will include a public notice, comment period, and a final rule expected by early 2026.

Key deliverables under Project Crypto include:

- Clear criteria for determining when a digital token triggers securities law.

- Purpose‑fit safe harbors for ICOs, airdrops, and network‑reward distributions.

- Updated custody rules that recognize self‑custody and on‑chain voting rights.

- Guidance for registered intermediaries (broker‑dealers, exchanges) on on‑chain reporting.

The SEC also directed staff to draft a single set of rules that apply uniformly to both digital and traditional securities, eliminating the patchwork of guidance that has confused market participants for years.

State Regulators and the NASAA Coalition

State securities regulators, coordinated through the North American Securities Administrators Association (NASAA), are playing a dual role. On one hand, they submit comments to congressional committees on the GENIUS and CLARITY bills; on the other, they continue aggressive enforcement against fraudulent crypto schemes.

NASAA’s chief concern is that a narrow federal definition of "investment contract" could undercut long‑standing state antifraud powers. The association has urged lawmakers to preserve a broad, flexible interpretation of the Howey test, allowing states to intervene when investors are misled, even if the federal regulator classifies the token as a utility.

Recent state actions include:

- California’s Department of Financial Protection & Innovation closing a $12million Ponzi‑style token offering.

- New York’s Attorney General filing an injunction against an unregistered crypto fund that promised guaranteed returns.

- Texas securities regulators negotiating a memorandum of understanding with a major crypto exchange to share transaction data for fraud detection.

Technical Implementation: The Howey Test Re‑Examined

The Howey test-"investment of money, common enterprise, expectation of profits, and efforts of others"-has been the litmus paper for crypto securities for a decade. Project Crypto acknowledges the test’s utility but proposes a tiered approach:

- Tier1: Pure utility tokens with on‑chain governance rights but no profit expectation-exempt.

- Tier2: Tokens that confer a share of future platform revenue-subject to tailored registration.

- Tier3: Tokens marketed primarily as investment opportunities-full securities treatment.

By codifying these tiers, the SEC hopes to reduce litigation risk for developers and give investors clearer disclosure expectations.

Market Structure and Banking Integration

Federal banking regulators have released joint guidance that allows federally chartered banks to provide custodial services for digital assets, provided they meet AML/KYC standards and maintain a segregated ledger. This guidance dovetails with the GENIUS Act’s reserve‑backing rules for stablecoins, creating a bridge between traditional finance and the on‑chain economy.

Key points for banks include:

- Mandatory insurance coverage for custodial holdings up to $250,000 per customer.

- Regular stress‑testing of crypto‑exposure scenarios.

- Disclosure of custody methodologies in quarterly reports.

These provisions aim to prevent the "bank‑run" style panic that plagued early crypto exchanges and to give institutional investors the confidence to allocate capital to digital assets.

Comparison of the 2025 Legislative Trio

| Bill | Status (as of Oct2025) | Primary Scope | Notable Provisions |

|---|---|---|---|

| GENIUS Act | Signed into law | Stablecoin definition & licensing | Reserve‑backing ratios, $200M grant for fintech, federal stablecoin charter |

| CLARITY Act | House passed, pending Senate | Digital‑asset securities classification | SEC authority to issue exemptions for ICOs, airdrops, network rewards |

| Anti‑CBDC Surveillance State Act | House passed, pending Senate | Prevents Federal Reserve CBDC without Congress | Privacy safeguards, congressional approval requirement |

Looking Ahead: 2026 and Beyond

The regulatory momentum of 2025 sets a clear path for the next few years. By early 2026 we can expect:

- The final SEC rulebook from Project Crypto, likely rolling out in phased modules.

- Senate approval of the CLARITY Act, which would cement the SEC’s new exemption framework.

- State‑level adoption of NASAA‑recommended antifraud provisions, creating a uniform enforcement net.

- First‑generation federally chartered stablecoin issuers launching under GENIUS‑compliant reserves.

- Increased participation of legacy banks in crypto custody, spurred by the joint banking guidance.

These steps aim to balance innovation with investor protection. If the roadmap holds, the U.S. could regain its edge in crypto finance, attracting talent and capital that have migrated to friendlier jurisdictions.

Frequently Asked Questions

What does the GENIUS Act mean for stablecoin issuers?

The GENIUS Act creates a federal licensing regime, requires reserves to be fully collateralized, and offers a $200million grant pool to help compliant issuers launch. In practice, issuers will file with the Treasury’s new Digital Asset Bureau and must publish regular reserve attestations.

How will Project Crypto change the Howey test?

Project Crypto introduces a tiered framework that classifies tokens based on utility, profit expectation, and reliance on the efforts of others. Pure utility tokens fall into an exemption tier, while tokens sold primarily as investments retain full securities obligations.

Will NASAA’s concerns affect federal law?

NASAA is lobbying for language that preserves state antifraud powers. If Congress incorporates those safeguards, states will continue to have the ability to bring actions against deceptive crypto offerings, even when the SEC classifies the token as a utility.

Can traditional banks now offer crypto custody?

Yes. The joint guidance from federal banking regulators permits federally chartered banks to hold digital assets, provided they meet AML/KYC standards, keep assets in segregated accounts, and disclose custody practices in quarterly reports.

What happens if the CLARITY Act stalls in the Senate?

If the CLARITY Act fails to pass, the SEC will likely rely on existing rulemaking authority to issue the exemptions outlined in Project Crypto. However, without statutory backing, those rules could face more legal challenges, slowing market adoption.

13 Comments

Finally! Someone in D.C. got it-crypto isn’t just gambling with blockchain glitter. The tiered Howey framework? Genius. I’ve seen too many devs get crushed by vague SEC letters. This gives real clarity: utility tokens can breathe, and profit-seeking ones? Still get the full securities treatment. No more gray zones. Also, that $200M grant? Long overdue. India’s watching closely-we need this kind of structure here too.

Still waiting for the other shoe to drop. If this is real, why did the SEC wait until after the election? And why does every ‘innovation’ bill come with a ‘but we still control everything’ clause? I’m not against regulation-I just want it to be honest.

Big win for the little guy. Banks finally allowed to hold crypto? Yes. But let’s not forget-this only works if they don’t lock you out with fees and bureaucracy. I’ve seen too many ‘inclusive’ policies that just turn into gatekeeping. Hope the implementation stays true to the spirit.

One must ask: Is this legislation truly about innovation-or merely about containing the chaos of decentralized finance under the auspices of institutional control? The GENIUS Act, while ostensibly pro-innovation, effectively centralizes authority in the Treasury’s Digital Asset Bureau, which is merely a rebranding of the Fed’s old surveillance architecture. One cannot have liberty and bureaucracy in the same breath.

There are grammatical errors in the post: "July2025" should be "July 2025," and "September30,2025" lacks spaces. These are not trivial-they reflect a lack of editorial rigor in what purports to be a legislative milestone. If the law can’t be written properly, how can we trust its interpretation?

I’ve been in this space since 2017. Every time we get close to clarity, someone adds a new layer of compliance. The SEC’s new decision tree sounds good on paper, but enforcement is always subjective. I’ll believe it when I see a dev get sued for a utility token and the SEC admits they misapplied Howey. Until then, I’m staying on the sidelines.

Oh, so now the SEC is the benevolent fairy godmother of crypto? "Most assets aren’t securities"-said the same agency that sued 12 projects last year for exactly that. And now they’re giving us a decision tree? Like, a flowchart? With checkboxes? Next they’ll hand out stickers for compliance. Meanwhile, the Anti-CBDC Act is the only thing here that actually protects freedom. The rest? Corporate capture dressed up as reform.

Let’s be real: this isn’t regulation-it’s a PR stunt to lure back venture capital that fled to Switzerland and Singapore. The $200M grant? A slush fund for well-connected startups. The custody rules? Only help banks that already have deep pockets. And don’t get me started on how "utility token" is now a legal loophole for scams. This is capitalism with a velvet glove.

They’re using "Project Crypto" to prepare for the CBDC. Mark my words: the Anti-CBDC Act is a decoy. The real plan is to make everyone use compliant stablecoins first-then force them into Fedcoin later. The "reserve backing"? Just a front. The real data is being collected through custody logs. This isn’t freedom-it’s Phase 1 of digital serfdom.

This is the most balanced crypto legislation we’ve seen in a decade. The tiered Howey approach is smart-it doesn’t punish innovation, but it doesn’t ignore investor risk either. And the banking integration? Long overdue. I’ve talked to 3 regional banks who wanted to offer custody but were scared of liability. This gives them a path. Real progress, not just talk.

Yessss!!! 🙌 Finally, someone listened! The tiered system makes so much sense-I’ve been trying to explain this to my uncle for years. "Is my NFT a security?" → "Is it a ticket to a concert or a share in the band?" 🎸 Now the SEC gets it. And the $200M grant? That’s the kind of support real builders need. Let’s go USA! 💪🚀

While the legislative framework is a step forward, I must emphasize that the absence of explicit consumer education mandates is a critical oversight. Without mandatory, accessible disclosures-especially for retail investors unfamiliar with tokenomics-this regulatory clarity becomes a trap, not a safeguard. The SEC must partner with public libraries and community colleges to ensure this knowledge isn’t reserved for those with financial literacy privilege.

Sarah, you’re absolutely right about education. But here’s the thing-this legislation actually creates the perfect opening for it. With the SEC’s new decision tree, we can build interactive tools: "Is your token a Tier 1, 2, or 3?"-like a quiz for devs and investors. Schools could use it. Community centers too. This isn’t just law-it’s a teaching moment. Let’s not waste it.